Originally published on blog.evaluateenergy.com by Mark Young.

According to CanOils’ new study “How Sustainable Is Canadian Oil & Gas At $50 Per Barrel?” the majority of the Canadian oil and gas industry is set for difficult times ahead; less than 20% of the biggest oil and gas companies in Canada have what CanOils defines as sustainable operations at $50 oil. This conclusion was reached by looking into breakeven metrics for the 50 companies as a whole at various oil price benchmarks, as well as debt positions and hedging arrangements in place.

Key conclusions of this CanOils study:

--Less than 20% of leading Canadian oil and gas companies with oil-weighted production will be able to sustain their business long-term at US$50 a barrel. The longer that benchmark prices stay this low, the quicker and deeper the decline in expenditures on exploration and new development – and consequently on Canadian oil production – will be. Externally-sourced finance for development could also be limited; the inevitable write-downs of assets that will accompany the falling oil price could harm companies’ ability to borrow based on their reserves going forward and low share prices may discourage companies from securing finance by issuing equity.

--In the immediate future, however, expect the opposite; companies will aim to maximize output from existing facilities and squeeze every last drop of oil from existing wells. That is because virtually all Canadian oil and gas producers (including oil sands producers) should continue to generate positive cash flow at US$50 oil. Trouble is, it’s not sustainable and this is only acceptable in the very short-term.

--A significant number of companies with high debt ratios are particularly vulnerable right now.

--Natural gas-weighted producers’ profits will be substantially shielded from the effects of the drop in oil prices, assuming gas prices hold up.

--Expect to see more M&A activity as companies with the most liquidity upgrade their portfolios.

How the market has responded to the falling oil price so far

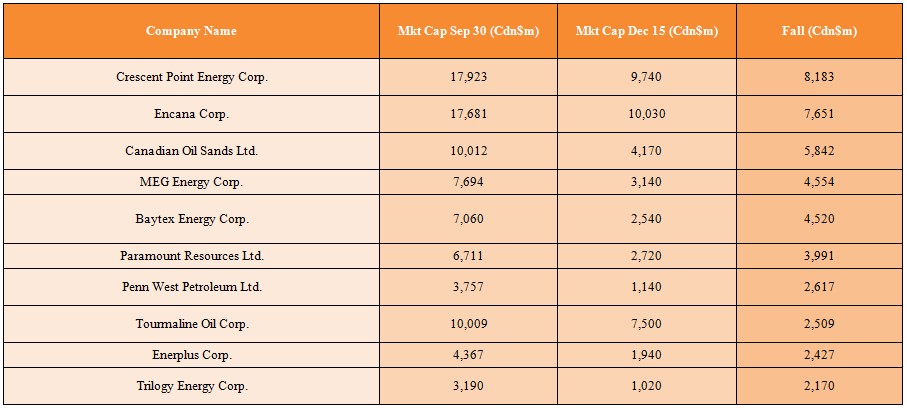

The 50 Canadian oil and gas companies included in CanOils’ study have suffered a very significant fall in market capitalization values since the price began to fall. At the end of September 2014, the WTI spot price (see note 1) was still above US$90 and the combined market cap of the group was around CA$151 billion. By mid-December 2014, only 10 weeks later, this combined value had dropped by a staggering CA$66 billion. The 10 biggest falls in market cap of the companies included in the study are listed below.

Source: CanOils study: How Sustainable Is Canadian Oil & Gas At $50 Per Barrel?

This general fall in market cap for the entire group is very interesting as it is not only the oil companies who have been impacted. The companies that are heavily gas-weighted have been tarred with the same brush, even though CanOils’ study concludes that their profits should be protected from a falling oil price if gas prices hold up. CanOils expects this situation to rectify itself before too long, but for now it seems that all oil and gas companies are suffering, regardless of their individual production portfolios.

Notes

1) The WTI spot price is used as the benchmark price in this CanOils study because it is the price against which the majority of the 50 companies included hedge their oil production.

2) This study was written in January 2015, using average breakeven costs between Q1 2013 and Q3 2014 for the 50 companies included.

Recommended Reading

In Service: Appalachian E&Ps Banking on MVP for Bigger Returns

2024-06-14 - Appalachian Basin E&Ps are expected to ramp up production for the Equitrans-operated Mountain Valley Pipeline by 2025 — although, near term, only about 38% of the line’s capacity is expected to be used, an analyst said.

Appeals Court Rules Against Enbridge in Jurisdictional Fight on Line 5

2024-06-18 - Reform is needed to counter a litigate-on-all-fronts strategy, an industry analyst says.

US Wins $15B Arbitration Fight Over Keystone Pipeline Extension

2024-07-16 - Arbiters ruled that TC Energy had no case because NAFTA, under which the Canadian company planned the pipeline extension, was no longer in effect when the Biden administration canceled the project in 2021.

Williams Begins Louisiana Project Despite Lingering Legal Dispute

2024-07-22 - Williams Cos. Informed FERC that the Louisiana Energy Gateway project will begin construction despite an ongoing dispute with midstream rival Energy Transfer.

Canada’s Train Strike Goes Off—Then Back On—the Rails

2024-08-23 - After the Canadian government stepped in to end the work stoppage, the Teamsters Union indicated that the strike would go forward.