The following information is provided by RedOaks Energy Advisors LLC. All inquiries on the following listings should be directed to RedOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

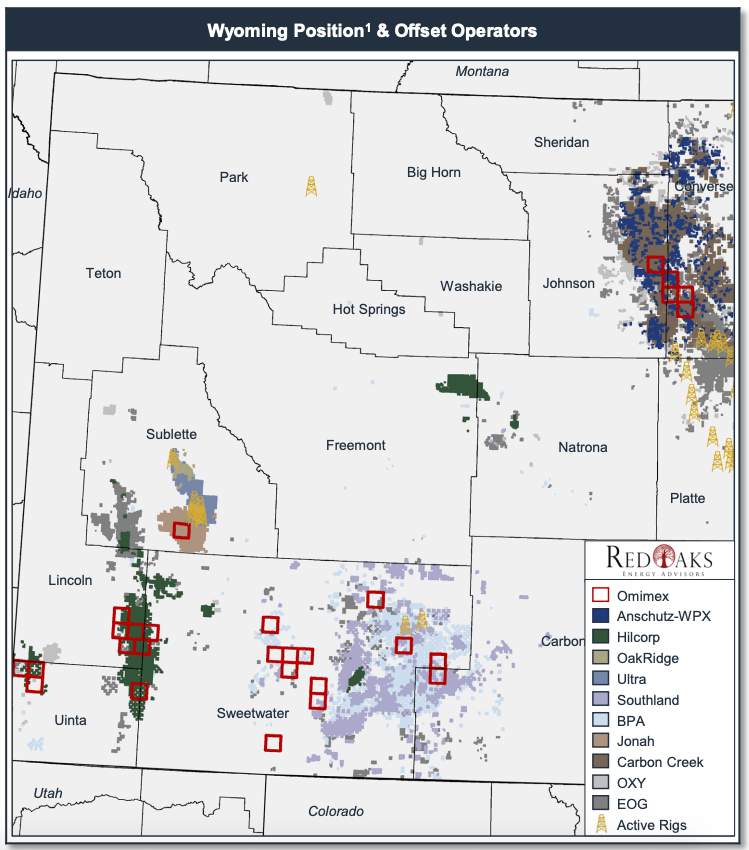

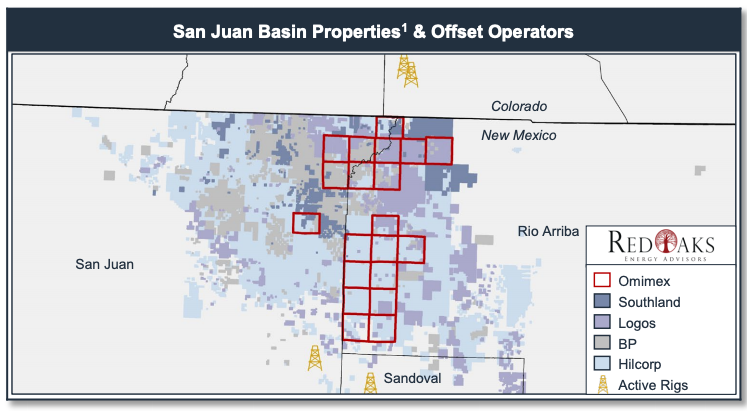

Omimex Resources Inc. retained RedOaks Energy Advisors LLC for the sale of certain properties located in Wyoming and New Mexico.

The offer comprises a package of primarily operated producing assets in Wyoming and a nonoperated working interest position within the San Juan Basin in New Mexico. According to RedOaks, Omimex will consider separate offers for both the operated and nonoperated packages.

Highlights:

Operated – Wyoming

- Primarily operated conventional asset

- Average Working Interest / Net Revenue Interest: 62% / 50%

- Proved Developed Producing (PDP) PV-10 value: $6.9 million

- 55 producing vertical wells

- Projected 2020 average monthly cash flow: $114,000 per month

Nonoperated – San Juan Basin

- Strong operators across the position

- Hilcorp Energy Co., BP Plc, ConocoPhillips Co., Chevron Corp.

- PDP PV-10 value: $5.6 million

- Projected 2020 average monthly cash flow: $82,000 per month

Bids are due by Oct. 24. For information visit redoaksenergyadvisors.com or contact David Carter, managing director of RedOaks, at David.Carter@redoaksadvisors.com or 214-420-2334.

Recommended Reading

Plus 16 Bcf/d: Power Hungry AI Chips to Amp US NatGas Draw

2024-04-09 - Top U.S. natural gas producers, including Chesapeake Energy and EQT Corp., anticipate up to 16 Bcf/d more U.S. demand for powering AI-chipped data centers in the coming half-dozen years.

Turning Down the Volumes: EQT Latest E&P to Retreat from Painful NatGas Prices

2024-03-05 - Despite moves by EQT, Chesapeake and other gassy E&Ps, natural gas prices will likely remain in a funk for at least the next quarter, analysts said.

CNX Joins Crowd of Companies Cutting Back NatGas Production

2024-03-12 - Appalachian gas producer CNX Resources is reducing natural gas production in 2024 and announced delays for well completions on three shale pads.

Midstream Builds in a Bearish Market

2024-03-11 - Midstream companies are sticking to long term plans for an expanded customer base, despite low gas prices, high storage levels and an uncertain political LNG future.

Exclusive: Can NatGas Save the 'Fragile' Electric Grid?

2024-02-28 - John Harpole, the founder and president of Mercator Energy, says he is concerned about meeting peak electric demand and if investors will hesitate on making LNG export facilities investment decisions after the Biden administration's recent LNG pause, in this Hart Energy LIVE Exclusive interview.