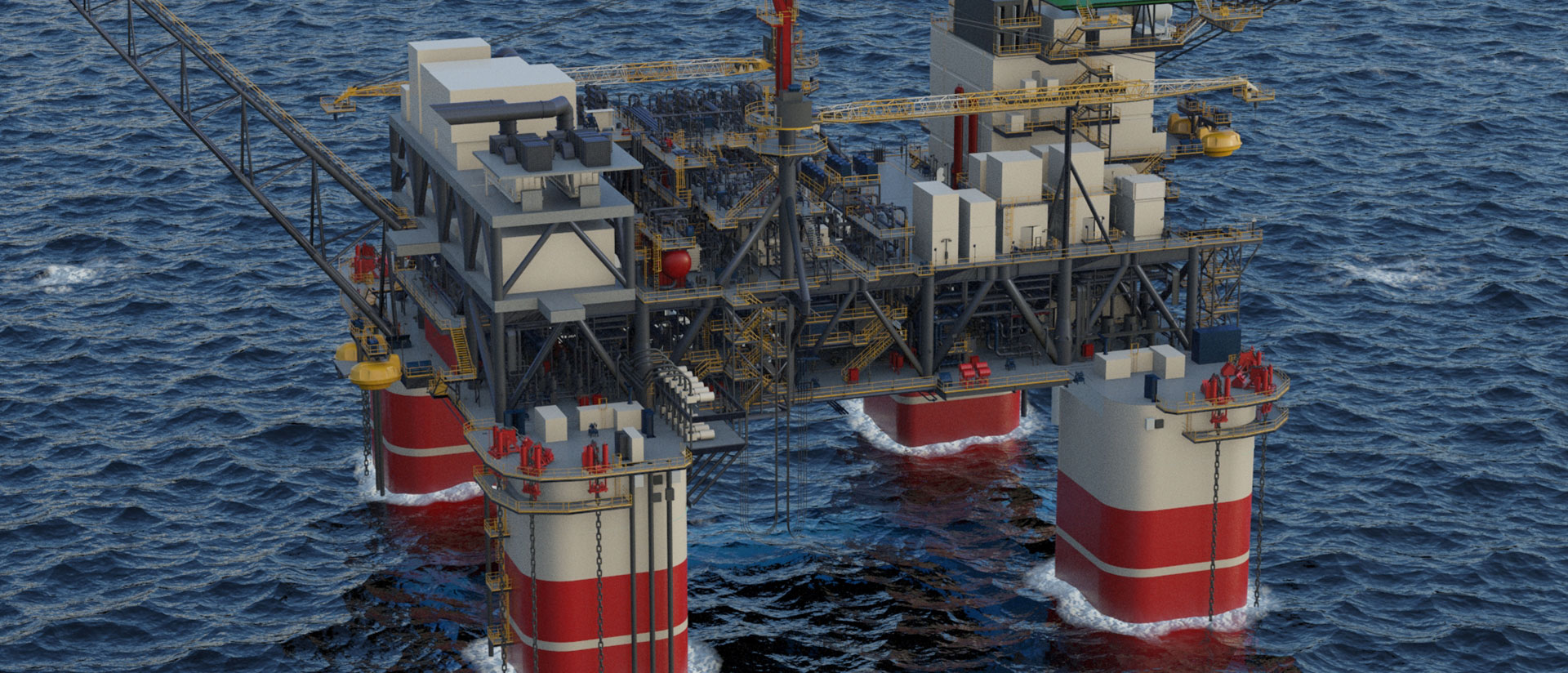

Offshore oil installation. (Source: Shutterstock)

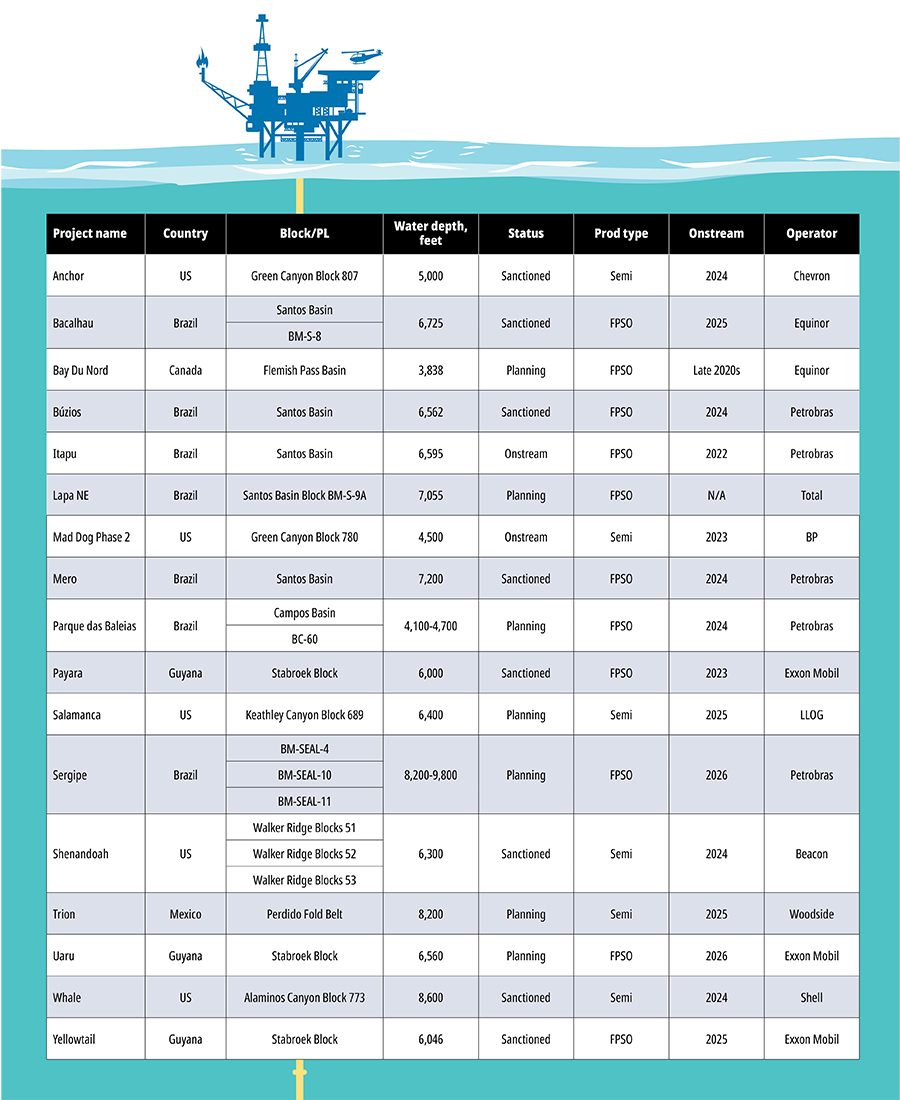

Deepwater projects are a key source for global energy, and part three of Hart Energy E&P’s latest project-by-project summary highlights some of the latest deepwater developments located in the Americas, based on publicly available information and Hart Energy analysis.

Both North and South America are home to major players in the oil and gas industry. The U.S. and Brazil are world leaders in oil and gas production, and the number of projects under development between them should continue that ascendency. Between the two nations, the U.S. and Brazil account for14 projects on this list, with onstream dates ranging from 2022 through mid-decade.

Guyana, despite being one of the smallest and least populated nations in South America, has also emerged with a trio of projects expected to come online in the coming years. The small country has emerged as an oil powerhouse with Exxon Mobil discovering more than 11 Bbbl of recoverable oil and gas in the region.

The final part of this four-part series will cover deepwater projects offshore Europe and the Middle East.

Anchor

After being sanctioned in late 2019, first oil for Chevron Corp.’s Anchor project in the Gulf of Mexico (GoM) is expected in 2024. The project is located in Green Canyon Block 807 in a water depth of 5,000 ft.

Discovered in late 2014, the project will tap Wilcox-aged reservoirs expected to hold as much as 440 MMboe. The field will be developed via seven subsea wells tied back to a new-build semisubmersible floating production unit (FPU).

The FPU for the field will be capable of producing 75,000 bbl/d and 28 MMcf/d of natural gas. The hull for the FPU was recently completed at Daewoo Shipbuilding & Marine Engineering in Singapore. The topsides facility remains under construction at Kiewit Offshore in Ingleside, Texas.

The facility for the $5.7 billion project will be the first 20,000‑ pounds per square inch (psi) system in the GoM. The 8th-generation Deepwater Titan drillship, which is equipped with a 20,000 psi well control system, is expected to start its contract with Chevron in the second quarter of 2023 in the Anchor area. The drillship, which will be deployed at Chevron's Anchor project in the GoM, will stay with Chevron until second-quarter 2028 at a dayrate of $455,000.

Subsea 7 received the project management as well as the engineering, procurement, construction and installation (EPCI) contract for the subsea umbilicals, risers and flowlines (SURF) for the Anchor Field development in 2020.

Also in 2020, Aker Solutions entered a master agreement to provide umbilicals for Chevron-operated oil and gas fields in the U.S. GoM. The scope for the Anchor project includes about 15 miles of 20,000 psi dynamic steel tube and power umbilicals and distribution equipment.

Wood Group received the contract for the preliminary FEED as well as FEED services for the FPU topsides and the subsea system for the Anchor Field development in February 2020.

OneSubsea, a subsidiary of SLB, was contracted in 2019 to supply an integrated subsea production system and multiphase boosting system for the Anchor Field development.

Chevron operates Anchor with a 62.86% working interest, while co-owner Total E&P USA Inc. holds the remaining 37.14%.

Bacalhau

Startup for the Equinor-operated Bacalhau oil and gas field has been delayed until 2025, one year later than expected, after the COVID-19 pandemic slowed work on the project.

The Bacalhau is located across two licenses in the Santos Basin. The blocks are offshore Brazil in a water depth of 6,725 ft.

Final investment decision (FID) on the $8 billion project was taken in 2021. The development will consist of 19 subsea wells tied back to an FPSO. The FPSO, supplied by MODEC, will be one of the largest in Brazil with a production capacity of 220,000 bbl/d and 2 MMbbl of storage capacity. Oil will be offloaded to shuttle tankers, and the gas from Phase 1 will be re-injected in the reservoir.

In April 2021, Equinor awarded Seadrill’s West Saturn drillship a four-year drilling contract. Drilling and well services contracts worth $455 million went to oil services firms Baker Hughes, Halliburton Co. and SLB in November 2020.

Subsea Integration Alliance, formed by Subsea7 and OneSubsea, won a contract for SURF on the project. Aibel was awarded a FEED contract for the Bacalhau project from MODEC in 2020. In January 2021, the two companies then signed an engineering, procurement and construction (EPC) contract for the delivery of 20,000 tons of topside modules for the giant Bacalhau FPSO.

Equinor is the operator for the field with a 40% ownership of the project. Exxon Mobil (40% ownership interest) and Petrogal Brasil (20%) are partners in the field.

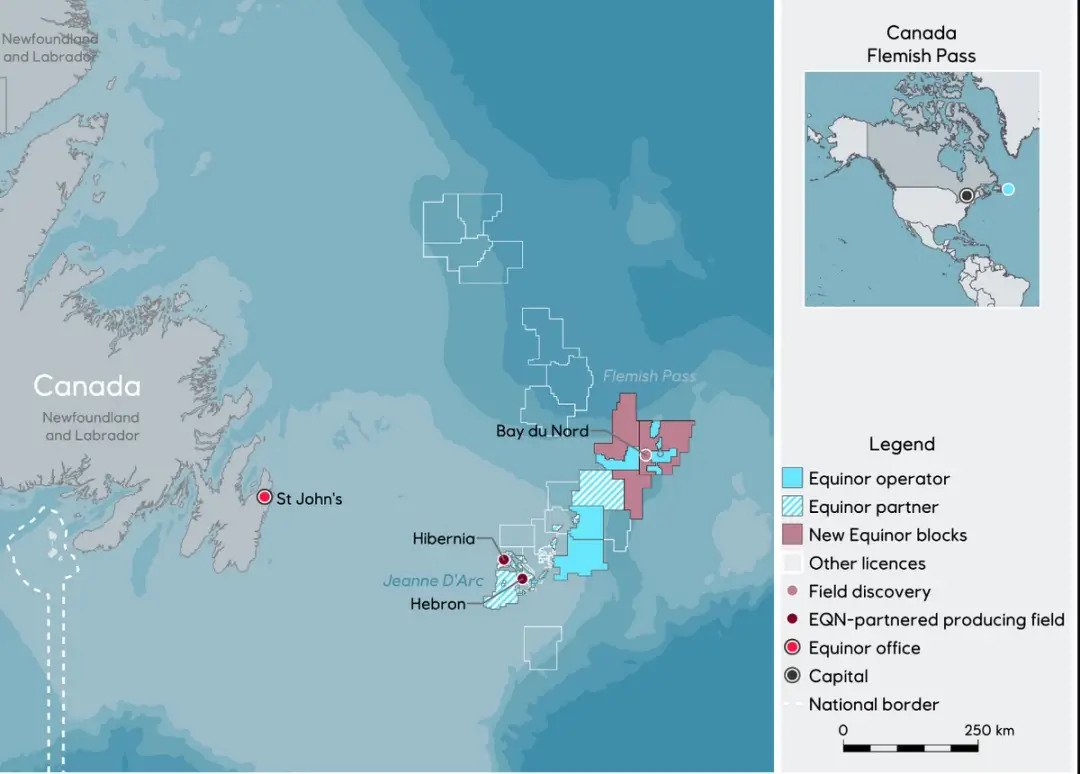

Bay du Nord

Equinor Canada has given KBR Industrial Canada Co. a letter of intent (LOI) for the FEED of the topside facilities for the new Bay Du Nord FPSO to be located in deep waters offshore Newfoundland, Canada. KBR performed pre-FEED work on the Bay Du Nord project in 2022 and will further develop the engineering and execution planning.

Located in a harsh environment, the $12 billion project is in 3,838 ft water depth in Canada’s Flemish Pass Basin. Once completed, it will be the first deepwater drilling site in Canada. The development is expected to involve a substantial 40-well subsea production system tied back to a large FPSO.

The Bay Du Nord Field holds 407 MMbbl of recoverable oil. When combined with other discoveries in the area – Cappahayden (385 MMbbl), Mizzen (102 MMbbl), Baccalieu (45 MMbbl) and Harpoon (40 MMbbl) – the operator estimates total recoverable resources of nearly 1 Bbbl. At its peak, the field is expected to produce 200,000 bbl/d of oil.

Equinor is the operator of the project with a 65% ownership stake. Partner BP holds a 35% stake.

Búzios

Discovered in 2010, the Petrobras-operated Búzios Field entered production in 2018 through the P-74 FPSO. Due to the size of the field, a total of 12 FPSOs are planned with production capacity expected to reach more than 2 MMboe/d by the end of the decade.

The P-74, P-75, P-76 and P-77 were installed within the Búzios 1, Búzios 2, Búzios 3 and Búzios 4 areas, respectively. Production at the P-74 started in April 2018, followed by the P-75 in November 2018. The P-76 and P-77 were commissioned in 2019. At present, Búzios averages production of 575,000 bbl/d of oil and 800 MMcf/d of gas.

Búzios-5 is expected to come into production later this year via a MODEC-supplied FPSO. The FPSO will be capable of processing 150,000 bbl/d of crude oil, 212 MMcf/d and will have minimum storage capacity of 1.4 MMbbl of oil.

On March 31, SBM Offshore officially announced the signing of the project financing of FPSO Almirante Tamandaré for a total of $1.63 billion. The Almirante Tamdare will be deployed at the Búzios-6 project in about 6,500 ft water depth.

The Búzios-6 development will involve the drilling of approximately 15 wells, the FPSO and subsea trees. Production from the project is expected to begin in the back half of 2024, peaking in 2026 at approximately 220,000 bbl/d of crude oil and condensate and 85 MMcf/d of natural gas.

The field is expected to recover 885 MMboe, comprised of 830 MMbbl of crude oil and condensate and 329 Bcf of natural gas.

The FPSO will be operated by SBM Offshore with 55% ownership. Mitsubishi will have a 25% stake and the remaining 20% will be held by Nippon Yusen Kabushiki Kaisha.

Petrobras is the operator of the field with a 92.6% stake, with partners CNOOC and CNODC each holding a 3.7% stake.

Itapu

Production at Petrobras’ pre-salt Itapu Field via the P-71 FPSO started in December 2022.

The P-71 FPSO, located in the Santos Basin in water depth of 6,595 ft, started production ahead of its anticipated start of 2023. Due to the early start, the FPSO is expected to reach peak production in 2023. The vessel’s capacity can process up to 150,000 bbl/d of oil and 212 MMcf/d of gas, and it can store up to 1.6 MMbbl of oil.

The P-71 is the sixth and last of the series of replicant platforms operated by Petrobras. They are characterized by a standardized engineering design, high-production capacity and technologies that reduce greenhouse-gas emissions. One of the unit's low-carbon technologies is a flare gas recovery system, which contributes to a greater use of the produced gas and reduces emissions.

Estaleiro Jurong Aracruz (EJA), a Brazilian subsidiary of shipbuilder Sembcorp Marine, constructed the P-71, integrating topsides into the FPSO. The hull was built by CIMC Raffles. Baker Hughes received two contracts from Petrobras for flexible pipes on the field.

Lapa NE

In September 2022, TotalEnergies awarded TechnipFMC a contract for the EPCI on the Lapa North East Field in the pre-salt Santos Basin offshore Brazil. TechnipFMC will reconfigure and install umbilicals and flexible pipe to boost production from the field.

Subsea 7 also secured a contract from TotalEnergies for the development of the Lapa North East Field.

The company did not reveal the contract value but indicated that it is in the range of $50 million to $150 million.

Under the contract, Subsea 7 will be responsible for the transport, installation and pre-commissioning of 22 miles of flexible pipelines and 12 miles of umbilicals. These will connect five wells to the FPSO Cidade de Caraguatatuba, which will serve the Lapa North East Field. The field, in about 7,000 ft of water, is still in the planning stages.

According to TotalEnergies estimates, the Brazilian oilfield holds recoverable reserves of 459 MMboe.

The Lapa Field Consortium is comprised of operator TotalEnergies, with a 35% stake, Shell Brasil Petróleo (30% interest), Repsol Sinopec Brasil (25% stake) and Petrobras (10%).

Mad Dog Phase 2

On April 13, BP announced it had reached first oil with its Argos production semi as part of the Mad Dog Phase 2 project in the deepwater GoM.

A decade after scrapping the original plans for the Phase 2 development, BP and its partners brought the project to the next stage of its journey, receiving production from the first of 14 producers to the deepwater Argos production semi, 6 miles away from the Mad Dog spar that started production in 2005.

Named Argos as a nod to Odysseus’ loyal dog from Homer’s "The Odyssey," getting the $9 billion Mad Dog Phase 2 project over the finish line has been something of a journey for BP.

Appraisal drilling around Mad Dog in 2009 and 2011 revealed that the area held estimated reserves in place of more than 5 Bboe. The operator decided to use a second platform to produce the additional reserves.

In 2013, BP and its partners scrapped initial spar-based development plans for the Phase 2 project as too complex and costly. In late 2016, BP sanctioned a simplified and standardized platform design that reduced project costs by about 60%, to $9 billion from the initial price tag of more $20 billion. Production was expected to begin in 2021 but was delayed due to COVID-19.

Construction of the Argos offshore platform began in 2018 by Samsung Heavy Industries in South Korea. In 2021, Argos arrived at Kiewit Offshore Services fabrication yard in Ingleside, Texas, after a two-month, 16,000-mile journey onboard the Boskalis BOKA Vanguard heavy transport vessel.

Other major contracts went to Worly for contracting support, Subsea7 for engineering and installation, OneSubsea for the major subsea equipment and Honeywell for the automation.

The platform — BP’s fifth platform in the GoM — has a nameplate capacity of 140,000 bbl/d of oil from up to 14 production wells and water injection capacity of 140,000 bbl/d through eight injectors. So far, 11 production and four water injection wells have been drilled. The platform is moored in 4,500 ft water depth about 190 miles south of New Orleans in Green Canyon Block 780.

BP operates the Mad Dog Field with 60.5% interest on behalf of Woodside Energy with 23.9% and Chevron affiliate Union Oil Co. of California with 15.6%.

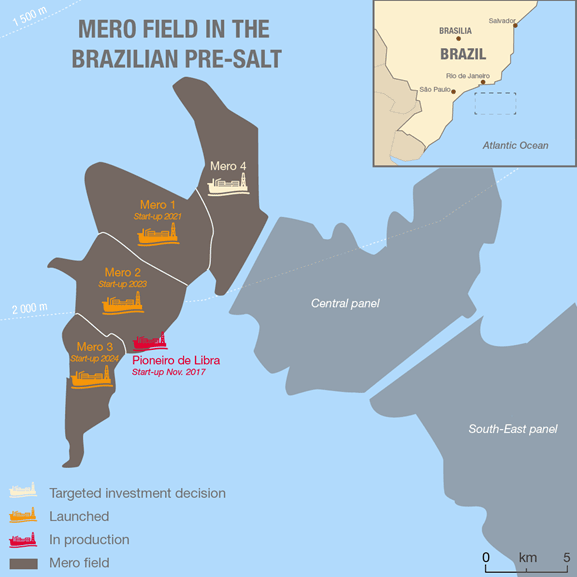

Mero

FID on Phase 3 of the Mero project has been taken, with first production expected in 2024 from the Libra Consortium-operated project.

Mero Phase 3 is located deep offshore, 112 miles off the coast of Rio de Janeiro, in the prolific pre-salt area of the Santos Basin.

Production from the third phase of the Mero development is expected to start through MSIC Berhad’s FPSO Marechal Duque de Caxias in 2024. The production unit will be located at a water depth of 7,200 ft in the southern part of the Mero oil field. The Mero 3 FPSO will have a liquid treatment capacity of 180,000 bbl/d and 423 MMcf/d. Production is expected to start by 2024. It follows the 2017 FID for Mero 1, which started production in 2022. The FID for Mero 2 was taken in 2019 and with startup expected in 2023.

The Mero 3 development plan includes linking FPSO with 15 wells, including eight oil producers and seven water and gas injectors. The wells will be connected using subsea infrastructure consisting of fixed production and injection ducts, control umbilicals and flexible service ducts.

The Libra Consortium also plans to test Petrobras’ HISEP – high pressure separation – technology in the field. The technology involves subsea separation and reinjection via centrifugal pumps of the carbon dioxide produced with the oil, increasing oil production and easing the strain on the FPSO’s oil processing plant.

Subsea 7 was awarded in 2021 a contract to provide engineering, fabrication, installation and pre-commissioning of 50 miles of risers and flowlines, 37 miles of flexible service lines, 31 miles of umbilicals and associated infrastructure for the Mero-3 project. The company will also be responsible for installing the FPSO mooring lines and hook-up.

Steel pipes and related services supplier Tenaris received a contract for the supply of tubular solutions for Mero 3 in 2021. MISC Berhad subcontracted Siemens Energy for the supply of eight topside modules for the Mero 3 FPSO in 2021.

The Mero project is owned by the Libra Consortium. The consortium consists of Petrobras, which owns 38.6% of the project, while Shell and Total each own 19.3%.

Non-consortium stakeholders include Chinese state oil companies CNOOC and China National Petroleum Corp, each with 9.65% stakes. Pré-sal Petróleo owns 3.5%.

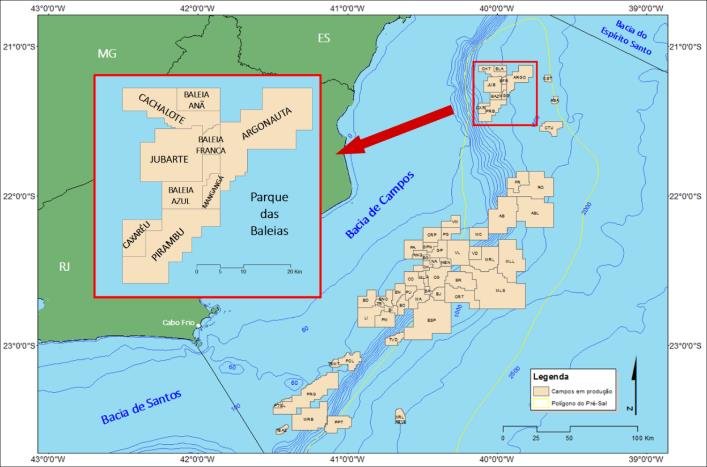

Parque das Baleias

Petrobras’ Parque das Baleias project includes seven fields and four production platforms, of which one is expected on line in 2024.

Malaysia’s Yinson Holdings has entered into a $720 million syndicated loan facility for the Maria Quiteria FPSO to replace the FPSO Capixaba, which ended production in 2022.

The unit, which will be able to process 100,000 bbl/d of oil and 177 MMcf/d of natural gas, is due to enter operation for Brazilian oil giant Petrobras at the Parque das Baleias cluster in the Campos Basin in 2024.

The Parque das Baleias project is comprised of seven fields with pre-salt and post-salt reserves: the Jubarte, Baleia Azul, Baleia Franca, Baleia Anã, Cachalote, Caxaréu and Pirambú. The area is estimated to hold more than 2 Bboe of recoverable reserves.

The project envisions the interconnection of 17 wells to the FPSO, nine of them oil producers and eight water injectors. The subsea infrastructure will be composed of flexible pipelines, electro-hydraulic umbilicals and wet christmas trees.

Currently, three platforms are in operation: P-57, P-58 and FPSO Cidade de Anchieta. A fourth, the Maria Quiteria FPSO, is expected to start production in the fourth quarter of 2024.

Shearwater received a contract for Parque das Baleias for the 4D monitoring of the Jubarte and Baleia Ana fields, with work expected to begin in third-quarter 2023.

Petrobras is the sole owner and operator of Parque das Baleias.

Payara

SBM Offshore’s Prosperity FPSO arrived in Guyanese waters on April 11, 2023. The vessel will develop the Exxon Mobil-operated Payara Field in the offshore Stabroek Block. Prosperity, which will be moored in around 6,000 ft of water, has an initial production capacity of 220,000 bbl/d of oil, with gas treatment of 400 MMcf/d and water injection of 250,000 bbl/d. The FPSO’s overall storage is about 2 MMbbl.

FID on the $9 billion development was reached in 2020. The project will target an estimated resource base of about 600 MMboe. Exxon Mobil and Hess Corp., working with China’s CNOOC Ltd., plan 10 drill centers for up to 20 production wells and 21 injection wells.

TechnipFMC secured the contract to manufacture and deliver the subsea production system for Payara. The system comprises 41 enhanced vertical deepwater trees and tooling, six flexible risers and 10 manifolds with associated controls and tie-in equipment.

TechnipFMC and Halliburton were awarded contracts to provide the fiber optic solution for Payara. TechnipFMC provides optical connectivity from the topside to the completions while Halliburton is handling the fiber optic sensing technology and analysis to support reservoir diagnostics.

Exxon is the operator of the field with a 45% ownership stake. Hess has a 30% stake and CNOOC a 25% stake.

Salamanca

LLOG Exploration Co.’s Salamanca project, still in the planning stages, features a refurbished production semi to handle hydrocarbons from the Leon and Castile fields in the Keathley Canyon area of the GoM.

Trendsetter Engineering won a contract to provide subsea hardware, including the subsea production manifold. Trendsetter is also supplying subsea connectors, along with valves sourced from Advanced Technology Valve SpA for the export tie-ins. The equipment is slated for delivery in early 2024.

Repsol drilled the Leon discovery in late 2014 on Keathley Canyon Block 642 in 6,000 ft of water. The discovery well was drilled to a total depth of about 32,000 ft and encountered nearly 700 ft of high-quality net oil pay. The Castile discovery was drilled on Keathley Canyon Block 736 in over 6,500 ft of water and encountered nearly 400 ft of high-quality net oil pay.

The deep-water development project will initially involve three subsea wells to achieve production from the two fields. Two of the three development wells will be drilled at the Leon Field, while the third will be drilled at the Castile Field.

The fields will be developed using the previously decommissioned semi-submersible Independence Hub platform. LLOG purchased the platform in 2022 and plans to refurbish it to have a capacity of 60,000 bbl/d of oil and 40 MMcf/d of natural gas.

The Salamanca production facility will be moored in Keathley Canyon Block 689 in a water depth of 6,400 ft. First production is expected in mid-2025.

Assisting in the refurbishing of the platform are Audubon, which won a contract to design the topsides, and Kiewit, which is fabricating the topsides. SMB designed the hull.

LLOG is operator. Partners include Repsol and Beacon Offshore Energy.

Sergipe

Petrobras will charter two FPSOs for its operated Sergipe deepwater project in the Sergipe-Alagoas Basin offshore Brazil.

The FPSOs, the SEAP I and SEAP II, will be moored in water depths of 8,200 ft to 9,800 ft, and will each be able to process up to 120,000 bbl/d of 38° API and 41° API oil. Together, they will be able to handle up to 18 MMcm/d of gas.

The first FPSO will serve the Agulhinha, Agulhinha Oeste, Cavala and Palombeta fields, located in the BM-SEAL-10 and BM-SEAL-11 concessions. Petrobras operates BM-SEAL-10 with 100% interest and BM-SEAL-11 with 60% interest. IBV Brasil Petróleo LTDA holds the remaining BM-SEAL-11 40% interest.

The second FPSO will serve the Budião, Budião Noroeste and Budião Sudeste fields, located in the BM-SEAL-4, BM-SEAL-4A and BM-SEAL-10 concessions, respectively. Petrobras operates BM-SEAL-4 with 75% interest on behalf of ONGC Campos Limitada with 25%. Petrobras operates BM-SEAL-4A and BM-SEAL-10 with 100% interest.

While Petrobras has declined to provide a volume estimate, market analysts have said the region contains about 1.2 Bbbl of recoverable reserves.

Shenandoah

Beacon’s operated deepwater Shenandoah project in the U.S. GoM is scheduled to come online in late 2024.

Shenandoah, which is in an HP/HT environment, is in Walker Ridge blocks 51, 52 and 53. Multiple wells are expected to develop an estimated 100 MMbbl of oil reserves to 400 MMbbl of gas reserves, targeting previously discovered oil-bearing Upper and Lower Wilcox reservoirs.

Beacon has contracted for Transocean’s Deepwater Atlas drillship — the world’s first 8th gen ultradeepwater drillship — to drill at Shenandoah. Atlas will initially use dual BOPs rated to 15,000 psi to handle drilling before switching out one of the BOPs on the drillship for a 20,000-psi BOP for the completion activities.

South Korea’s Hyundai Heavy was awarded a contract for design, procurement, construction and delivery of Shenandoah’s semisubmersible production platform and its installation, while U.S. energy company Williams is providing offshore natural gas gathering and transportation services and onshore natural gas processing services to the development. Subsea 7 is delivering EPCI and commissioning of the subsea equipment, including structures, umbilicals and production and gas export flowlines. Subsea 7’s scope also included the wet tow and hook-up of the semi-submersible floating production and storage vessel to the field and mooring system installation.

The project is owned and operated by Beacon, who holds a 31% working interest in the field, after acquiring ownership and operatorship from LLOG in 2020. ShenHai holds 49% interest in the project and HEQ 20%.

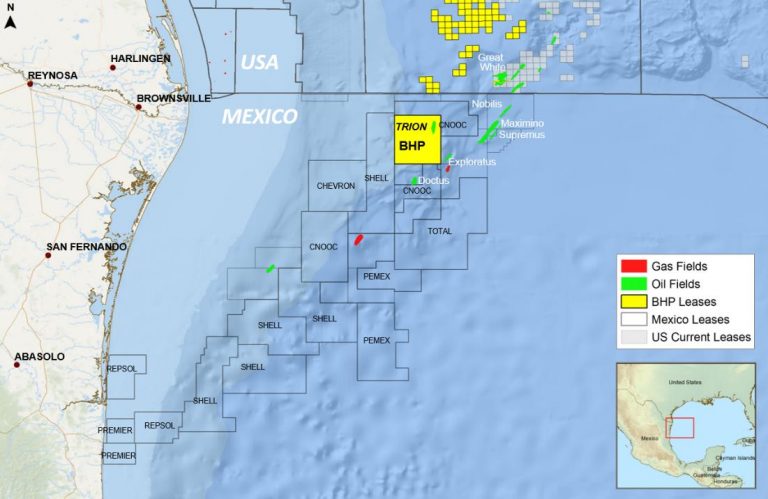

Trion

Woodside Energy is on track to reach FID on the Trion project in the Mexico GoM later this year. Woodside delayed FID on the $11 billion project until 2023 as costs have risen worldwide for manufacturing components for megaprojects.

Discovered in Mexico’s Perdido fold belt in 2012, Trion is a greenfield development of a reservoir that holds more than 1 Bboe. The field is about 20 miles south of the U.S. and Mexico maritime border at a water depth of 8,200 ft.

Trion will be developed as a semi-submersible floating production unit (FPU) capable of producing and transferring 100,000 bbl/d to a floating storage and offloading (FSO) vessel. Oil from the FSO is expected to be exported to the market, with excess gas transferred via a pipeline to existing offshore gas export infrastructure.

The main components of the reservoir development plan include gas injection, water injection and phased development drilling of 24 total wells. The field was appraised with a total of six well penetrations.

In 2020, SBM Offshore, TechnipUSA and McDermott were selected to conduct pre-FEED studies for the FPU. McDermott confirmed the pre-FEED contract award for a semisubmersible.

Doris, an engineering and project management company, received a contract in 2020 to provide engineering services for SURF, as well as the export pipeline.

Woodside acquired Trion from BHP Petroleum following a merger. They now operate the field and hold a 60% participating interest. PEMEX Exploration & Production Mexico owns the remaining 40%.

Uaru

Exxon Mobil estimates the development of the Uaru Field offshore Guyana will cost about $12.7 billion, due to inflationary pressures on oil and gas projects internationally.

Uaru will be the supermajor’s fifth deep-water development in the Stabroek Block, with first oil expected in fourth-quarter 2026. The project is in water depths of 6,560 ft and encompasses the Mako and Snoek finds in the area. The fields contain an estimated recoverable resource of 1.3 Bboe.

Announced in 2020, Uaru was the 16th oil discovery in the 6.6-million-acre Stabroek Block. Drilled in 6,342 ft of water, the Uaru-1 well encountered approximately 94 ft of high-quality oil-bearing sandstone reservoir. The supermajor announced the Uaru-2 discovery in the same block in April 2021. Drilling at Uaru-2 encountered 120 ft of high-quality oil-bearing reservoirs, including newly identified intervals below the original Uaru-1 discovery.

Uaru will use a subsea system connected to the Errea Wittu FPSO vessel, supplied by MODEC. The vessel will have oil storage capacity of 2 MMbbl and capacity to process 250,000 bbl/d of oil and 540 MMcf/d of natural gas. The FPSO will be able to offload approximately 1 MMbbl onto a tanker in a 24-hour period.

Saipem was awarded a contract for the design, fabrication and installation of subsea structures, risers, flowlines and umbilicals for a large subsea production facility. Saipem plans to undertake the contract work using its FDS2 and Constellation vessels. Strohm won a second jumpers-on-demand contract to supply more than 24 jumpers and associated pipe handling equipment for Uara.

Exxon Mobil has a 45% operating stake in the project. Hess holds 30%, and CNOOC 25%.

Whale

After reaching FID in 2021, Shell’s Whale project in the U.S. GoM is expected to come onstream in 2024.

Discovered in 2017 in Alaminos Canyon Block 773, Whale will feature a semi-submersible production host in 8,600 ft of water with 15 oil-producing wells. The field currently has an estimated recoverable resource volume of 490 MMboe with expected peak output of around 100,000 boe/d.

The FPU will be a 99% replica of Shell's Vito project. The topside will be an 80% replication of the topsides from Vito, a four-column semi-submersible host facility located in the greater Mars Corridor. By leveraging the engineering, construction and supply chain of Vito, Shell said, Whale is expected to achieve first oil only 7.5 years after discovery, despite being delayed a year by the pandemic.

Worley won contracts to design the hull and topsides of the FPU, and Sembcorp won contracts for the fabrication of the hull and topsides.

Koil Energy, formerly known as Deep Down, received a contract for the design, engineering and manufacturing of a riser isolation valve control system and subsea production equipment in 2020.

Shell Offshore operates Whale with 60% interest on behalf of Chevron with 40%.

Yellowtail

After receiving approval from the Guyanese Environmental Protection Agency, Exxon Mobil reached FID on their $10 billion Yellowtail project in April 2022. Production on the field in the Stabroek Block offshore Guyana is scheduled to begin in 2025.

Yellowtail—Exxon Mobil’s fourth and largest project in the block—is in 6,046 ft of water and has an estimated resource of more than 900 MMbbl.

Yellowtail production from the One Guyana FPSO is expected to produce 250,000 bbl/d of oil. It will have associated gas treatment capacity of 450 MMcf/d and water injection capacity of 300,000 bbl/d. It will also be able to store approximately 2 MMbbl of crude oil. The project will include six drill centers and up to 26 production wells and 25 injection wells.

TechnipFMC will provide project management, engineering, manufacturing and testing capabilities for the subsea production system. The system includes 51 enhanced vertical deepwater trees and associated tooling, as well as 12 manifolds and associated controls and tie-in equipment. TechnipFMC will also deliver the overall subsea production system for the development.

SBM Offshore is set to perform FEED work on the Yellowtail FPSO with plans based on one of its Fast4Ward hulls. Hunting Plc has been contracted to provide titanium stress joints for the project.

Esso Exploration & Production Guyana Ltd., a subsidiary of Exxon Mobil, is operator and holds 45% interest in Stabroek Block. Hess Guyana Exploration Ltd. holds 30% interest and CNOOC Petroleum Guyana Ltd. 25% interest.

Recommended Reading

Equinor, Ørsted/Eversource Land New York Offshore Wind Awards

2024-02-29 - RWE Renewables and National Grid’s Community Offshore Wind 2 project was waitlisted and may be considered for award and contract negotiations later, NYSERDA says.

Ørsted Names New CFO, COO Following 2023 Setbacks

2024-02-27 - Ørsted appointed Trond Westlie as CFO and executive board member and Patrick Harnett as COO following company difficulties in 2023, including a $4 billion impairment charge in third-quarter 2023.

US Gives Final Green Light to Sunrise Wind Offshore Project

2024-03-26 - The approval by the Bureau of Ocean Energy Management solidified Ørsted and Eversource’s commitment to the project with both taking final investment decisions.

Energy Transition in Motion (Week of Feb. 23, 2024)

2024-02-23 - Here is a look at some of this week’s renewable energy news, including approval of the construction and operations plan for Empire Wind offshore New York.

Eversource to Sell Sunrise Wind Stake to Ørsted

2024-04-19 - Eversource Energy said it will provide service to Ørsted and remain contracted to lead the onshore construction of Sunrise following the closing of the transaction.