Ring Energy Inc. (AMEX: REI) added to its position in the Permian’s Central Basin Platform (CBP) with a recent “core-of-the-core” bolt-on acquisition in Andrews County, Texas.

The acquisition, which Ring said closed on Dec. 26, consists of 4,763 net acres in Andrews County from Tessara Petroleum Resources LLC, a subsidiary of global asset management firm The Carlyle Group LP (NASDAQ: CG).

Ring will be the operator with a 100% working interest and 75% net revenue interest in the acquired acreage offsetting existing the company’s position where it has focused on drilling horizontal wells targeting the San Andres Formation.

Ring CEO Kelly Hoffman said the company has been working on acquiring the Carlyle property located within the sweet spot of Ring’s CBP operations for over six months.

“We have continued to look for acquisitions that will complement our existing properties and be immediately accretive,” Hoffman said in a statement on Dec. 20.

The Midland, Texas-based oil and gas operator agreed to pay the Carlyle subsidiary for roughly $11.9 million in Ring shares, according to analysts with Capital One Securities Inc. using the closing stock price on Dec. 20.

The 2.6 million shares being issued to the sellers equate to about 4% of Ring’s outstanding share count, the Capital One analysts said in a Dec. 21 research note.

“The transaction works out to about $2,500 per acre [no associated production] and about $425,000 per each of the 28 net drilling locations we estimate are being added with the transaction,” the Capital One analysts said. “We estimate the company now has about 12 years of horizontal drilling inventory in the CBP based on the one rig planned for 2019 drilling an estimated 28 wells.”

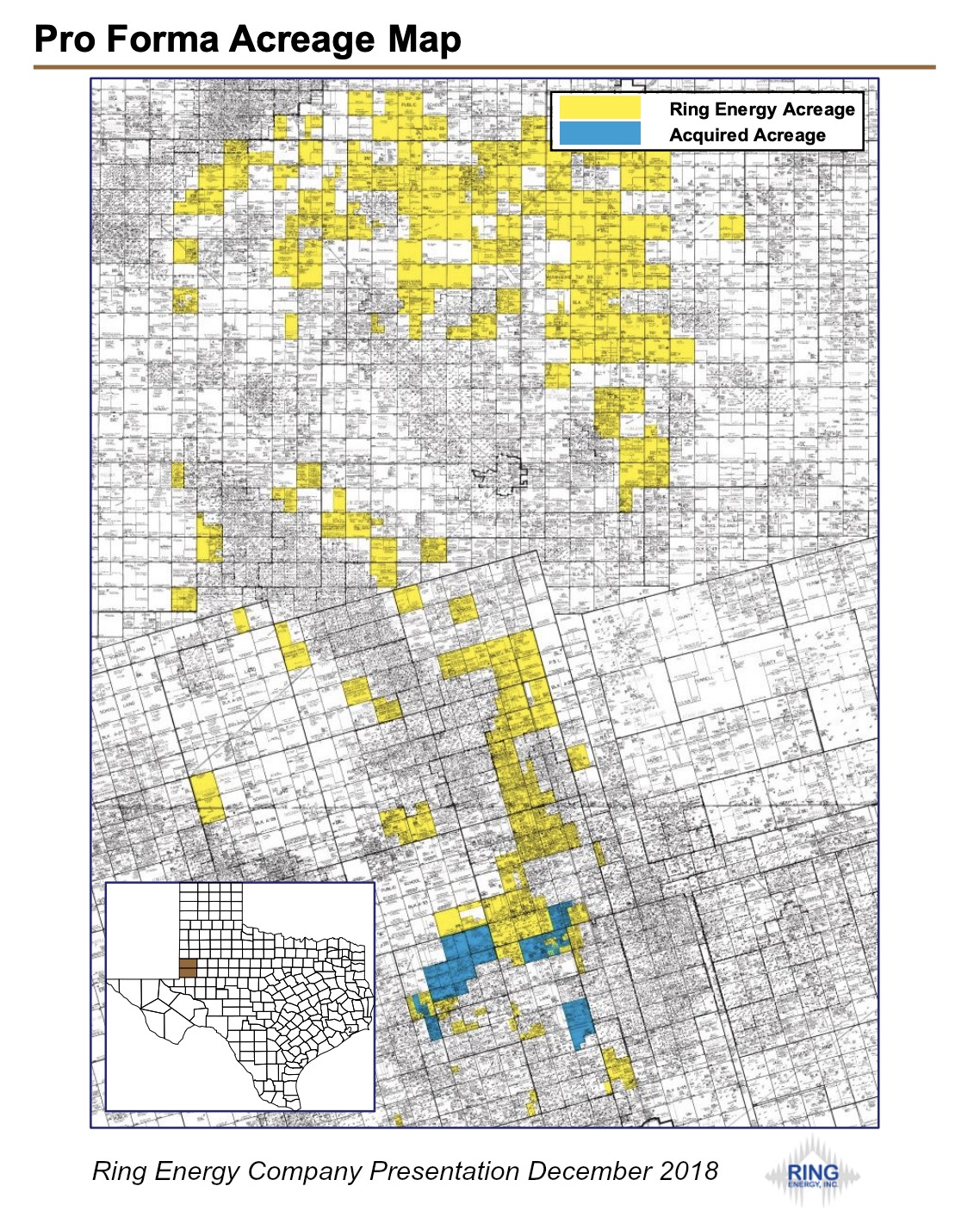

Separately, Ring also acquired about 550 surrounding net acres through small transactions. In total, the company will have roughly 75,926 net acres in the Permian’s CBP.

Ring management estimates that this acquisition, in combination with additional smaller surrounding leases the company acquired, will add 5,313 net acres and 55 new gross horizontal drilling locations, which Hoffman said equates to the addition of over two years of new drilling locations to the company’s current inventory.

“These additional locations could potentially add as much as $180 million of PV-10 value, or approximately $2.85 per share, at a realized price of $45 per boe (barrels of oil equivalent) even after the issuance of the transaction shares,” he said.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.