Consultants with both Enverus and Wood Mackenzie are optimistic about construction of new platforms in the Gulf of Mexico (GoM), especially in deep water. In fact, deeper water and deeper wells are the hallmarks of current activity. (Source: Shutterstock.com)

Consultants with both Enverus and Wood Mackenzie are optimistic about construction of new platforms in the Gulf of Mexico (GoM), especially in deep water. In fact, deeper water and deeper wells are the hallmarks of current activity.

According to R. Scott Nance, principal analyst of Americas Upstream Oil and Gas for Wood Mackenzie, “If you look at the five years from 2021 to 2025, there are seven new platforms added, versus four platforms in the five years previous.” Most are in deepwater and pushing the frontier into “areas that don’t have as much infrastructure” for takeaway.

The uptick involves many projects that were on the drawing board by 2019 or 2020. Tabled during the COVID-related demand collapse, they are now being restarted.

Projects are located in deepwater production areas such as Alaminos Canyon, Garden Banks and Keathley Canyon.

Marvin Ma, vice president of intelligence for Enverus, added Green Canyon and Walker Ridge to that list. Ma noted that the areas have similar geologies, being in the Lower Tertiary interval, in what he called “deepwater calm.” Very little new production is in the works for wells in shallower water.

Production, investment amounts

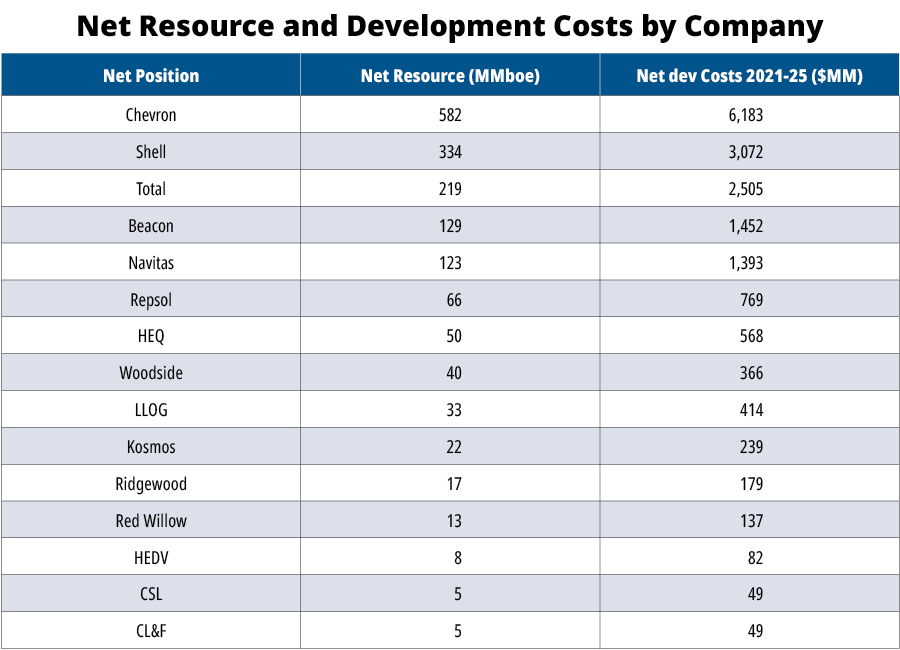

According to Enverus Intelligence Research, major players from the dollars-invested for construction and net recoverable resources perspective include Chevron Corp. ($6.18 billion, 587 MMboe), Shell ($3.07 billion, 334 MMboe) and TotalEnergies ($2.5 billion, 219 MMboe).

Four of the projects, said Ma, are standalones and require their own platforms—including Shell-operated Whale, Chevron-operated Anchor, Beacon Offshore-operated Shenandoah and LLOG-operated Leon and Castile. Chevron-operated Ballymore, Woodside Energy-operated Shenzi North and Beacon-operated Winterfell are subsea tiebacks to existing production units.

Carrying multi-billion dollar price tags, many GoM projects are joint ventures.

“Basically, all these projects are pursued as joint ventures because that’s the only way to manage the risk, to spread out that cost,” Nance said.

And risk there is. Ma said a new well’s chance of being commercially successful ranges between 12% and 25%. In some cases, even when oil is found, if the supply is not expected to be commercially successful, that well—no matter the amount already spent on it—will be abandoned.

Nance is optimistic about future takeaway infrastructure in the GoM.

“From what we can tell, that’s certainly being actively pursued by the midstream companies, to try and get those deals,” Nance said. Whale and Shenandoah will have dedicated export lines, but more takeaway will be needed.

With deepwater oil-to-gas ratios at 9-1 or greater, there’s only a real need for one pipeline system, for the oil.

Construction companies involved

Most companies doing the platform construction are headquartered overseas. Mfon Usoro, Wood Mackenzie Senior Research Analyst, Americas Upstream Oil and Gas, said, “There are two key players here.”

She listed Singapore-based Sembcorp Marine, which has recently rebranded to Seatrium, along with South Korea-based Hyundai and Samsung as the key players for semi-submersible platform hulls.

“Most of the new facilities we’ve seen are semi-subs. I think in the past the spars were gaining popularity, but it seems to have switched” with recent construction, she said.

Nance added that after the above companies build the hull, they send it to Kiewit Offshore Services in Ingleside, Texas for “the bulk of the topside fitting out” before the floating production units are sent out into the Gulf of Mexico.

Fiscal advantages outweigh regulatory concerns

The current regulatory climate is creating some uncertainty, Ma said, pushing some producers to move ahead while the window is still open. “We know, in September, there will be one (U.S.) lease sale coming up—Lease Sale 261.” Ma said he believes the current uncertainty about whether more lease sales will be held in the future will prompt companies to collect a number of leases during Sale 261.

“I am still optimistic when I think about the U.S. GoM,” he said. “If we compare U.S. GoM with Brazil, Mexico, Guyana, Suriname, and if we talk about policy risk, generally we know that U.S. GoM definitely has the lowest risk.”

Economics, including taxes, favor the U.S. GoM over other countries.

The U.S. GoM royalty rate is 18.75%, plus a 21% corporate income tax, Ma pointed out. “When we benchmark that fiscal regime on America’s offshore, we know that it is one of the most favorable regimes” in the world. Fiscal regime includes the contract, the production license, royalties and taxes paid to the government.

The breakeven point is also part of the decision-making process.

“We estimate a median breakeven of $39 for tiebacks (ranging from $35-$45/boe) and $47 for standalones (from $40-$50/boe) for all GoM projects that recently achieved first production or are under construction,” he said.

For the seven top projects listed in the table, he said break-even is closer to $43/boe.

Most analysts expect oil prices to remain well above that rate, with some seeing $100/bbl by the end of 2023.

OPEC+ production cuts, although slight, combined with falling production and limited investment elsewhere, are expected to prop up oil prices. If those predictions hold true, the U.S. GoM is expected to remain profitable.

One thing inhibiting shallow water wells is a new royalty regime initiated in the Inflation Reduction Act. Ma said the law increased the shallow water royalty to 18.75%, a 50% increase from the previous 12.5% rate. But, he said, the deepwater royalty was already at the higher number, and either way, remains one of the most favorable rates in the world.

With limited flaring due to the low natural gas ratio and emissions controls, Ma said U.S. GoM production is among the cleanest in the world, on an emissions-per-barrel basis.

What’s next?

As oil prices stay above the break-even mark for GoM projects, some producers, including BP and Shell, are reopening previously mothballed projects.

“In the next two years,” said Ma, “for discovered resource/pre-sanctioned projects, we expect to hear investment decisions on Shell’s Sparta and Leopard, BP’s Kaskida, (Equinor’s) Monument and LLOG’s Blacktip,” which LLOG bought from Shell.

Sparta is currently at FEED, he said. As for BP’s new discovery in Kaskida, that is “the next big, mega project.”

Recommended Reading

1PointFive, AT&T Enter Carbon Removal Pact

2024-03-13 - 1PointFive said it is also participating in AT&T’s Connected Climate Initiative to collaborate on carbon removal solutions like direct air capture.

Trace Carbon Solutions Applies for First Phase of Class VI Wells at Evergreen Hub

2024-03-12 - Trace is applying for its subsidiary Evergreen Sequestration Hub to be allowed to permanently sequester CO2 in underground geological formations in Louisiana.

SLB to Acquire Majority Stake in Aker Carbon Capture

2024-03-31 - SLB and Aker Carbon Capture plan to combine their technology portfolios, expertise and operations platforms to bring carbon capture technologies to market faster and more economically, SLB said in a news release.

Red Trail Energy Issues Carbon Removal Credits

2024-03-06 - Red Trail Energy’s CO2 removal credits is the largest durable carbon removal project registered on the Puro Registry to date.

Shell Taps Bloom Energy’s SOEC Technology for Clean Hydrogen Projects

2024-03-07 - Shell and Bloom Energy’s partnership will investigate decarbonization solutions with the goal of developing large-scale, solid oxide electrolyzer systems for use at Shell’s assets.