The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

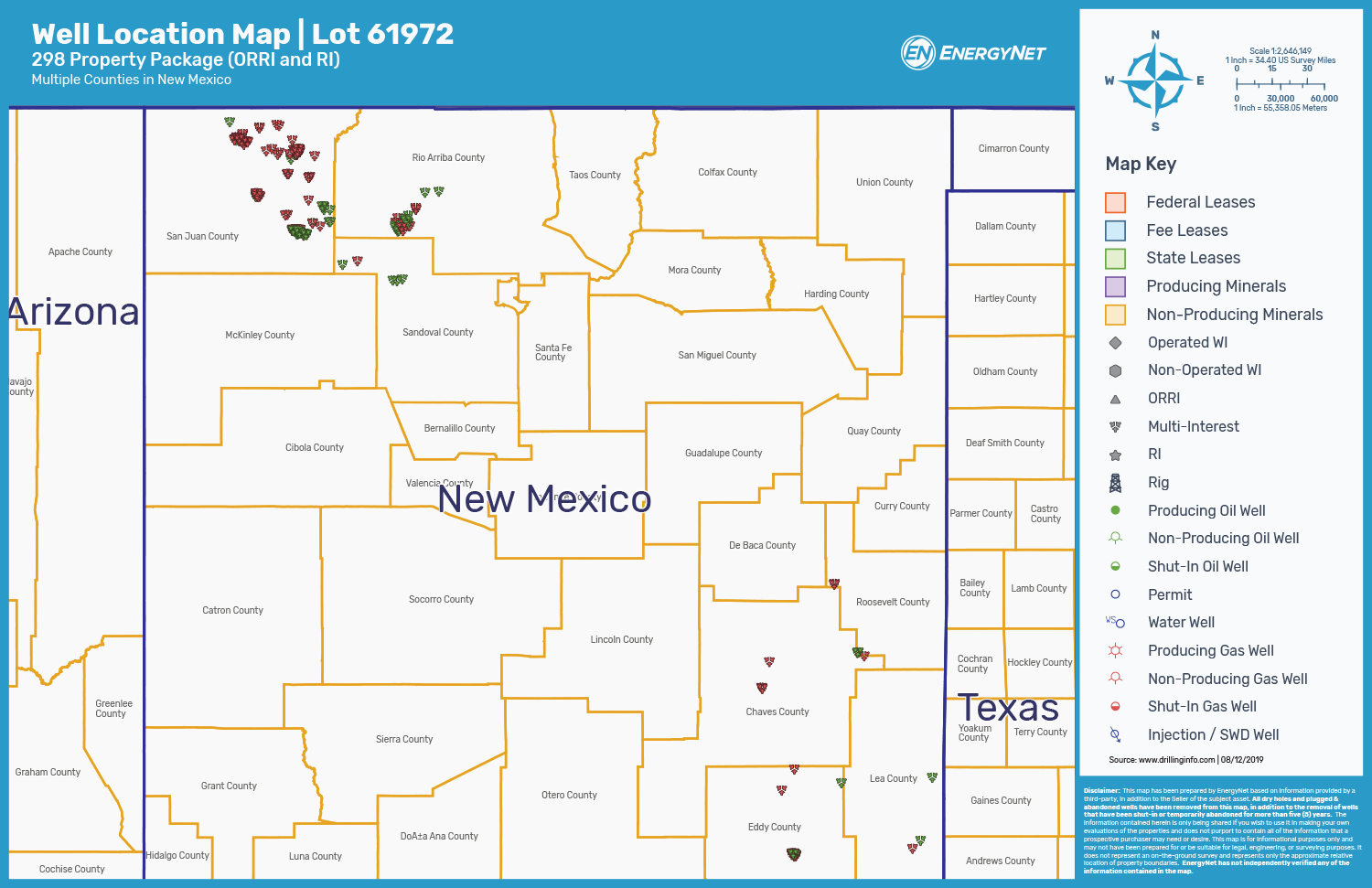

QEP Energy Co. retained EnergyNet for the sale of properties in the Permian and San Juan basins in an auction closing Sept. 18.

The offering comprises of overriding royalty interest (ORRI) and royalty interest in nearly 300 properties plus minerals and leasehold located in various New Mexico counties.

Highlights:

- ORRI in 266 Properties:

- 8.835% to 0.004774% ORRI

- 247 Producing Properties | One Saltwater Disposal | 17 Non-Producing Properties | One Plugged and Abandoned Property

- Royalty Interest in 32 Properties:

- 5.90625% to 0.318858% Royalty Interest

- 27 Producing Properties | Four Non-Producing Properties | One Temporarily Abandoned Property

- Six-Month Average Net Income: $12,358 per Month

- Six-Month Average 8/8ths Production: 1,332 barrels per day of Oil and 10.937 million cubic feet per day of Gas

- 2,084.16 Net Mineral Acres

- 2,035.16 Net Non-Producing Net Mineral Acres

- 49.00 Net Producing Net Mineral Acres

- 2,808.00 Net Leasehold Acres

- Select Operators include COG Operating LLC, Dugan Production Corp. and Hilcorp Energy Co.

QEP Energy is an affiliate of QEP Resources Inc.

Bids are due by 3:05 p.m. CDT Sept. 18. For complete due diligence information energynet.com or email Ryan Dobbs, vice president of business development, at Ryan.Dobbs@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

CERAWeek: LNG to Play Critical Role in Shell's Future, CEO Says

2024-03-19 - Sawan said LNG will continue to play a critical role adding that LNG currently makes up around 13% of gas sales but was expected to grow to around 20% in the coming 15 to 20 years.

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

API Gulf Coast Head Touts Global Emissions Benefits of US LNG

2024-04-01 - The U.S. and Louisiana have the ability to change global emissions through the export of LNG, although new applications have been frozen by the Biden administration.

US Expected to Supply 30% of LNG Demand by 2030

2024-02-23 - Shell expects the U.S. to meet around 30% of total global LNG demand by 2030, although reliance on four key basins could create midstream constraints, the energy giant revealed in its “Shell LNG Outlook 2024.”

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.