The price of Brent crude ended the week at $90.89 after closing the previous week at $84.58. (Source: Shutterstock)

The price of Brent crude ended the week at $90.89 after closing the previous week at $84.58. The price of WTI ended the week at $87.69 after closing the previous week at $82.79. The price of DME Oman ended the week at $91.47 after closing the previous week at $84.98.

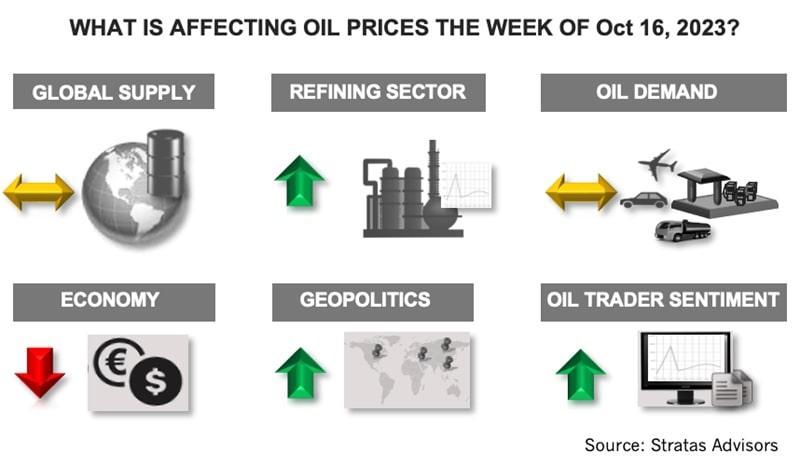

The conflict between Israel and Hamas will continue to be the most important factor affecting the oil markets and the situation will be in the forefront this week with Israel finishing preparations for a ground incursion into Gaza. The conflict could have an impact on oil supply in several different ways. One such potential way would be an effort to tighten sanctions on Iranian oil exports. Iran’s oil production increased to 3.15 MMbbl/d in August, which is the highest level since 2018, when additional sanctions were imposed on Iran by the U.S. So far, in 2023, Iran’s total crude oil exports are more than twice the level of 2022 when exports were around 800,000 bbl/d. Given the current supply/demand situation for the oil market, any further reduction in supply will put significant upward pressure on oil prices. As such, we do not think an effort to reduce Iranian crude exports will occur in earnest unless the U.S. has secured assurance from Saudi Arabia that it will increase production to offset any lost production from Iran. Regardless, the risk of supply disruption, however, will still put upward pressure on oil prices.

There remain other factors that will put downward pressure on oil prices – most notably concerns about the global economy.

The latest readings from the University of Michigan Index of Consumer Sentiment indicate that U.S. consumers are less optimistic about the future. The preliminary reading for October decreased to 63.0 from 68.1 of the previous month and is the lowest reading since May. Additionally, the reading is consistent with recession levels and well below pre-COVID levels. Further evidence of growing concerns of consumers includes the expectation for inflation to increasing. With respect to current conditions, the reading decreased to 66.7 from 71.4 of the previous month and the reading for future expectations decreased to 60.7 from 66.

The Eurozone economy is projected by the IMF to grow by only 0.7% in 2023 and 1.2% in 2024. Germany continues to be the laggard with its economy projected to contract by 0.4% in 2023 and is projected to grow by 0.9% in 2024. Germany’s economy continues to be hampered by high energy costs, tight labor market and overdependence on exports.

The latest set of data for China indicate a mixed picture for China’s economy. Exports in September decreased by 6.2% from a year ago, but was an improvement in comparison to a decrease of 8.8% in August. China's exports to the ASEAN nations, which have become more important in relation to exports to the United States and Europe continues to shrink.

Total merchandise imports decreased by 6.3%, which compares to the 7.3% decrease in August. Imports of copper decreased by 5.8% in comparison to the previous year, which is a broad indicator of economic activity with copper being used in so many economic sectors.

As we pointed out last week, another factor that will moderate the increase in oil prices is the strength of the U.S. dollar. The U.S. Dollar Index ended last week at 106.65, which compares to 99.91 in early July of this year. Typically, the U.S. dollar will strengthen during times of heightened geopolitical risks. The U.S. dollar is also getting support because of lingering inflation in the U.S., along with the appearance of a strong job market, which together are leading to expectations that the Federal Reserve will, at a minimum, keep interest rates relatively high, if not move forward with additional rate increases.

For the upcoming week, we are expecting there will be upward pressure on oil prices and could test $95.00, unless there are tangible signs that the Israeli-Hamas situation is deescalating – which at this time does not seem likely.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Sitio Royalties Dives Deeper in D-J with $150MM Acquisition

2024-02-29 - Sitio Royalties is deepening its roots in the D-J Basin with a $150 million acquisition—citing regulatory certainty over future development activity in Colorado.

Is Double Eagle IV the Most Coveted PE-backed Permian E&P Left?

2024-04-22 - Double Eagle IV is quietly adding leases and drilling new oil wells in core parts of the Midland Basin. After a historic run of corporate consolidation, is it the most attractive private equity-backed E&P still standing in the Permian Basin?

ConocoPhillips CEO Ryan Lance: Upstream M&A Wave ‘Not Done’ Yet

2024-03-19 - Dealmaking in the upstream oil and gas industry totaled $234 billion in 2023. The trend shows no signs of slowing, ConocoPhillips CEO Ryan Lance said at the CERAWeek by S&P Global conference.

EIA: E&P Dealmaking Activity Soars to $234 Billion in ‘23

2024-03-19 - Oil and gas E&Ps spent a collective $234 billion on corporate M&A and asset acquisitions in 2023, the most in more than a decade, the U.S. Energy Information Administration reported.

ONEOK CEO: ‘Huge Competitive Advantage’ to Upping Permian NGL Capacity

2024-03-27 - ONEOK is getting deeper into refined products and adding new crude pipelines through an $18.8 billion acquisition of Magellan Midstream. But the Tulsa company aims to capitalize on NGL output growth with expansion projects in the Permian and Rockies.