Crestwood Midstream Partners LP (CMLP) opened cash tender offers to purchase $250 million of outstanding senior notes issued by it and its wholly owned subsidiary, the company said May 12. CMLP is itself a wholly owned subsidiary of Crestwood Equity Partners LP.

The tender offers will expire on June 9.

Morgan Stanley & Co. LLC is the lead dealer manager and SunTrust Robinson Humphrey Inc. is the co-dealer manager.

D.F. King & Co. Inc. is the tender agent and the information agent.

Crestwood Midstream Partners LP is based in Houston.

Recommended Reading

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.

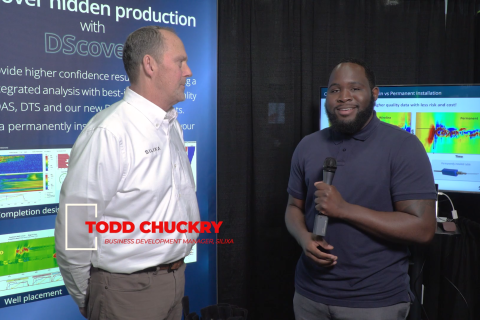

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.