The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

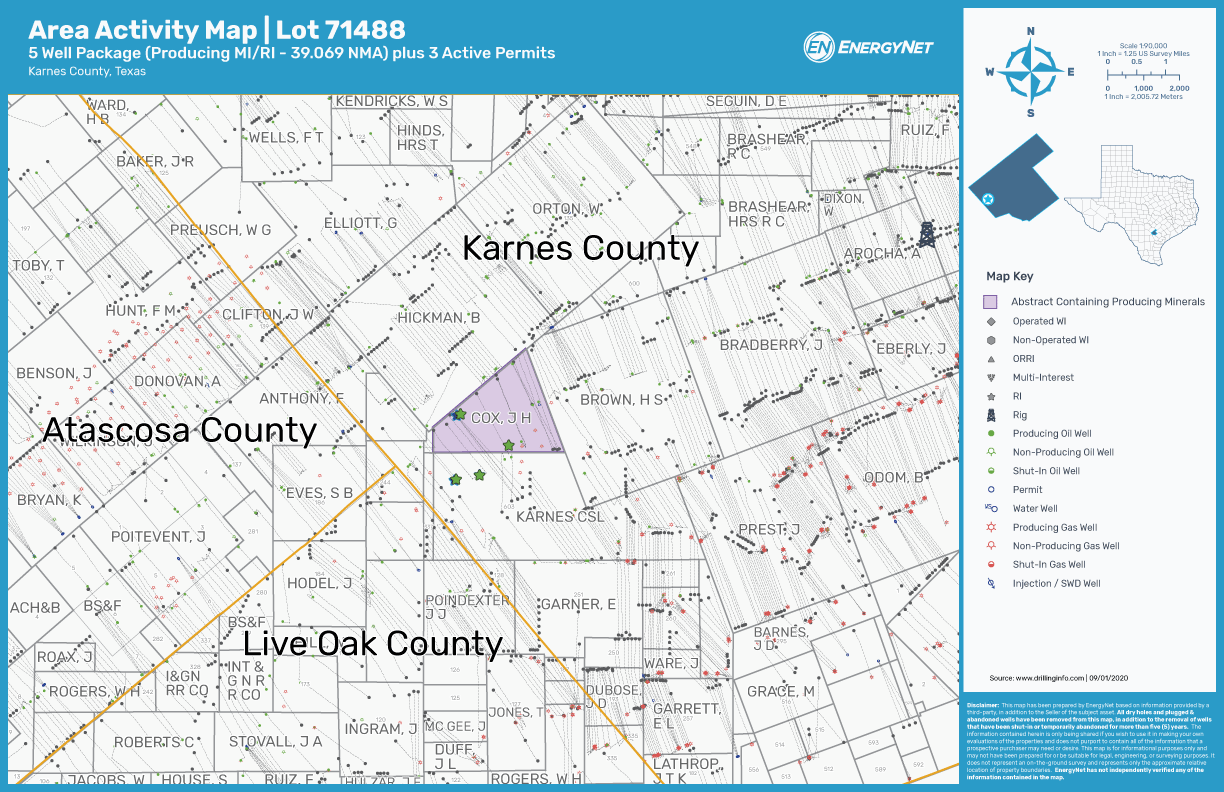

Bellatorum Phalanx Investments LP retained EnergyNet for the sale of producing mineral and royalty interests in a five-well package located in Karnes County in South Texas through an auction closing Oct. 6.

Highlights:

- 39.069 Producing Net Mineral Acres (62.5156 Net Royalty Acres)

- 1.529609% to 0.23188% RI in 5 Producing Hz Wells

- Three Permitted Hz Wells

- Six-Month Average 8/8ths Production: 1,064 bbl/d of Oil and 1.614 MMcf/d of Gas

- Seven-Month Average Net Income: $10,321 per Month

- Operator: Verdun Oil & Gas LLC

Bids are due at 1:45 p.m. CT Oct. 6. For complete due diligence information visit energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.