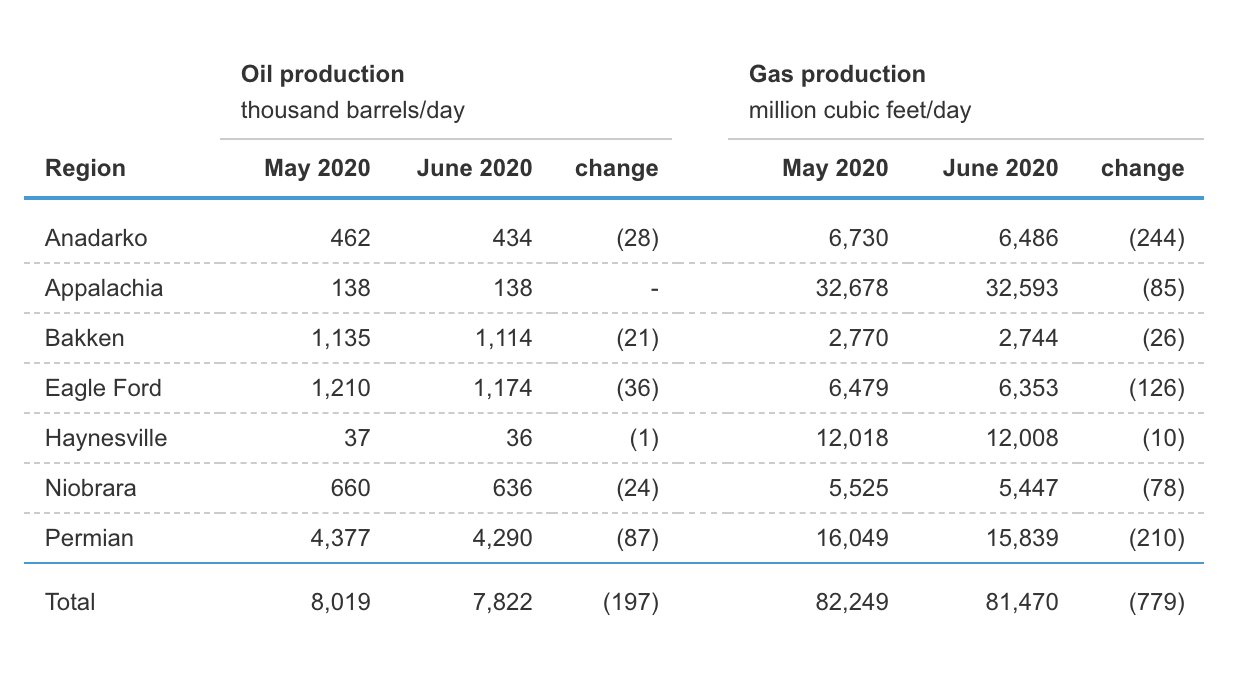

U.S. crude production from seven major shale formations is expected to fall by a record 197,000 bbl/d in June to 7.822 million bbl/d, the U.S. Energy Information Administration (EIA) said in a monthly report on May 18.

The output from shale formations would be the lowest since August 2018, according to data from the agency.

U.S. crude production from shale formations has more than doubled since 2013, lifting the country's overall oil output to new record highs. Producers have throttled back production since March as prices have crashed due to oversupply and a sharp drop in demand due to the novel coronavirus outbreak.

In June, oil output from shale is expected to drop in each of seven major shale regions, with the largest drop of about 87,000 bbl/d in the Permian Basin of Texas and New Mexico. In the Permian, the largest producing shale region, production is expected to fall to about 4.29 million bbl/d.

Separately, the EIA projected in its productivity report that U.S. natural gas output would decline for a seventh month in a row to 81.5 Bcf/d in June.

That would be down almost 0.8 Bcf/d from the agency's forecast for May. U.S. output from the big shale fields hit a monthly all-time high of 86.3 Bcf/d in November.

Output in the Appalachia region, the biggest U.S. shale gas formations, was also set to slip for a seventh month in a row in June to 32.6 Bcf/d, down about 0.1 Bcf/d from May.

The EIA said producers drilled 718 wells and completed 705 in the biggest shale basins in April. That left total drilled but uncompleted (DUC) wells up 13 to 7,617, their first increase in 11 months.

The number of wells drilled and completed were both at the lowest levels in a month since December 2016.

Recommended Reading

US Expected to Supply 30% of LNG Demand by 2030

2024-02-23 - Shell expects the U.S. to meet around 30% of total global LNG demand by 2030, although reliance on four key basins could create midstream constraints, the energy giant revealed in its “Shell LNG Outlook 2024.”

Majors Aim to Cycle-proof Oil by Chasing $30 Breakevens

2024-02-14 - Majors are shifting oilfields with favorable break-even points following deeper and more frequent boom cycles in the past decade and also reflects executives' belief that current high prices may not last.

CERAWeek: LNG to Play Critical Role in Shell's Future, CEO Says

2024-03-19 - Sawan said LNG will continue to play a critical role adding that LNG currently makes up around 13% of gas sales but was expected to grow to around 20% in the coming 15 to 20 years.

Liberty Energy CEO: NatGas is Here to Stay as Energy Transition Lags

2024-03-27 - The energy transition hasn’t really begun given record levels of global demand for oil, natural gas and coal, Liberty Energy Chairman and CEO Chris Wright said during the DUG GAS+ Conference and Expo.

CERAWeek: CEO Patrick Pouyanné Jokes that Texas is TotalEnergies’ ‘El Dorado’

2024-03-19 - TotalEnergies CEO Patrick Pouyanné said during CERAWeek by S&P Global that Texas was important for his company, which he jokingly called the French company’s “El Dorado” due to the state’s love for oil, gas and renewables.