The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

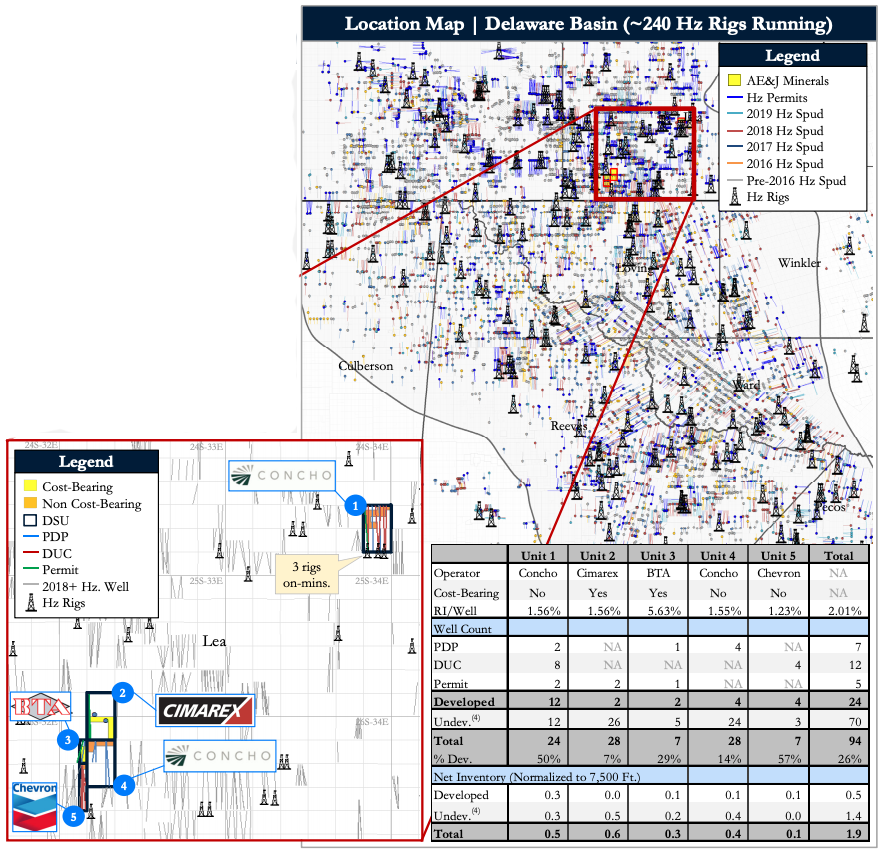

AE&J Royalties LLC is offering for sale a mineral interest position located in the core of the Delaware Basin in southern Lea County, N.M.

Detring Energy Advisors, which was retained for the sale, said the AE&J position is "concentrated in the highest-returning portion of the highest-returning basin in the Lower 48" with substantial near-term cash flow as a result of premier operators drilling extended laterals utilizing next-gen, high-intensity completion techniques.

Cash flow from the offered assets is forecasted to reach roughly $5 million in 2020E. Currently, the position includes exposure to seven proved developed producing and 17 drilled but uncompleted horizontal wells and permits.

Detring added the offering includes non-cost bearing clauses across roughly 50% of the net royalty acreage that increases margin and realized cash flow. Additionally, the offering's high royalty interests average about 2% per well, accelerating the impact of on-mineral development.

Highlights:

- About 550 Net Royalty Acres (at 1/8)

- 100% minerals

- Roughly 50% non-cost bearing

- Core mineral position operated by premier Delaware Basin E&P’s

- About 50% Concho Resources Inc., 35% Cimarex Energy Co., 15% BTA Oil Producers LLC and less than 5% Chevron Corp.

- Prolific stacked-pay in the deep, overpressured core of the most active basin in the United States

- IP-24: 2,300 to 4,900 barrels of oil equivalent per day

- EUR: 1.3 million to 2.3 million barrels of oil equivalent

- Spacing: 28 wells per mile

- Significant cash flow generated by 24 existing horizontal wells/permits:

- About $5 million (2020E); about $8 million (next three years); about $20 million (full-life)

- Substantial undeveloped inventory generates about $65 million of additional undiscounted cash flow (about $85 million 3P)

- 70 total undeveloped locations across the Wolfcamp A, Wolfcamp B, Bone Spring 1-3 and Avalon

- Total net inventory of 1.9 wells (0.5 developed / 1.4 undeveloped) normalized to 7,500 ft

- Additional unbooked inventory in the highly prospective Wolfcamp C and Wolfcamp D

- Southern Lea County exhibits the highest quality Bone Spring and Wolfcamp rock properties found throughout the Delaware Basin

- About 5,000 ft of stacked-pay with multiple landing zones and upside throughout the position

Process Overview:

- Evaluation materials available via the Virtual Data Room Aug. 14

- Proposals due Sept. 11

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.