As public E&Ps hold fast with capital discipline, even exuberant prices might not be enough to substantially bump up production, although private operators remain a wild card, analysts said. (Source: Shutterstock)

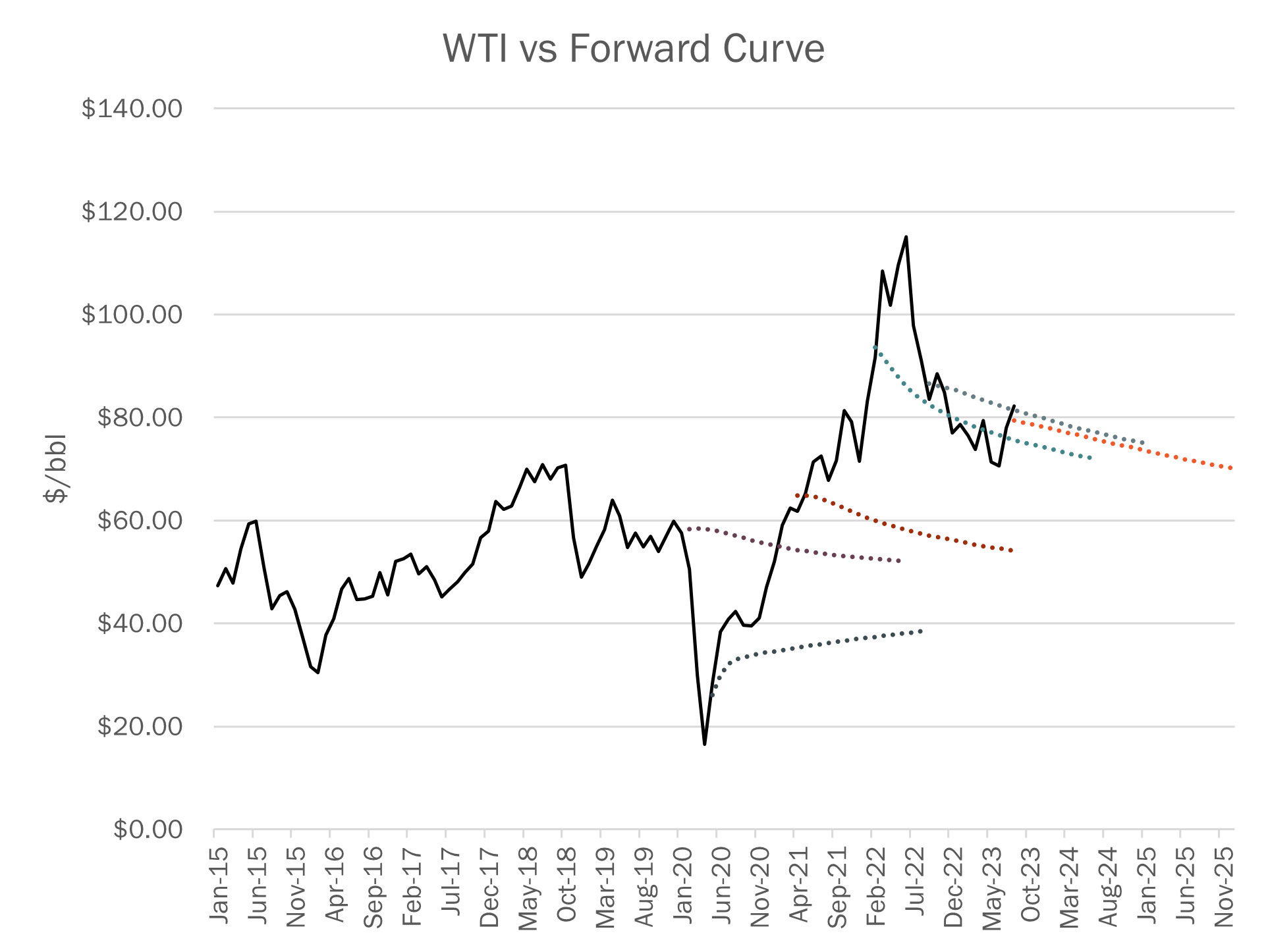

Oil prices continue to be erratic, with WTI spot prices swinging from the high $60s to the low $90s between May and September.

Reading the tea leaves from so much volatility has created as many price decks as there are analysts. And price forecast may ultimately be pointless for U.S. producers.

With the confirmation of production cuts for the near term by OPEC+ and U.S. producers’ commitments to maintaining fiscal discipline, the global crude outlook is beginning to clear up, says Michael Scialla, managing director of Stephens.

Lower 48 E&Ps are likely to shrug off the highs and lows.

“I think production is going to creep higher, and there may be some companies that ramp up faster than others, but it will still be slow growth overall,” Scialla said. “It will not be the big spike of past cycles that ended in ruin.”

For most of the larger Permian players, there is ample runway for incremental increases. “There is still plenty of inventory,” said Scialla. “We will see a bit more reliance on some secondary zones.”

Acknowledging the increasing reports of interference from infill drilling, Scialla suggested “that is one reason we won’t see a big bump in production. Producers want to maintain their capital efficiency,” which unusually means infill drilling, recompletions and other approaches that are less expensive than hiring more rigs.

“Companies are starting to figure out separation,” Scialla said. “Industry has always amazed me with its technological prowess, but at some point capital efficiency has got to slip” if they are going to keep pace to maintain incremental increases in production.

“We base our outlook on the bias that the strip has got to move higher,” said Scialla. “It’s really backwardated. That does not necessarily mean flatten or go into contango, but we really need the out years [to] come up.” The overall supply-demand balance is in deficit, and there is a need for $90 WTI to make [economic] sense of drilling secondary zones or fringe acreage.”

That said, he also reckons companies are better positioned, so prices would have to go below $60/bbl for there to be any substantial change to incremental production growth.

Nathan Nemeth, principal research analyst at Wood MacKenzie, said the firm expects large publics operators to continue with their capital discipline.

“The wild card is the private operators, especially in the Permian,” he said. “They have usually been the most responsive to price changes and they could increase production in response to higher prices.”

However, the lag time from rig hire to spud and then to first oil means that any significant increase in production is unlikely until first-quarter 2024. “The logistics of transporting and setting rigs means that there is a lag of two or three months from the time the producer makes the decision until the rig is on site ready to drill. There is then usually three to six months to first oil.”

Rigs working in the middle of September were down 30 or 40 from the peak in April, Nemeth noted. “That took them out of potential production in the second half of this year.”

Rig count roll off

As incremental production increases continue, and any surge is contemplated, it is likely to come from the Permian. “When we look across the Lower 48, we see all the growth in the Permian. We might see a bit from the D-J [Denver-Julesburg Basin] or the Powder River [Basin (PRB)], but those are small basins, with the D-J at about 450,000 bbl/d, and the PRB at just 190,000 bbl/d. The Eagle Ford and Bakken are flat.”

In contrast, the Permian is producing 6 MMbbl/d. “The focus for growth will be on the Delaware Basin, especially in New Mexico,” Nemeth said.

Vikas Dwivedi, global energy strategist with Macquarie Group, noted that total oil production is roughly equivalent to pre-COVID-19 levels. “We are close to 13 million barrels a day. Producers don’t need to hit it out of the park. That said, these companies are built for growth. It’s what they need to do to maintain their skill set and core competency.”

Addressing production specifically, Dwivedi said “we can potentially get growth as long as the decline in the rig count slows and levels off. But if the rig count continues to grind lower, it will get tough to keep even incremental production growth.”

One key number is the high end of the cost curve. “Even for those [marginal] producers, everyone wins when the price of crude is in the high 90s,” Dwivedi said.

Macquarie is also monitoring decline curves more closely as an aggregate factor in production. “Declines have always been an issue, and in the past we believe that has been given too much weight,” Dwivedi said. “Sure, wells start fast and decline quickly. But at the field level or basin levels, producers have learned a lot about back pressure and well management, so it hasn’t really been as much of a concern as it may have seemed.”

Macquarie also takes a different outlook on near-term pricing. “We are expecting WTI to trade back off,” Dwivedi said. “We are of the view that this price rally is already on borrowed time, especially for light sweet crudes that are also produced in Nigeria, Libya and the North Sea.”

By year end, Brent could be in the low $70s with WTI at $70, according to Macquarie’s outlook.

“That would be a reasonable correction for the rally that we have seen,” Dwivedi said. “The timing is not too bad, considering the number of refinery turnarounds scheduled toward the end of the year.”

Other than the Permian, the producing region with the most potential to add significantly to liftings is the Gulf of Mexico. But that’s based on potential.

“We do see rigs being added,” said AJ O’Donnell, director of research at East Daley Analytics, “but we don’t have great line of sight yet for the next few years.”

Kristine Marie Oleszek, director of analytics at East Daley, stressed that “stable growth is better growth, especially because the infrastructure can keep pace.”

East Daley is a midstream-focused operation and, “what we are hearing from our midstream clients is that they are building their outlook around WTI at $80 a barrel,” O’Donnell said.

Several major factors support a bullish outlook, according to East Daley. The most basic is not just demand growth, but increasing demand growth. More specifically, increasing consumption growth from international markets supplemented by the Department of Energy’s repurchase program for the Strategic Petroleum Reserve. At the same time, domestic crude stocks sit at historic lows, so both commercial and federal tanks need refilling at a time that global supply is shrinking. That is likely a political and economic decision by OPEC+ to reduce near-term production levels.

As a result, the U.S. has become “an export machine,” O’Donnell said. “Newly proposed offshore facilities will provide the world with better access to U.S. crude supply at more economical rates.”

The U.S. is also sticking with capital discipline, leading to consolidation through M&A and rig cuts, which will result in the moderated growth.

O’Donnell noted one further wrinkle: Canadian supply displacement. A shift in heavy Canadian barrels will see those volumes moving to Pacific export markets via the Trans Mountain pipeline expansion in the first quarter of 2024. That is expected to displace about 500,000 bbl/d of heavy Canadian crude currently going into Patoka and the U.S. Gulf Coast, and is a potential call on Gulf of Mexico production.

Recommended Reading

Keeping it Simple: Antero Stays on Profitable Course in 1Q

2024-04-26 - Bucking trend, Antero Resources posted a slight increase in natural gas production as other companies curtailed production.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

2024-04-26 - Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.