The following information is provided by RedOaks Energy Advisors LLC. All inquiries on the following listings should be directed to RedOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

RRIG Energy retained RedOaks Energy Advisors LLC as its exclusive adviser in connection with the sale of its Midland Basin royalty properties in West Texas.

Highlights:

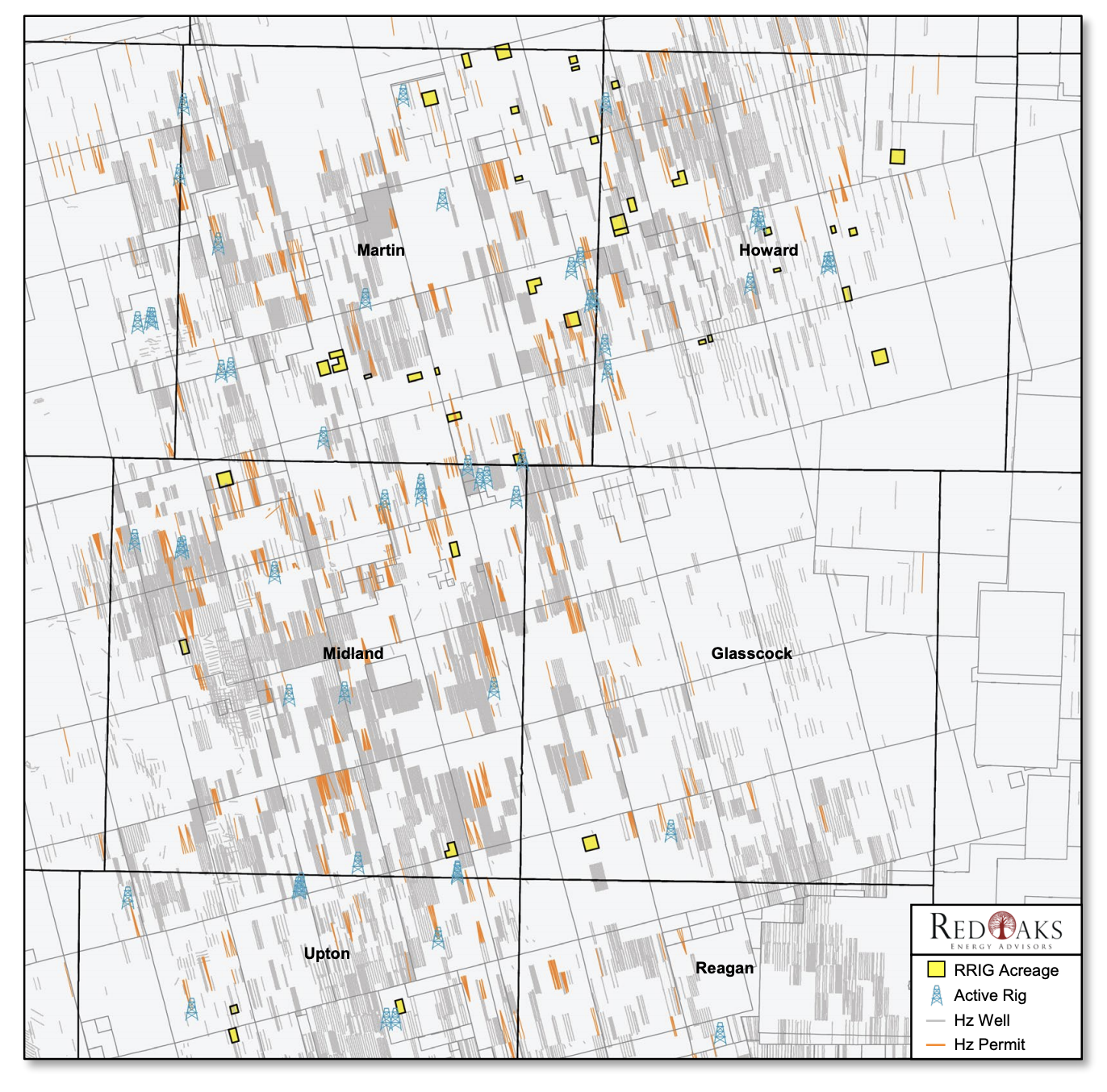

- 905 Net Royalty Acres across Martin, Howard, Midland, Glasscock and Upton counties, Texas;

- Substantial near-term upside: 36 DUCs | 8 Permits

- 950 undeveloped horizontal locations

- Key Operators: CrownQuest Operating LLC (64%) and Pioneer Natural Resources Co. (33%)

- CrownQuest and Pioneer are currently running 12 rigs in the Midland Basin

Bids are due Sept. 17. The transaction is expected to have a Sept. 1 effective date.

A virtual data room is open. For information visit redoaksenergyadvisors.com or contact Will McDonald, associate of RedOaks, at Will.McDonald@redoaksadvisors.com or 214-420-2338.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.