The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

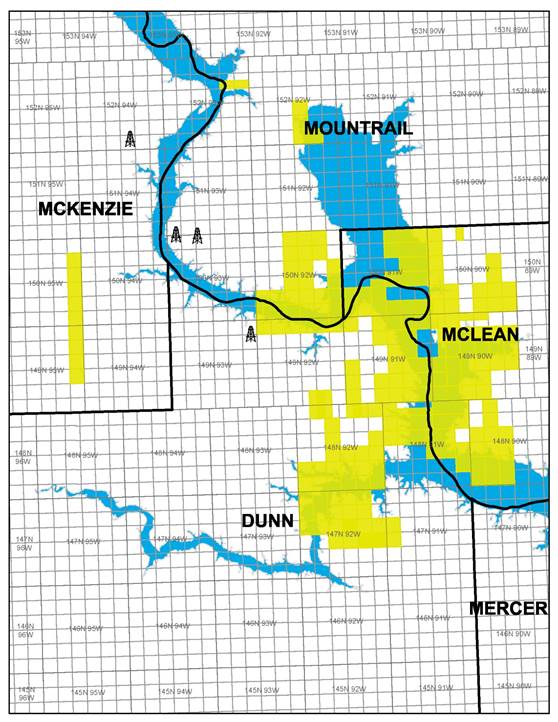

Eagle River Energy Advisors LLC has been exclusively retained by a private seller to divest certain overriding royalty interest (ORRI) assets and associated development rights in the Williston Basin of North Dakota’s Dunn, McKenzie, McLean and Mountrail counties.

Highlights:

- Significant Producing Assets in the Core Williston Basin

- ORRI position in about 60 DSUs / about 137,000 DSU acres on the Ft. Berthold Reservation in the Williston Basin

- About 334 existing wells

- About 120 boe/d net production (January 2021 Forecast)

- 77% Oil / 12% NGL / 11% Gas

- About $21.3 million net cash flow since 2012 (about $2.4 million average per year)

- New Asset Operatorship and Other Active Operator

- Impending acquisition of QEP Resources by Diamondback Energy provides catalyst to restored development of Seller’s assets

- QEP operates 33 DSUs / 177 wells with 73% of net production

- Diamondback Energy publicly announced its intention to divest the QEP Williston Basin assets

- Seller’s assets to meaningfully benefit from a change in operator

- Recent activity on assets by WPX Energy, XTO Energy, QEP Resources and RimRock Oil & Gas

- Flat production through 2018 as a result of about 32 wells drilled per year

- Optimal Portfolio of Production with Upside Development

- Drilling economics at current prices across three viable targets yield IRRs of 40%–65% and EURs 1–1.2 MMboe

- Production base with sizeable undeveloped inventory provides ideal mixture of producing and future upside reserves

- About 5 average PDP wells / DSU with about 30% of DSUs only having one well

- About 38 near-term locations either drilled awaiting completion, on confidential status, or permitted

- About 550 economic locations in the Bakken and Three Forks 1st and 2nd

The transaction is expected to have a Jan. 1 effective date.

Bids are due at 4 p.m. MT on Feb. 24. A virtual data room will be available starting Jan. 25.

For information contact Mallory Weaver, marketing director at Eagle River, at 720-726-6093 or mweaver@eagleriverea.com.

Recommended Reading

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.

Subsea7 Awarded Sizable Contract in GoM

2024-04-12 - Subsea7 will install a flowline for Talos’ Sunspear development in the Gulf of Mexico.

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.