From shallow and deepwater blocks on offer offshore Bangladesh to new production, below is a compilation of the latest headlines in the E&P space.

Activity headlines

Bangladesh Launches Offshore Bid Round

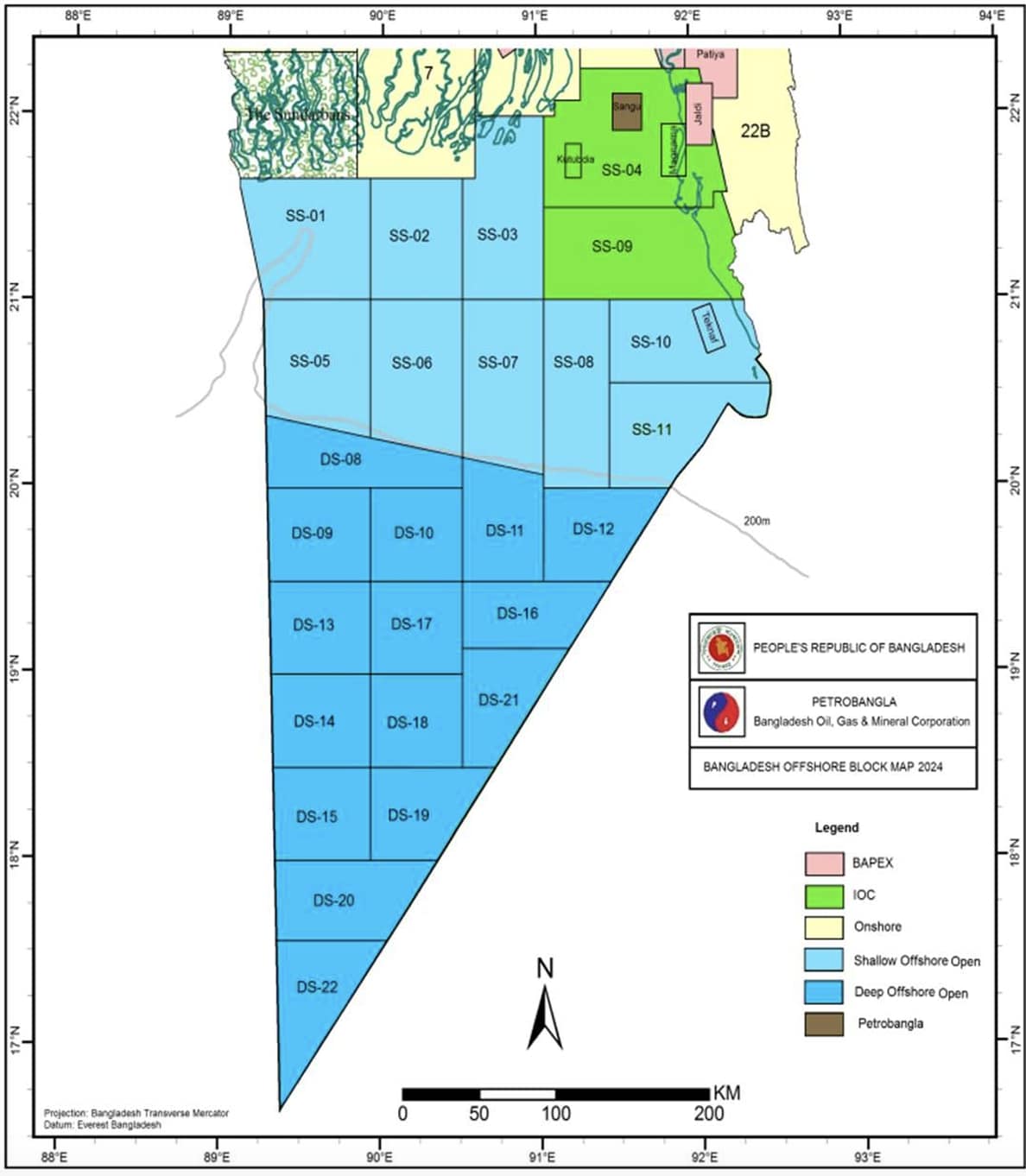

Two dozen blocks offshore Bangladesh are up for grabs in a new bid round, Bangladesh Oil, Gas and Mineral Corp. (PetroBangla) announced in early March.

In the Offshore Bidding Round 2024, nine shallow water blocks (SS-01, 02, 03, 05, 06, 07, 08, 10 & 11) and 15 deepwater blocks (DS-08, 09, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21 & 22) are up for exploration by the international oil companies.

Bids are due on Sept. 9.

Promotional and data packages are available for purchase from PetroBangla. Multi-client data can be purchased directly from the TGS-SLB joint venture.

In partnership with SLB and PetroBangla, TGS said on March 11 it acquired a 2D multi-client seismic data survey with widespread coverage offshore Bangladesh, encompassing over 75,000 sq km across all 24 blocks on offer in the bid round. The acquisition of this 12,636-line km 2D seismic survey was completed in April 2023. The final PSTM-processed products are available, and the final PSDM products will be available in May 2024.

New Hibiscus South Well Online

BW Energy announced March 8 it started production from the DHBSM-1H well in the Hibiscus South field on the Dussafu License offshore Gabon, five months after the November 2023 discovery.

Production performance from the well has been in line with expectations and stable at 5,000 bbl/d to 6,000 bbl/d.

The DHBSM-1H well was drilled as a horizontal well from the BW MaBoMo production facility to a 5,960 m total depth into Gamba sandstone reservoir. The well is about 5 km southwest of MaBoMo in a separate accumulation with a deeper oil-water contact than the nearby Hibiscus Field.

The DHBSM-1H well is expected to recover 6.6 MMbbl from approximately 22 MMbbl oil in place, based on third party 2P probable reserve estimates, BW said.

Contracts and company news

Aramco Renews Worley Contract

Worley said March 11 Aramco has renewed a general engineering services plus contract.

The additional five-year deal includes up to three one-year additional potential extensions.

Worley’s scope includes the project management and engineering services to support Aramco’s capital programs in Saudi Arabia across onshore, green and brownfield projects in gas, oil and new energy infrastructure.

FSO Design Receives Approval in Principle

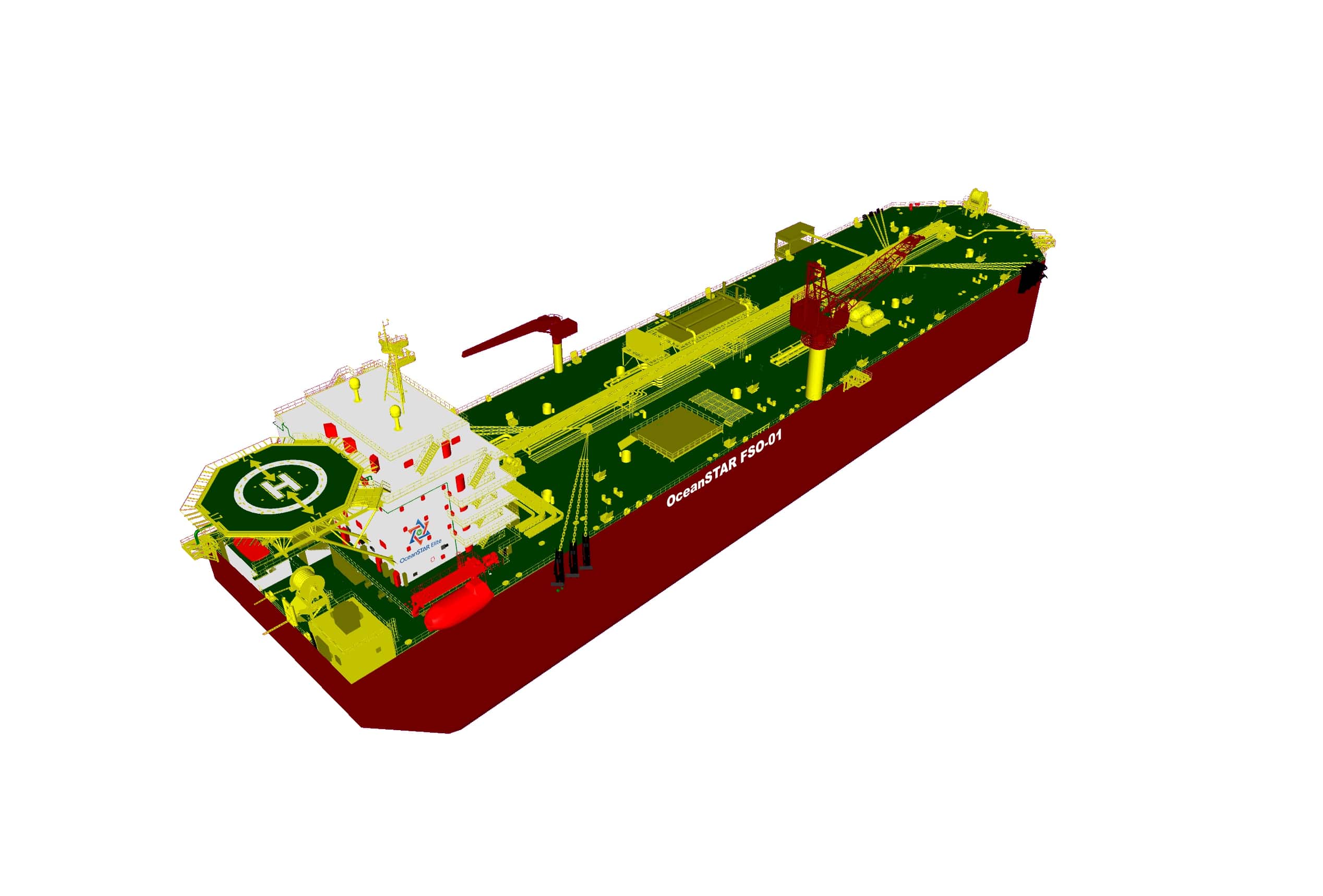

ABS said March 5 it delivered an approval in principle to OceanSTAR Marine & Offshore Investment Pte. Ltd. for its new build floating storage and offloading (FSO) design.

The OceanSTAR FSO-01 has a shipshape hull design developed to cater to midsize FSOs with a storage capacity to scale up to 750,000 bbl of oil for operational demands in Asia Pacific and African coastal offshore fields. Other features include a larger strengthened deck area, expandable living quarters and piping routings that can adapt to topsides for either FPSO or floating production unit applications.

STRYDE Nodes Ordered in Ukraine, Poland

STRYDE has received new contracts, the company reported March 5.

First-time client Ukrainian seismic acquisition firm Georozvidka LLC purchased 25,000 STRYDE Nodes for use on 2D and 3D seismic surveys in Ukraine.

STRYDE is also supplying 12,000 additional nodes to Polish geophysical survey company Geopartner Geofizyka to boost its current node inventory and support a new upcoming seismic survey in the outskirts of Krakow.

Recommended Reading

AI in Oil: Revolution’s Coming, but Tech Adoption Remains Tentative

2024-04-05 - CERAWeek experts say AI will disrupt oil and gas jobs while new opportunities will emerge as the industry braces for an AI-driven workflow transformation.