The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

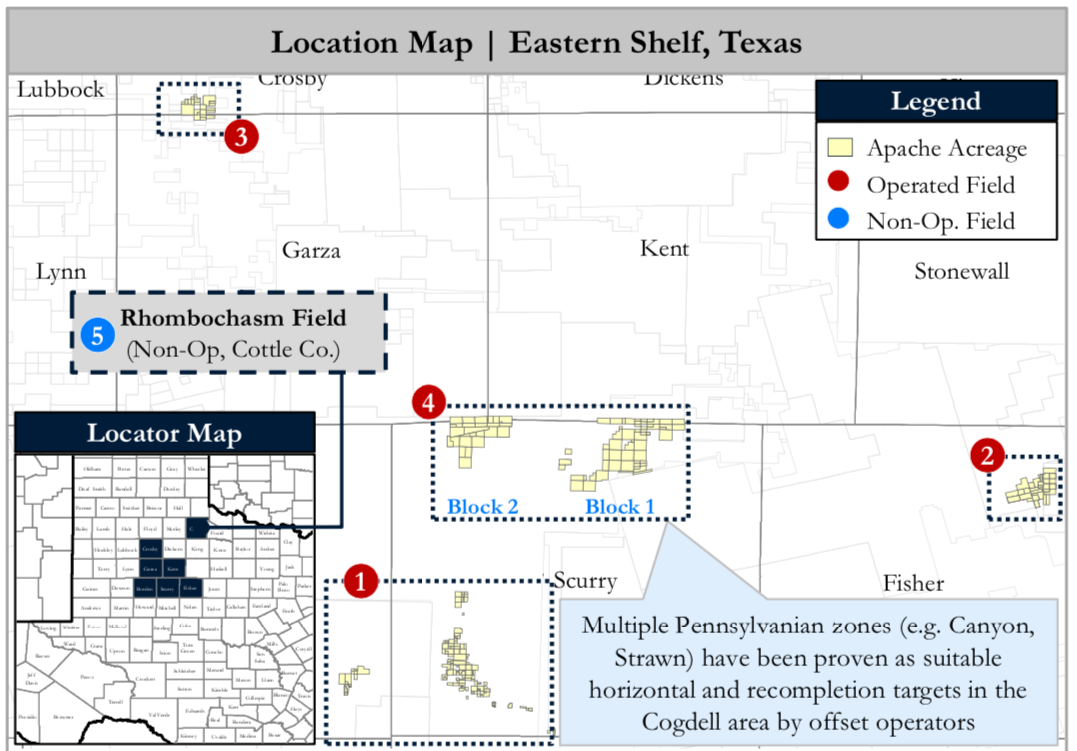

Apache Corp. retained Detring Energy Advisors for the sale of oil and gas producing properties, leasehold and related assets located in the Eastern Shelf of the Permian Basin as part of a full exit from the Eastern Shelf for the company. The sale includes assets in Borden, Cottle, Crosby, Fisher, Garza, Kent and Scurry counties, Texas.

According to Detring, the assets offer an attractive opportunity to acquire substantial low-decline, oil-weighted production generating about $11 million of annual cash flow. Additionally, the high working interest, operated, waterflood asset positions with meaningful upside potential including waterflood optimization and expansion opportunities, operational efficiency improvements and infill development drilling.

Highlights:

- Substantial Production Base of about 1,410 barrels of oil equivalent per day (boe/d), roughly 89% oil

- Shallow, 6% annual decline

- Annual operating cash flow of about $11 million (2019E)

- Majority of production on artificial lift with opportunity for operational value-add projects (474 active producers, 258 active injectors)

- Low oil differential benefitting from recent Permian infrastructure investment and build-out (about $4.50 per barrel discount to West Texas Intermediate)

- Operated Waterflood Assets (100% HBP)

- Predictable, low-decline, operated waterflood assets with high ownership interest and control

- Apache has prioritized its core Permian portfolio over its Eastern Shelf position

- Operational control provides opportunity to boost cash flow with additional operational oversight and capital budget

- Legacy Assets with Operational and Development Opportunities

- Contiguous, operated fields prime for operational improvement and development upside through waterflood optimization and infill drilling opportunities

- Multiple Pennsylvanian zones (e.g. Canyon, Strawn) have been proven as suitable horizontal and recompletion targets by offset operators

Process Summary:

- Evaluation materials available via the virtual data room beginning the week of Oct. 21

- Proposals due the week of Nov. 18

Detring said Apache anticipates executing a purchase and sales agreement in mid-December, with closing occurring by Jan. 31.

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

Segrist: The LNG Pause and a Big, Dumb Question

2024-04-25 - In trying to understand the White House’s decision to pause LNG export permits and wondering if it’s just a red herring, one big, dumb question must be asked.

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.