The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Camino Natural Resources LLC retained Detring Energy Advisors for the sale of oil and gas producing properties, leasehold and related assets located in Grady County within the Southern Oklahoma Hoxbar Oil Trend.

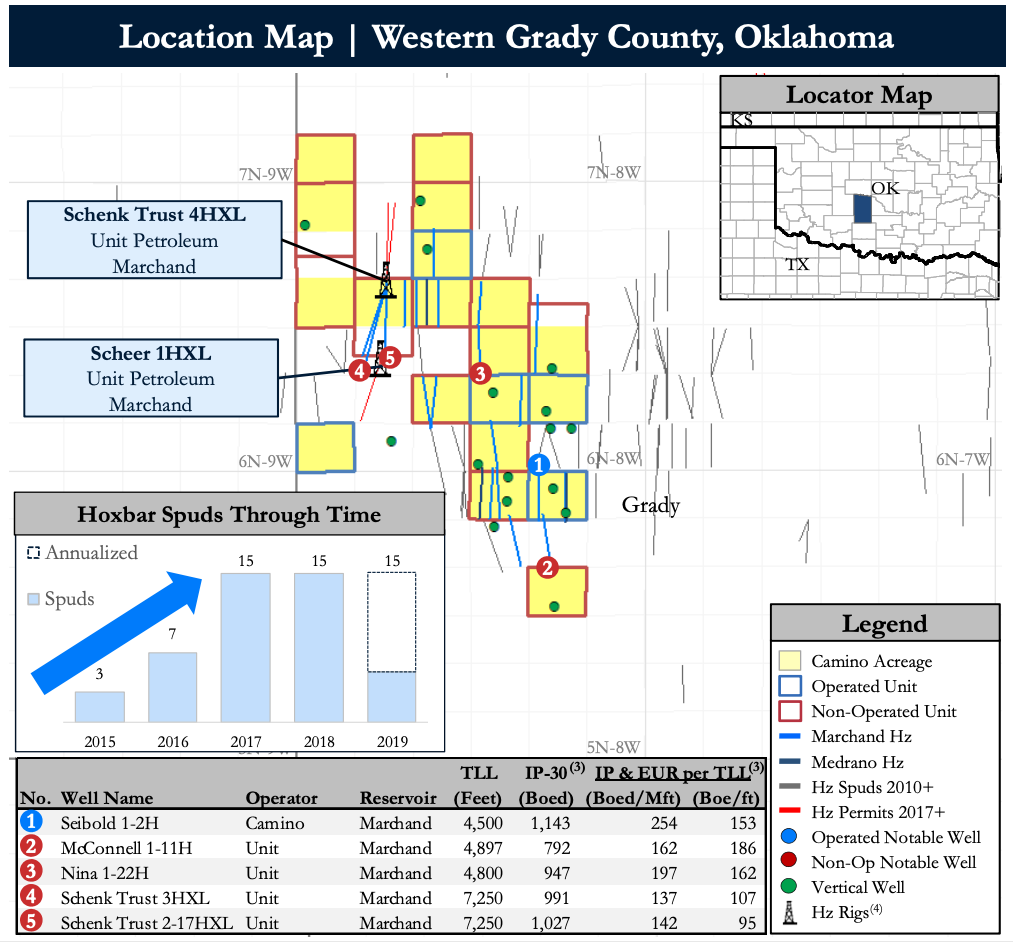

The assets comprise a contiguous acreage position with a highly economic drill-ready development program and active nonoperated program targeting the Marchand member of the Hoxbar Group with proven upside in the Medrano member, according to Detring.

Highlights:

- About 2,940 Net Acres (89% HBP)

- Large and contiguous position

- 61% operated with balance nonop under premier Hoxbar operator, Unit Petroleum Co.

- Development plan focuses on the prolific Marchand member of the Hoxbar group with upside in the Medrano member (About 95 and 75 horizontal locations, respectively)

- Highly economic results achieved by Camino and others

- Roughly 40%-60% rate-of-return type curve by applying modern completions techniques to conventional reservoirs

- Marchand IP-30 and EUR of about 1,000 barrels of oil equivalent per day (boe/d) and 1 million barrels of oil equivalent (boe), respectively, for 7,500 ft laterals at roughly 65%-75% oil

- About 600 boe/d net production (65% liquids) with roughly 4.5 million next 12-months cash flow

- About 19 million proved developed producing PV-10 value; 35 million boe 3P net reserves

- Significant resource potential in both the Marchand & Medrano members of the Hoxbar Group

- Camino acreage encompasses an area with roughly 3,000 ft of gross section, more than 550 ft net sand, and seven stacked horizontal targets

- Camino has successfully drilled wells in the Medrano and Marchand (upper, middle and lower) units

3. boe shown as two stream; 4. Horizontal rigs as of May 23, 2019.

Process Summary:

- Virtual data room opens June 12

- Bids due July 17

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

Dividends Declared in the Week of Aug. 26

2024-08-30 - Here is a selection of dividends declared from select upstream and service and supply companies.

Talos Energy CEO Tim Duncan Steps Down; Mills to Take Helm

2024-08-30 - An analyst said Talos Energy President and CEO Tim Duncan was forced out over share price performance, although other factors may have played a role.

HNR Acquisition to Rebrand as EON Resources Inc.

2024-08-29 - HNR’s name change to EON Resources Inc. and a new ticker symbol, “EONR,” will take effect when trading commences on Sept. 18.

Hunting Wins Contracts for OOR Services to North Sea Operators

2024-08-29 - Hunting is securing contracts worth up to $60 million to deliver organic oil recovery technology to increase recoverable reserves for North Sea operators.

GreenFire Appoints Rob Klenner as President to Deliver Geothermal Solutions

2024-08-27 - As president of GreenFire Energy, Rob Klenner will be responsible for overseeing GreenFire’s geothermal energy projects.