The following information is provided by Meagher Energy Advisors. All inquiries on the following listings should be directed to Meagher. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

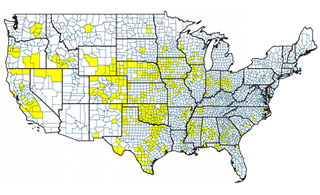

An undisclosed seller is offering for sale mineral rights and well interests across the continental U.S. Meagher Energy Advisor has been exclusively retained to serve as the adviser for the divestiture.

UPDATE - On Sept. 13, Meagher said the bid due date was extended to Oct. 4 due to the scheduling of technical presentations.

The sale includes assets in the Scoop/Stack, D-J Basin, Arkoma and Eagle Ford across 32 states including Colorado, Oklahoma, Texas and Wyoming.

Highlights

- 32 States and 571 Counties

- 416,712 Net Mineral Acres

- High-value acreage positions in the Scoop/Stack, D-J Basin, Arkoma and Eagle Ford

- Interests in about 1,850 wells

- ~3,500 horizontal drilling locations quantified in premier basins covering ~40,000 net acres

- Cash flow expected to grow significantly due to largely undeveloped position

- ~$16 million total net revenue and lease bonus income in 2017

- ~385 Net bbl/d of Oil and 4,140 Net Mcf/d

- ~280,000 net unleased mineral acres to contribute to future bonus income and exposure to frontier resource plays

- Oklahoma

- 4,252 net Scoop/Stack acres, 6,280 net Arkoma acres, 2,530 net Mississippian Lime acres

- $324,000/Month average historical cash flow from 850 wells

- 2,604 horizontal drilling locations with 26,015 Mboe resource potential

- Colorado / Wyoming

- 7,292 net mineral acres in tier 1 D-J Basin

- $425,000/Month average historical cash flow from 533 wells

- 852 drilling locations with 8,603 Mboe resource potential

- Texas

- 4,588 net Eagle Ford acres, 3,081 net Barnett acres, 102 net Permian Acres

- $265,000/Month average historical cash flow from 383 wells

- 1,590 undeveloped acres with 9,795 Mboe resource potential

Bids are due Oct. 4, with an anticipated economic effective date of Nov. 1, and a targeted closing on or prior to Dec. 31.

Potential bidders are requested to express interest as soon as possible, but no later than Aug. 31.

Contact Nick Asher at nasher@meagheradvisors.com or Chris McCarthy at cmccarthy@meagheradvisors.com to receive a non-disclosure agreement.

The competitive process will be managed in accordance with procedures to be established and communicated to qualified interested bidders, which procedures may be amended at any time in the sole discretion of the seller.

Potential bidders will be qualified subject to certain requirements. These may include relative experience in the ownership and development of mineral interests in the subject basins and a suitable credit profile based on market value, equity or asset holdings, among other criteria. Access to confidential information, including the identity of seller, will be subject to execution of a confidentiality and non-disclosure agreement.

Recommended Reading

Pembina Cleared to Buy Enbridge's Pipeline, NGL JV Interests for $2.2B

2024-03-19 - Pembina Pipeline received a no-action letter from the Canadian Competition Bureau, meaning that the government will not challenge the company’s acquisition of Enbridge’s interest in a joint venture with the Alliance Pipeline and Aux Sable NGL fractionation facilities.

ONEOK CEO: ‘Huge Competitive Advantage’ to Upping Permian NGL Capacity

2024-03-27 - ONEOK is getting deeper into refined products and adding new crude pipelines through an $18.8 billion acquisition of Magellan Midstream. But the Tulsa company aims to capitalize on NGL output growth with expansion projects in the Permian and Rockies.

SCF Acquires Flowchem, Val-Tex and Sealweld

2024-03-04 - Flowchem, Val-Tex and Sealweld were formerly part of Entegris Inc.

Enbridge Closes First Utility Transaction with Dominion for $6.6B

2024-03-07 - Enbridge’s purchase of The East Ohio Gas Co. from Dominion is part of $14 billion in M&A the companies announced in September.

EQT Deal to ‘Vertically Integrate’ Equitrans Faces Steep Challenges

2024-03-11 - EQT Corp. plans to acquire Equitrans Midstream with $5.5 billion equity, but will assume debt of $7.6 billion or more in the process, while likely facing intense regulatory scrutiny.