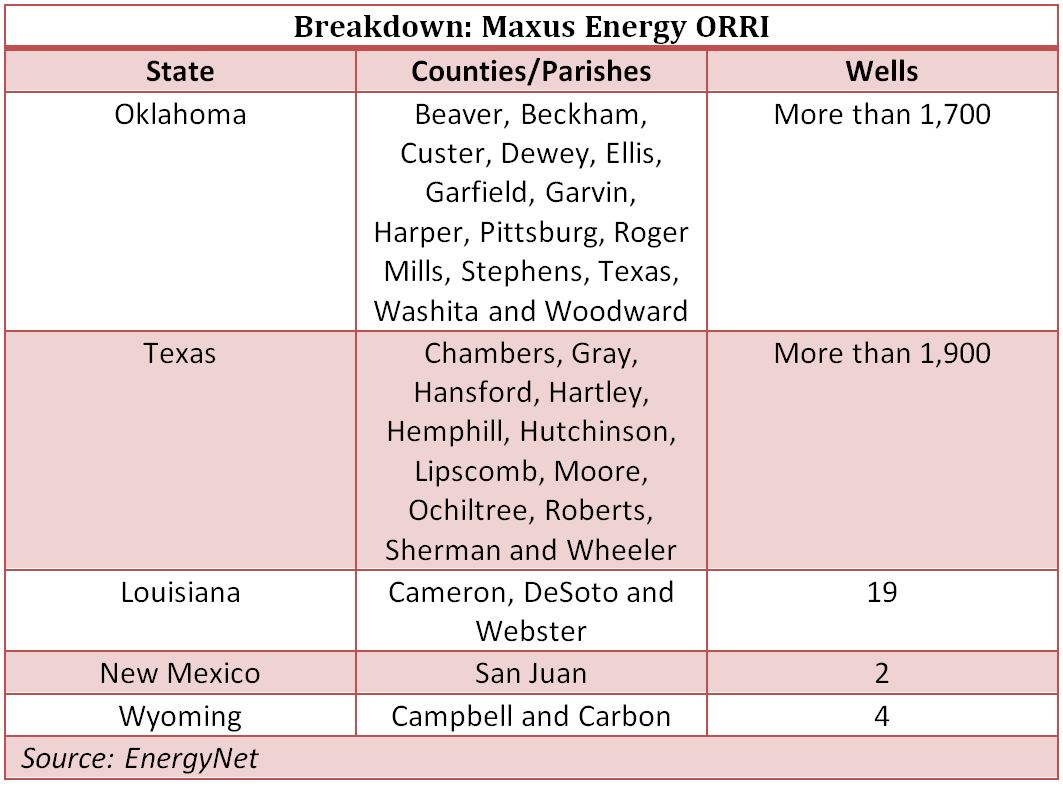

Maxus Energy Corp., a U.S.-based subsidiary of Argentina’s state-owned YPF SA, is selling its overriding royalty interests (ORRI) in more than 3,500 wells across five states in a sealed-bid offering handled by EnergyNet.

The assets are located in Oklahoma, Texas, Louisiana, New Mexico and Wyoming. Operators include Apache Corp. (NYSE: APA), BP Plc (NYSE: BP) and XTO Energy Inc., among others.

The assets recently averaged more than $125,000 in monthly net income, according to EnergyNet.

Highlights:

- About 0.000011% to 7.45% ORRI in more than 3,500 wells;

- 10-month average net income of $125,563 per month;

- Six-month average 8/8ths production is 191.907 million cubic feet per day and 5,496 barrels per day of oil; and

- Operators are comprised of Apache, BP America Production Co., Burlington Resources O&G Co. LP, Chevron U.S.A. Inc., Cimarex Energy Co. (NYSE: XEC), Citation Oil & Gas Corp., ConocoPhillips Co. (NYSE: COP), Continental Resources Inc. (NYSE: CLR), Devon Energy Corp. (NYSE: DVN), EOG Resources Inc. (NYSE: EOG), Exxcel Production Co., Hilcorp Energy Co. Inc., Marathon Oil Co., Newfield Exploration Mid-Continent, Noble Energy Inc. (NYSE: NBL), Samson Lone Star LLC, Unit Petroleum Co. and XTO Energy.

Maxus Energy filed for bankruptcy protection in June 2016.

Bids are due at 4 p.m. CT March 2. For information visit energynet.com or contact EnergyNet’s Cody Felton at 281-221-3042.

Recommended Reading

Turning Down the Volumes: EQT Latest E&P to Retreat from Painful NatGas Prices

2024-03-05 - Despite moves by EQT, Chesapeake and other gassy E&Ps, natural gas prices will likely remain in a funk for at least the next quarter, analysts said.

EIA: Oil Prices Could Move Up as Global Tensions Threaten Crude Supply

2024-02-07 - Geopolitical tensions in the Middle East and ongoing risks that threaten global supply have experts questioning where oil prices will move next.

Plus 16 Bcf/d: Power Hungry AI Chips to Amp US NatGas Draw

2024-04-09 - Top U.S. natural gas producers, including Chesapeake Energy and EQT Corp., anticipate up to 16 Bcf/d more U.S. demand for powering AI-chipped data centers in the coming half-dozen years.

US NatGas Futures Hit Over 2-week Low on Lower Demand View

2024-04-15 - U.S. natural gas futures fell about 2% to a more than two-week low on April 15, weighed down by lower demand forecasts for this week than previously expected.

Darbonne: Brownsville, We Have LNG Liftoff

2024-04-02 - The world’s attention is on the far south Texas Gulf Coast, watching Starship liftoffs while waiting for new and secure LNG supply.