(Source: Image of OPEC Secretary-General Mohammad Barkindo (L) courtesy of Prometheus72 / Shutterstock.com; Russian Energy Minister Alexander Novak (R) by magicinfoto / Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The two contrasting approaches from Russia and Saudi Arabia about how to address market imbalances will play a role in market prices by the end of the year. A potential feud among a proactive or reactive response to the winter uptick could disturb oil markets in a few weeks. The oil market is entering some of the most important weeks of the year, with the upcoming U.S. presidential election, a definitive decision—or lack thereof—of an additional economic package to support U.S. businesses and individuals, as well as OPEC’s definitive decision about crude cuts that could potentially impact oil markets and prices until 2022.

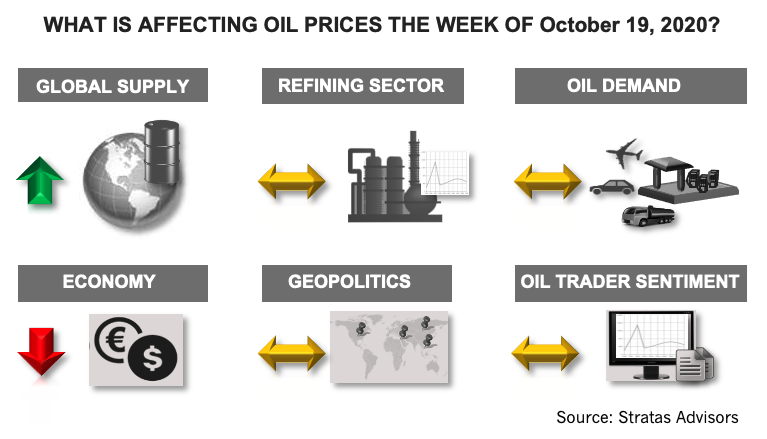

Global Supply—Positive

U.S. crude production has not fully recovered yet from hurricane Delta’s path. Above 400,000 bbl/d of U.S. Gulf Coast crude production was still shut by the end of last week, which will have an impact on commercial inventories for the next two weeks.

For the upcoming week, we continue to see this variable as positive for this week, in part, because US supply problems lingering over the next few days.

Geopolitics—Neutral

No major geopolitical event unfolded last week and none is expected for the upcoming week that could cause major disruption to oil trade or modify trading sentiment.

As such, for this week we expect this variable to neutral in terms of oil prices.

Economy—Negative

As the U.S. presidential election get closer the possibility of an additional economic stimulus package seems farther away, and along with news of additional lockdowns and restrictions across Europe generates a bearish sentiment this week for the global economy.

Within this context we see this variable as negative for this week.

Oil Demand—Neutral

U.S. refined products demand is now well within the range of the 5-year average, with stronger than usual diesel demand and resilient gasoline consumption for this time of the year. In other words, the U.S. market is behaving without an evident impact of COVID, at least when considering the total products consumption—with the exception of jet fuel demand, which is significantly lower than usual).

Because of this mixed picture we see this variable as neutral for this week.

Refining sector—Neutral

Global refiners are facing seasonal doldrums, diverging price signals from main hubs -that impact arbitrage opportunities- as well as pessimistic short-term for the next couple of months, due to colder weather conditions providing an environment where COVID infections could potentially soar.

Within this context we see refining having a neutral contribution to oil prices for this week.

Oil Trader Sentiment—Neutral

Traders in the U.S. reduced their participation in crude contracts and options last week, whereas participation in terms of products increased. Open interest for RBOB saw the most relevant increase, with an uptick of 5% in its open interest, whereas contracts and options for ULSD saw an increase of 1%.

We see this variable as neutral for the upcoming week, as the impact of the supply disruptions fade away.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.