Brazil’s state-controlled oil company Petrobras received only one proposal, from Holland’s SBM Offshore, in a bid to contract construction of the Mero 4 oil platform in the Santos Basin presalt, two sources with knowledge of the matter told Reuters.

Petrobras’ business plan foresees Mero 4 entering operation in 2025 with a capacity to produce 180,000 barrels of oil a day.

Petrobras and SBM declined to comment.

One of the sources commented that it is the “first time in a long time that Petrobras has received only one proposal” in a bid, a sign that the platform chartering market may no longer have as much room to absorb new demands.

In January, Petrobras held the first bid for the contracting of its own platforms in more than seven years, while seeking to diversify its suppliers of production units.

On that occasion, the company received three proposals from consortia led by Keppel Corp. Ltd., Samsung Heavy Industries Co. Ltd. and Daewoo Shipbuilding & Marine Engineering Co. Ltd., for the construction of the P-78 and P-79 platforms.

According to previous information provided by Petrobras, the Mero field is the third largest in the presalt layer and is located in the Libra area, the first to be auctioned in Brazil under production sharing in 2013.

This year, Mero will receive its first definitive production platform, according to the business plan.

The area is operated by Petrobras, with a 40% stake, in partnership with oil majors Royal Dutch Shell and Total each with a 20% stake, and 10% each held by Chinese companies CNODC and CNOOC.

Recommended Reading

Keeping it Tight: Diversified Energy Clamps Down on Methane Emissions

2024-04-24 - Diversified Energy wants to educate on emission reduction successes while debunking junk science.

Darbonne: The ESG Sword: BlackRock's Life, Death by ESG

2024-04-17 - BlackRock, the $10 trillion investment manager, is getting heat for too much ESG investing, while shareholders are complaining it’s doing too little.

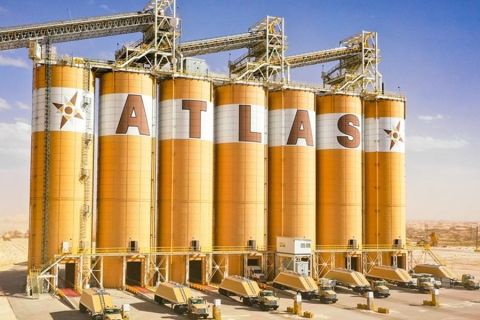

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.