The price of Brent crude ended the week at $84.58 after closing the previous week at $92.20. (Source: Shuttestock)

The price of Brent crude ended the week at $84.58 after closing the previous week at $92.20. The price of WTI ended the week at $82.79 after closing the previous week at $90.79. The price of DME Oman ended the week at $84.98 after closing the previous week at $92.29.

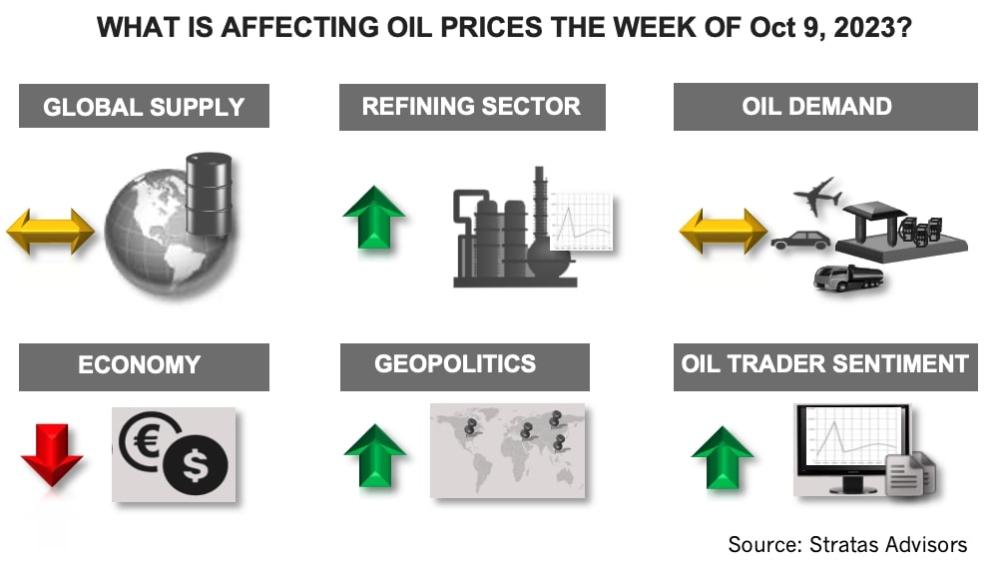

We have been highlighting for several weeks that the price of Brent crude would be under pressure and would test $90 again. The price of Brent crude broke below $90 on Oct. 4, falling to $84.07 before rebounding slightly on Oct. 6. The sharp drop-off in oil prices occurred even though the Joint Ministerial Monitoring Committee of OPEC+ announced (as expected) no change with respect to the current production cuts. During last week, the sentiment of Brent oil traders continued to turn more bearish with net long positions decreasing by 10.35% after decreasing the prior week by 8.29%. The net long positions of traders of WTI also decreased last week, which broke the streak of four consecutive weeks of increases.

The dynamic of the last few weeks, however, have been disrupted by the initiation of the conflict in Israel that occurred over the weekend. The conflict is having an immediate impact on oil prices with concerns that the conflict will expand beyond Israel. There have already been reports of missiles being fired on Israel from Hezbollah’s positions in Lebanon. Iran is a supporter of both Hamas and Hezbollah, and the Wall Street Journal (WSJ) is reporting that Iranian security officials and officers of Iran’s Islamic Revolutionary Guard Corps helped plan Hamas’ surprise attack and granted approval for the attack at a meeting in Beirut last Monday. Additional complexity is added to the conflict by Hamas taking hostages, which are likely to include citizens from western countries, including the U.S. and U.K. The U.S. has responded to the attack by moving a carrier strike force to the Eastern Mediterranean and the Biden administration pledging support for Israel.

The potential for direct involvement of western countries could lead to a much larger conflict that involves not only Iran, but could also draw in Russia and China, given that both have increased their ties with Iran during the last few years. China is a major buyer of Iran’s energy exports and Russia has been acquiring weapons from Iran. Additionally, some politicians in the U.S. are trying to link the conflict in Israel with the conflict in Ukraine with the view that Iran is playing a central role in both conflicts. Furthermore, during this year, Iran has been increasing its efforts to disrupt shipping through the Strait of Hormuz, including seizing vessels and confronting U.S. navy ships.

For the upcoming week, we are expecting that oil prices will increase with the price of Brent moving back to $90 and could test $95. If the flow of oil is not disrupted, however, the risk premium will start eroding and the previous price dynamics will return.

Another factor that will moderate the increase in oil prices is the strength of the U.S. dollar, with the U.S. Dollar Index ending last week at 106.04, which compares to 99.91 in early July of this year. Typically, the U.S. dollar will strengthen during times of heightened geopolitical risks.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

NextDecade Appoints Former Exxon Mobil Executive Tarik Skeik as COO

2024-07-25 - Tarik Skeik will take up NextDecade's COO reins roughly two months after the company disclosed it had doubts about remaining a “going concern.”

CEO: Baker Hughes Lands $3.5B in New Contracts in ‘Age of Gas’

2024-07-26 - Baker Hughes revised down its global upstream spending outlook for the year due to “North American softness” with oil activity recovery in second half unlikely to materialize, President and CEO Lorenzo Simonelli said.

Freeport LNG Parent Receives Junk-level Credit Score From Fitch

2024-07-25 - Credit-rating firm Fitch Ratings cited the 2 Bcf/d Texas plant’s frequent downtimes among the factors leading to lowering Freeport LNG Investments LLLP’s credit grade on July 25.

Golden Pass LNG Likely Delayed After Engineering Firm Lays Off 4,400

2024-06-06 - An analyst estimated Golden Pass LNG’s in-service date could be set back six months and that the export terminal’s owners, Exxon Mobil and Qatar Energy, might try to retain workers formerly employed by Zachry Engineering.

Cheniere Increases Share Repurchase Budget by $4B Through 2027

2024-06-18 - Cheniere will also increase its quarterly dividend by approximately 15% to $2 per share annualized.