The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

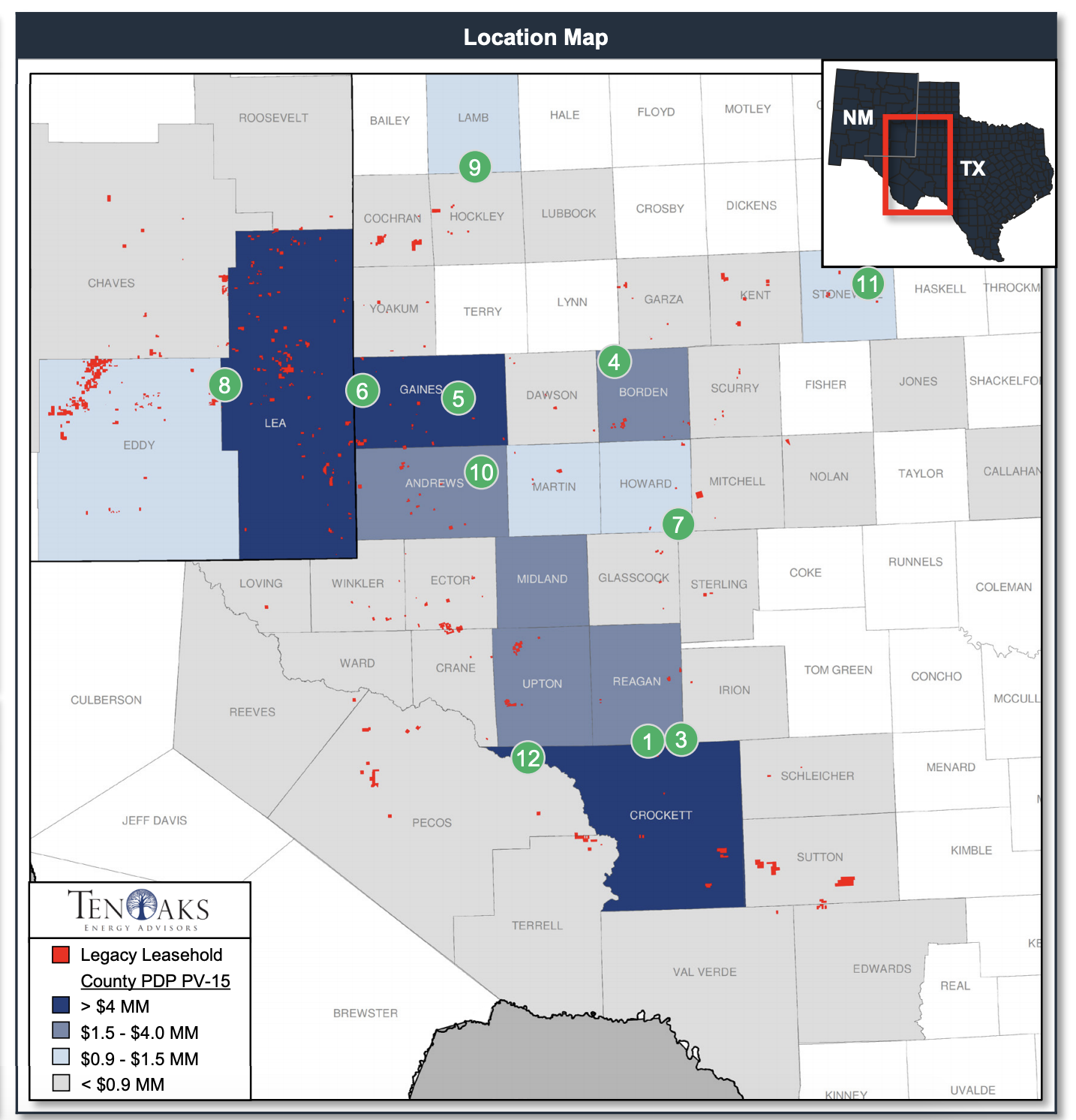

Legacy Reserves Inc. retained TenOaks Energy Advisors as its exclusive adviser in connection with the sale of certain operated and nonoperated properties located in the Permian Basin.

Highlights

- Predictable production base in the resource-rich Permian Basin

- 3,800 boe/d

- Conventional and unconventional existing development

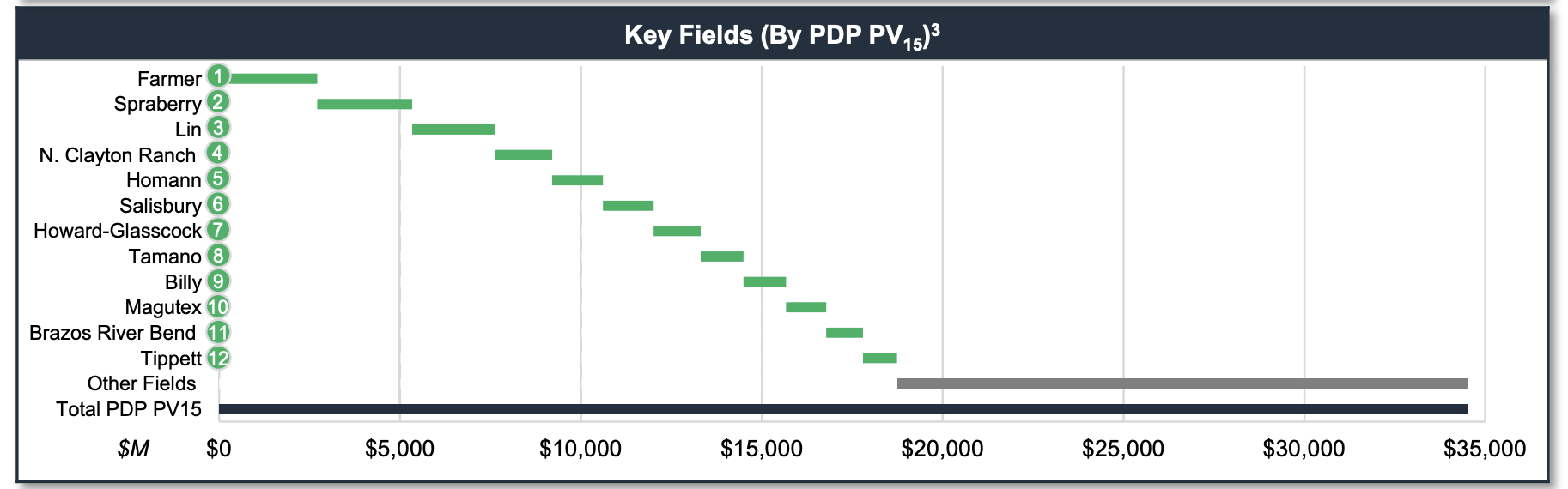

- PDP PV-15: $34 million

- HBP asset in historic fields with operational control

- 88,000 operated net acres

- Multiple upside opportunities (operational, RTP, infill drilling, LOE reductions) on historically undercapitalized Properties

- Experienced field staff available to Buyer

Note: Spraberry Field denomination encompasses multiple counties in the Midland Basin

Bids are due Sept. 30. The transaction is expected to have an Oct. 1 effective date.

A virtual data room will be available starting Aug. 27. For information visit tenoaksenergyadvisors.com or contact Trey Bonvino at TenOaks Energy Advisors at 214-420-2331 or Trey.Bonvino@tenoaksadvisors.com.

Recommended Reading

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.

Williams Beats 2023 Expectations, Touts Natgas Infrastructure Additions

2024-02-14 - Williams to continue developing natural gas infrastructure in 2024 with growth capex expected to top $1.45 billion.