In terms of oil prices, Stratas Advisors forecasts that the price of Brent crude oil will average $88.43 in the fourth quarter, while WTI averages $82.48 and Dubai crude oil averages $84.10. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $86.15 after closing the previous week at $91.35. The price of WTI ended the week at $78.74 after closing the previous week at $84.76.

As expected, the U.S. Federal Reserve increased interest rates by 0.75% on Sept. 21 after similar increases in the previous two months. After the latest increase, the federal funds rate is now in the range of 3% to 3.25%, which is the highest since 2008 and has increased at the fastest pace since 1981—the last time the U.S. faced concerns about inflation. Additionally, the Federal Reserve has indicated that future increases in interest rates will occur in the future months. The Federal Reserve is also expecting that the rate increases will result in job losses and the increased potential for a recession. The latest nowcast from the Federal Reserve Bank of Atlanta estimates that U.S. real GDP growth in the third quarter is 0.3% after the U.S. had negative growth in the first quarter and second quarter.

The tightening monetary policy continues to provide support for the U.S. dollar. The U.S. Dollar Index ended the week at 113.10 after closing the previous week at 109.76 and is at the high level since early in 2002. The strong U.S. dollar is putting further pressure on the economies of other countries because it is making dollar-denominated commodities more expensive.

The outlook for Europe’s economic growth continues to deteriorate with the combination of tightening monetary policy, elevated inflation, and concerns about the supply of energy, while China’s economy is still being hampered by restrictions pertaining to COVID-19 and an over-leveraged property sector. The Chinese Yuan has weakened substantially since April of this year with moving from 6.36 to the U.S. dollar to slightly above 7.16 to the U.S. Dollar. Even if the COVID-19 restrictions are removed, it is unlikely that China’s economy will rebound with the economies of two of its major trading partners—Europe and the U.S.—slowing down. We are projecting that China’s growth in the third quarter will be 1.19% and forecasting that growth in the fourth quarter will be 3.25%.

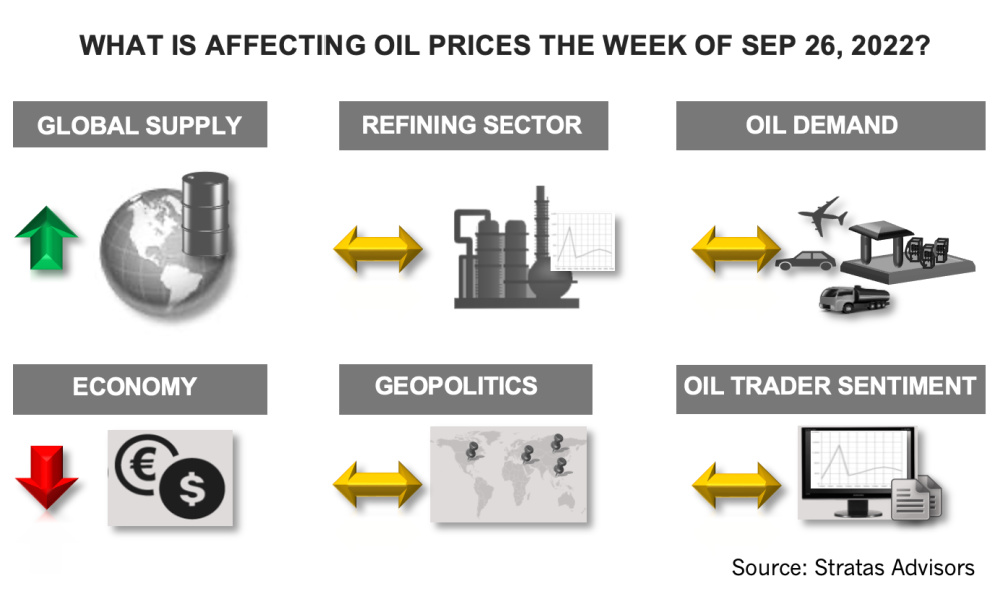

With the slowdown in economic activity, the growth in oil demand is waning and there is more downside risk than upside risk. In terms of oil prices, we are forecasting that the price of Brent crude oil will average $88.43 in the fourth quarter, while WTI averages $82.48 and Dubai crude oil averages $84.10.

For a complete forecast of energy prices, including crude oil and refined products, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.