From fast-tracked offshore Gabon developments to Baker Hughes’ pipeline solutions portfolio, below is a compilation of the latest headlines in the E&P space.

Activity headlines

Panoro Expands Work Offshore Gabon

Panoro Energy updated its production and drilling schedule in Dussafu Marin Permit offshore Gabon in third-quarter earnings released on Nov. 16.

Four production wells have been drilled and completed at the Hibiscus Field, with onstream rates between 6,000 bbl/d and 6,500 bbl/d. Due to the success of the Hibiscus Field, partners have accelerated development in the current campaign and will next spud the DHIBM-7H production well. The well is expected to be completed and put onstream in January.

“The better than expected well results at the Hibiscus Field and the recent discovery at Hibiscus South have prompted the Dussafu partners to expand the scope of the current campaign to incorporate seven new production wells and re-order the drilling sequence to optimize utilization of remaining contracted rig time,” John Hamilton, CEO of Panoro, said in a press release.

Development of the Hibiscus South well, located around 5 km southwest of the BW Mabomo production facility, has been fast-tracked, with partners planning to return to the well in early 2024 to drill a production section into the newly discovered oil-bearing zones in the Gamba reservoir. Preliminary estimates for recoverable volumes are 6 MMbbl to 7 MMbbl on a gross basis.

RELATED

BW Energy Discovery Commercial Oil in Hibiscus South Prospect

The Bourdon Prospect, located 7 km southeast of the BW Mabomo facility in a water depth of 115 m, will also be drilled during the current campaign. The prospect has an estimated mid-case potential of 83 MMbbl in place and 29 MMbbl recoverable in the Gamba and Dentale formations.

Contracts and company news

ABS Issues AIP for Bumi Armada FLNG Design

ABS awarded an approval in principle (AIP) to Bumi Armada for a barge-based floating LNG infrastructure design on Nov. 16.

The new concept incorporates a barge-based liquefaction unit and uses existing LNG carriers for storage. ABS completed design reviews based on class and statutory requirements.

Oceaneering Secures IMR, Survey Work

Oceaneering Australia was awarded an inspection, maintenance and repair (IMR) and survey contract from a major Australian energy company, Oceaneering said in a Nov. 15 press release.

Oceaneering will mobilize in mid-November to carry out the IMR and survey work, including the provision of an ROV and survey personnel and equipment. The company will also provide subsea inspection, onshore project management and engineering, data processing, photogrammetry and onshore ROV video streaming for remote inspections.

This contract is Oceaneering’s first survey scope in Australia, with the company wanting to offer “more integrated projects to our valued customers in the APAC region,” said Vandana Crispin, Oceaneering’s senior IMR manager. The offshore work scope is expected to take 15 days to complete.

Subsea7 awarded decommissioning contract in Brazil

Subsea7 announced on Nov. 20 a sizeable contract awarded by Shell for the decommissioning of subsea infrastructure associated with the FPSO Fluminense in the Bijupirá and Salema fields of the Campos Basin.

Subsea7’s scope of work includes the disconnection, recovery and disposal of 10 flexible risers, three umbilicals and nine mooring lines. Offshore work is planned to start in December.

Aker Solutions Wins Second Vanguard Wind Contract

Aker Solutions has been awarded an engineering, procurement, construction and

installation (EPCI) contract from Vattenfall for the Norfolk Vanguard East offshore wind farm, Aker Solutions said on Nov. 14.

The EPCI a high-voltage direct-current offshore platform in the U.K.

The EPCI will be performed on a high-voltage direct-current offshore platform in the U.K.

Fabrication of the topsides will be executed in a joint venture with Drydocks World Dubai, and the substructure will be fabricated at Aker Solutions’ yard in Verdal, Norway.

The announcement follows Aker Solutions’ recent award for the Norfolk Vanguard West project, part of the Norfolk Offshore Wind Zone development in the U.K.

The project is subject to regulatory approvals and the customer’s final investment decision (FID). Aker Solutions estimates the total contract value, following Vattenfall’s FID, to be in the range of NOK 6 billion (US$561 million) to NOK 7 billion (US$654 million).

Baker Hughes Launches New RTP Solution

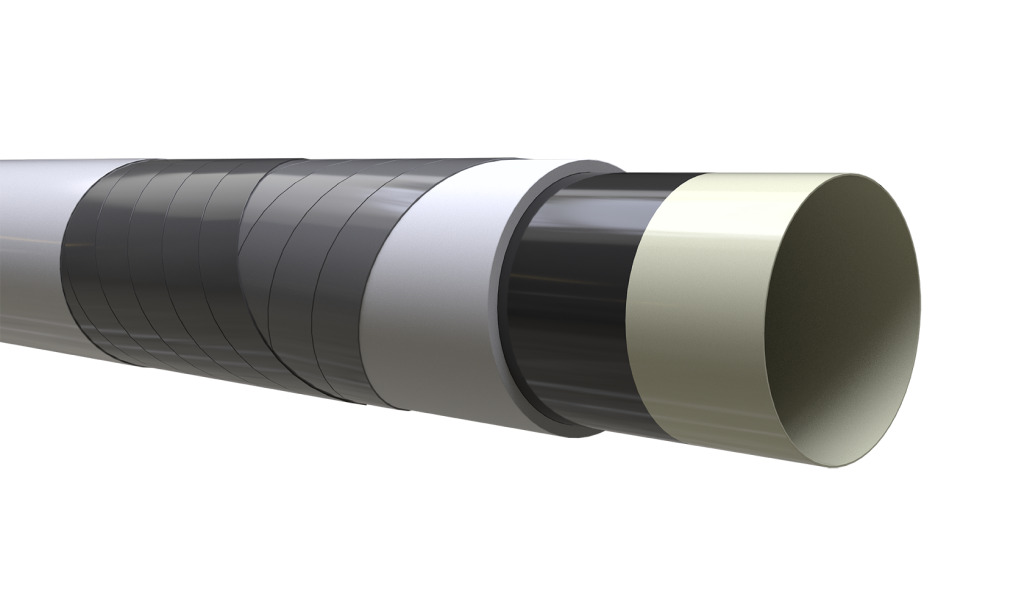

Baker Hughes announced on Nov. 14 a new reinforced thermoplastic pipe (RTP) solution, PythonPipe.

The PythonPipe offers up to 60% reduction in installation time and achieves up to 75% reduction in carbon emissions throughout its lifecycle, according to Baker Hughes. The solution also offers up to 80% reduction in maintenance costs and trims crew requirements by 60%, according to Baker Hughes.

The PythonPipe portfolio also offers pressure capacities of up to 3,000 psi and temperature resilience of up to 180 F. The advanced co-extruded liner technology enhances durability and reduces permeability, making it suitable for challenging and corrosive environments.

“Our PythonPipe technology is a testament to our extensive industry expertise, underlined by over 10,000 km of successfully installed pipes,” said Jeff Shorter, product management director at Baker Hughes’ flexible pipe systems business. “The diverse liner options in the PythonPipe portfolio provide chemical and permeation resistance, combined with a wide range of reinforcement types, product sizes, temperature and pressure capacities to address our customers’ diverse needs.”

Silverwell Announces Successful Dual Completion Gas Lift with DIAL Technology

Silverwell Technology Inc. announced on Nov. 14 a successful dual completion gas lift deployment using its digital intelligent artificial lift (DIAL) production optimization system for a major oil company.

DIAL overcomes production and operations constraints of traditional gas lift practices in dual-completion wells by enabling production from both strings in the well, the company said. The system, which is used by operators worldwide both onshore and offshore, integrates in-well monitoring and control of gas lift well performance with surface analytics and automation to continually optimize gas-lifted fields, remotely and without intervention.

“Gas lifting both strings enables operators to achieve increased production from their dual string wells, while saving them the capex of having to drill additional wells,” said Steve Faux, Silverwell’s operations manager. “DIAL enables the recovery of by-passed reserves. It also allows easy adjustment of the gas lift parameters as reservoir conditions evolve over time, such as increased water cut or lower well productivity.”

RELATED

Tech Trends: Premium Gas Lift Tools for Non-premium Applications [WATCH]

Kongsberg Selected by Equinor for Offshore Simulator Installation

Kongsberg Digital has been selected by Equinor to deliver simulation solutions for safety and emergency training in Norway, according to a Nov. 14 press release.

Kongsberg will deploy four of their K-Sim Offshore simulators to the North Cape Simulator Center in Honningsvaag, Norway. These will be integrated with KONGSBERG’s K-Pos dynamic positioning systems and Aptomar, NORBIT’s pioneering Oil Spill Detection system. The configuration enables offshore procedure training for personnel, as well as environmental conservation drills, oil spill detection and recovery simulations and “all-encompassing” safety and crisis management drills for Equinor's specialized personnel.

The investment will enable the training of professionals from Johan Castberg, Norne, Åsgård A and Njord N offshore installations, as well as the Melkøya onshore plant.

The comprehensive simulator suite will be installed at the North Cape Simulator Centre in Honningsvaag, Norway. The simulator center offers safety courses and emergency training for seafarers and personnel in the oil and gas industry.

DOF Awarded Charter, Adds New Vessel to Fleet

DOF Group secured a long-term charter for a construction vessel and agreed to add another construction vessel to its fleet through a two-year charter, the company said on Nov. 15.

DOF Group was awarded a time charter contract by Subsea7 for the Skandi Acergy, an ROV construction support vessel, the company said. This contract adds a minimum of 18 months firm backlog to DOF at a value in the range $85 million to $105 million. Commencement is expected to in first quarter 2025 after the vessel’s current commitment.

DOF Group also reached an agreement with Maersk Supply Service to charter its Maersk Installer on a two-year firm time charter, with options for extensions. The vessel is expected to join DOF's fleet at the end of the first quarter of 2024.

Odfjell Announces Extension of Deepsea Aberdeen by Equinor

Odfjell Drilling Ltd. announced on Nov. 16 Equinor will exercise options for seven wells, extending the use of the Deepsea Aberdeen on the Breidablikk Field.

The exercised options are planned to start in first quarter 2025 in direct continuation of the current firm period and extend the firm backlog on the Deepsea Aberdeen to end of fourth-quarter 2025. The options have a value of approximately $138 million, excluding integrated services, performance and fuel incentives.

The contract also includes further optional periods, which could keep the Deepsea Aberdeen contracted until 2029. Rates for optional periods will be mutually agreed upon prior to signing new contracts.

Recommended Reading

Canadian Railway Companies Brace for Strike

2024-04-25 - A service disruption caused by a strike in May could delay freight deliveries of petrochemicals.

Enterprise’s SPOT Deepwater Port Struggles for Customers

2024-04-25 - Years of regulatory delays, a loss of commercial backers and slowing U.S. shale production has Enterprise Products Partners’ Sea Port Oil Terminal and rival projects without secured customers, energy industry executives say.

Report: Crescent Midstream Exploring $1.3B Sale

2024-04-23 - Sources say another company is considering $1.3B acquisition for Crescent Midstream’s facilities and pipelines focused on Louisiana and the Gulf of Mexico.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

Energy Transfer Announces Cash Distribution on Series I Units

2024-04-22 - Energy Transfer’s distribution will be payable May 15 to Series I unitholders of record by May 1.