Latest From Hart Energy

Seatrium Awarded Contract for FPSO Bound for Guyana’s Stabroek

The topsides fabrication and integration contract will be for the FPSO Jaguar, bound for the Whiptail Field in the Stabroek block offshore Guyana for Exxon Mobil.

Seadrill Sells Three Jackups for $338MM to Gulf Drilling International

Seadrill Ltd. is also selling its 50% equity interest in the joint venture that operates the rigs offshore Qatar.

Third Suriname Find for Petronas, Exxon Could Support 100,000 bbl/d FPSO

A recent find offshore Suriname in Block 52 by Petronas and Exxon Mobil could support a 100,000 bbl/d FPSO development, according to Wood Mackenzie.

Adkins: Attacks on Fossil Fuels, Overregulation Poised to Backfire

Raymond James’ J. Marshall Adkins tells Hart Energy’s Super DUG conference attendees demonizing oil and gas, strenuous regulations and continued inflation are bound to have unexpected consequences for E&P opponents.

US NatGas Flows to Freeport LNG in Texas Seen at Five-month High, LSEG Data Shows

The startup and shutdown of Freeport and other U.S. LNG export plants often has a major impact on global gas prices.

US Drillers Add Oil, Gas Rigs for First Time in Four Weeks: Baker Hughes

The oil and gas rig count rose by one to 604 in the week to May 17.

Energy Transition in Motion (Week of May 17, 2024)

Here is a look at some of this week’s renewable energy news, including more moves by the U.S. to strengthen and protect the U.S. solar panel manufacturing sector from China.

CGG to Change Name to Viridien

The company’s new ticker symbol will be “VIRI” and listed on Euronext Paris, effective May 21.

Apache CEO: Longer Laterals Expected as Permian Enters New Era

With more than a decade of development in the Midland and Delaware basins, there are more limitations that operators will have to work around, said Apache Corp. CEO John Christmann at Hart Energy's SUPER DUG Conference & Expo.

Sector’s Appetite for Capital Remains Amid Consolidation Frenzy, Panelists Say

There’s still an appetite for capital in the oil and gas sector—companies just need to think creatively to find it, a number of panelists said during SUPER DUG in Fort Worth, Texas.

Could Crescent, SilverBow Buy More in South Texas After $2.1B Deal?

The combination of Crescent Energy and SilverBow Resources will yield one of the Eagle Ford’s top producers—and the pro forma E&P could look to gobble up more acreage in South Texas after closing.

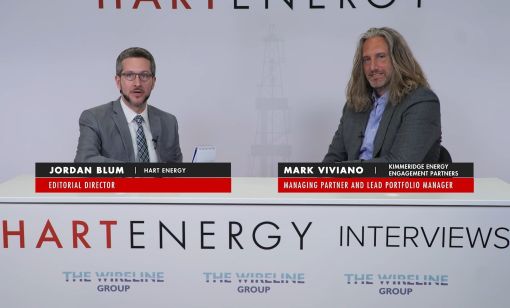

Kimmeridge’s Mark Viviano on Reshaping the Energy Sector, SilverBow-Crescent Deal

Kimmeridge Energy Engagement Partners’ Mark Viviano says the company is evaluating the Crescent Energy and SilverBow Acquisition and how Kimmeridge played a key role in transforming the shale sector in this Hart Energy Exclusive interview.

Oil, Gas Groups Sue BLM to Block Increased Federal Drilling Fees

Under new U.S. Bureau of Land Management rules, royalty rates will jump to 16.67% from 12.5% and minimum lease bonds will increase to $150,000 from $10,000, which industry groups say will deter future oil and gas development.

SilverBow Resets Shareholder Meeting After $2.1B Crescent Deal

SilverBow Resources said it will adjourn its May 21 shareholders’ meeting until May 29 following Crescent Energy’s agreement to buy the Eagle Ford operator.

SUPER DUG Shale 4.0 Era about Building Scale- Rystad

The Shale 3.0 era or capital discipline era will be followed by the Shale 4.0 era, which will see companies focused on building scale, according to Rystad Energy Senior Shale Analyst Matthew Bernstein.

IndustryVoice: Hydrogen Blending in Natural Gas Pipelines - Meter Compatibility, Challenges, and Industry Solution

Companies around the world are using hydrogen blended with natural gas to reduce the amount of carbon output or the greenhouse gas emissions that come from the combustion of hydrogen. The question this brings is: Can the current flow meters handle this without the need to redo the whole pipelines’ infrastructure and their measurement stations?

BPX Looks to Ramp US Production Over 60% by 2030

BPX Energy is looking to boost its U.S. production over 60% by 2030 as it considers bringing online a fourth processing facility in the Permian by mid-year 2025, Clark Edwards, the company’s vice president of development, said during SUPER DUG in Fort Worth.

Quantum Capital’s View on AI: Lots of Benefits, Pain Points

The energy industry is lagging in the race to implement AI, but Sebastian Gass, CTO of Quantum Capital Group, offered a few solutions during Hart Energy’s 2024 SUPER DUG Conference & Expo.

Empire Petroleum’s Williston Drilling Program Identifies New Zones

Empire Petroleum provided updates on its Williston Basin development drilling program in its first quarter 2024 earnings results.

Diamondback’s Van’t Hof Plays Coy on Potential Delaware Divestiture

Diamondback Energy’s President and CFO Kaes Van't Hof also addressed new Permian exploration and the lack of “fun” dealing with the FTC on its deal to buy Endeavor Energy Resources.

Permian Powerhouse: Apache Doubles Down on Core Assets After Callon Acquisition

Apache CEO John Christmann detailed plans for the Permian Basin and Suriname during the SUPER DUG Conference & Expo.

CoolCo, GAIL Enter Long-term LNG Agreement

CoolCo and GAIL’s agreement is intended to secure long-term LNG supply in India’s market, with GAIL having an option to extend the 14-year agreement by another two years.

Boralex Secures Financing for UK Wind Farm

Boralex' project, located in Scotland, is the company’s largest project in Europe, capable of powering 100,000 British homes.

US to Favor Existing Investors for Venezuela Oil Licenses, Say Sources

The U.S. is preparing to prioritize issuing limited licenses to operate in Venezuela to companies with existing oil production and assets over those seeking to enter the sanctioned OPEC nation for the first time.

Crescent Energy to Buy Eagle Ford’s SilverBow for $2.1 Billion

Crescent Energy’s acquisition of SilverBow Resources will create the second largest Eagle Ford Shale E&P with production of about 250,000 boe/d, the companies said.

ConocoPhillips: Permian Basin a ‘Growth Engine’ for Lower 48

ConocoPhillips views the Permian Basin as a “growth engine” within its Lower 48 portfolio, the company’s Midland Basin Vice President Nick McKenna said during Hart Energy’s SUPER DUG event in Fort Worth.

SUPER DUG: Diamondback's Van't Hof Talks Endeavor Merger, Future of Legacy Delaware Acreage

The SUPER DUG Conference & Expo is in full swing in Fort Worth, Texas, and speaker Diamondback President Kaes Van’t Hof is with Hart Energy's Jordan Blum to talk about Diamondback's pending merger with Endeavor Energy Resources, development philosophies going forward and future plans in the Delaware.

Williams Cos. Blasts Energy Transfer’s FERC Filing

In response to Energy Transfer, Williams says the rival’s action is “lawfare” to delay the company’s Louisiana Energy Gateway project.

KeyState, CNX Bring Hydrogen Facility to Pittsburgh Airport

KeyState Energy and CNX Resources said the facility can produce hydrogen solely, reaching up to 68,000 metric tons annually, or sustainable aviation fuel solely, reaching up to 70 million gallons per year.

Blue Racer Midstream Prices Senior Notes Offering

Net proceeds from the sale of senior notes will be used to pay off debt and other general corporate purposes.