The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Chevron USA Inc. retained EnergyNet for the sale of an operated position in the Midland Basin through a sealed-bid offering closing Nov. 19. (Editor's note: Bid due date has been updated.)

The offer includes mature producing Permian assets with future development upside in the Jo-Mill and Spraberry fields located in Borden and Dawson counties, Texas. The company, an affiliate of Chevron Corp., retained EnergyNet to serve as its exclusive transaction and technical advisor for the sale.

Highlights:

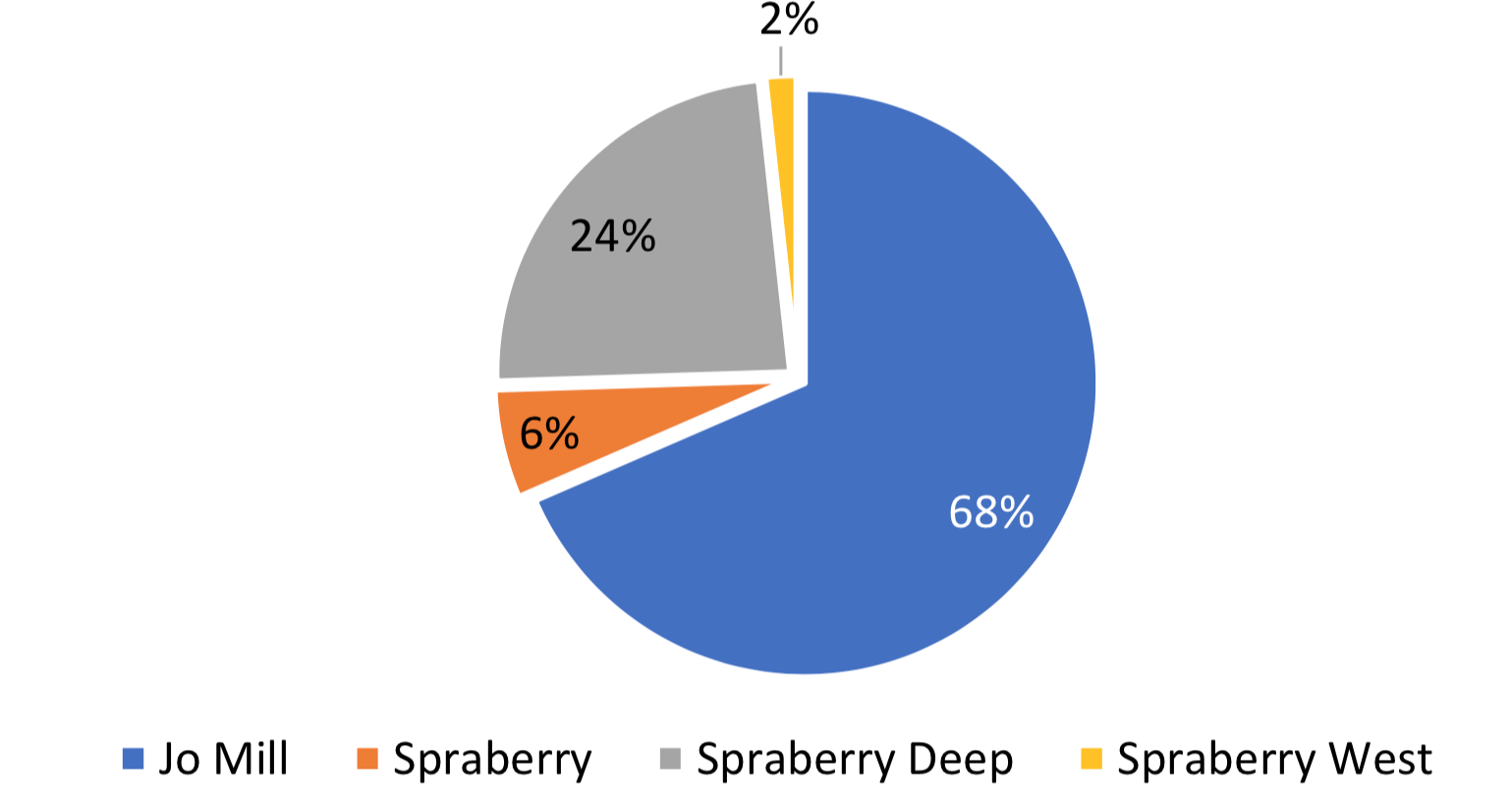

- Operations in Jo-Mill, Spraberry, Spraberry Deep and Spraberry West Fields

- 236 Producing wells; Average Working Interest 65.66% / Weighted Average Net Revenue Interest 58.11%

- Producing from Jo-Mill, San Andres and Spraberry Formations

- 27,975.73 Gross (21,038.29 Net) HBP Leasehold Acres

- Six-Month Average 8/8ths Production: 2,618 barrels per day of Oil And 1.016 million cubic feet per day of Gas

- 12-Month Average Net Income: $1,578,125 per Month

Upside Potential:

- Mature Producing PDP (Proved Developed Producing) Cash Flowing Asset with Future Development Upside

- Horizontal Infill Spraberry Potential

- Vintage Vertical Well Improvement through Horizontal Fracking

- Infill Development on 20-Acre Spacing

- Production Enhancement through Two Sided Injection Support

- Optimize Injection Support through Conversion and Pattern Realignment

- Re-enter and Establish Production in Inactive Wells due to New Fracking Technology Applications

Bids are due by 4 p.m. CDT Nov. 19. The transaction is expected to have a Dec. 1 effective date.

For complete due diligence information visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.

US Drillers Add Most Oil Rigs in a Week Since November

2024-02-23 - The oil and gas rig count rose by five to 626 in the week to Feb. 23