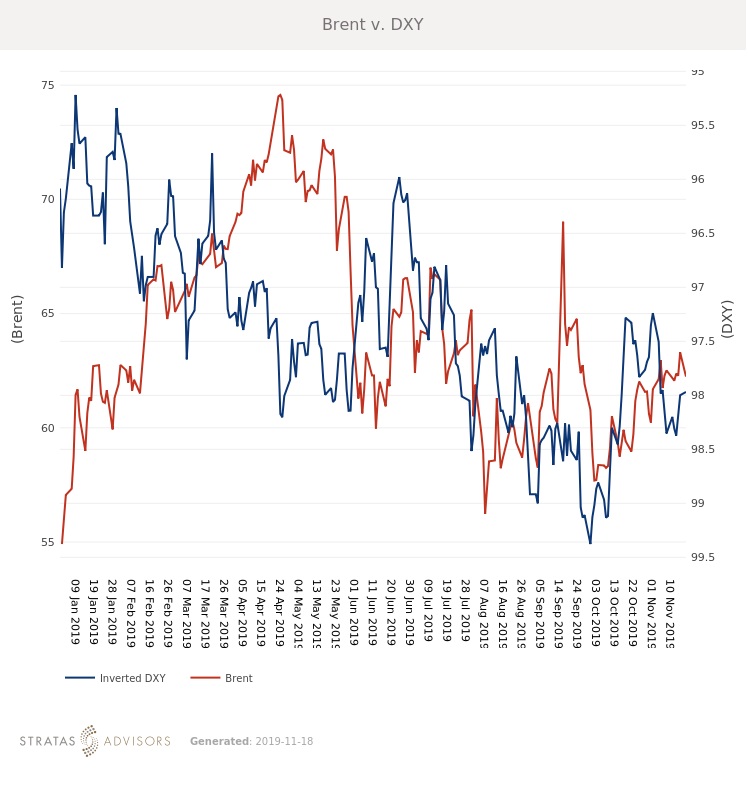

As Stratas Advisors expected, Brent and WTI were both range bound last week. Brent crude averaged $62.44/bbl, up $0.11/bbl. WTI crude averaged $57.05/bbl, up $0.15/bbl. For the week ahead, Stratas Advisors expect prices to slowly drift lower with Brent averaging closer to $62/bbl. The next few weeks are likely to be relatively calm with most participants awaiting official news on U.S.-China and OPEC+.

As reiterated several times, no news is bad news for prices when it comes to the U.S.-China trade discussions. There have been few updates about a potential first phase deal, or the current pace of talks. Markets will continue to wait-and-see if a trade deal materializes in the weeks ahead. If no news appears, prices will continue to drift lower.

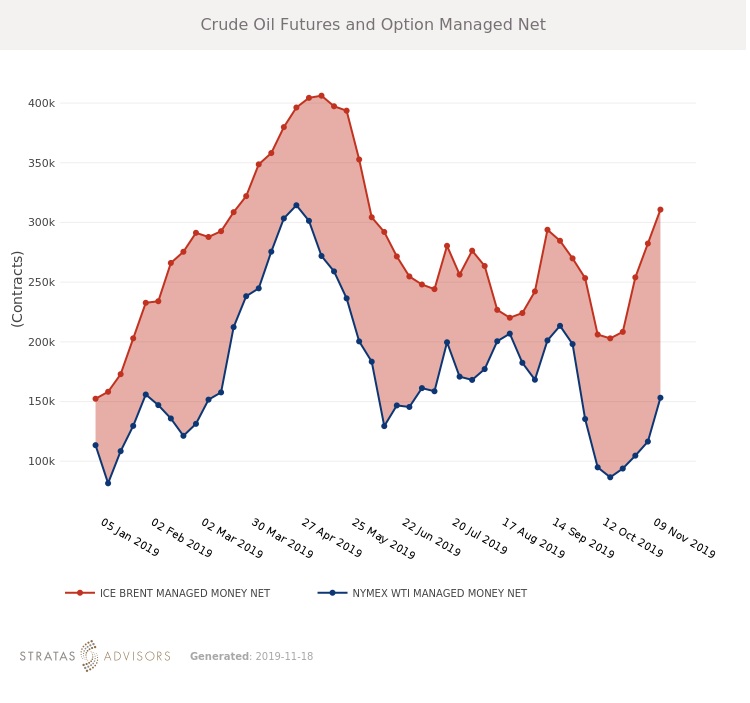

An extension of the current OPEC+ supply agreement is now generally expected by markets. Prices will see little movement if an extension is announced, but will certainly move to the downside if the extension is lower or shorter than expected. Trader positioning and corporate commentary indicates that supply is much less of a concern heading into 2020 on expectations for an extension and the belief that 2018’s subdued prices likely discouraged investment.

Day-to-day activity will likely be tracking headlines, although there is the possibility of larger profit-taking transactions in advance of the shorter trading week in the U.S. next week. Protests in Iran are unlikely to have a physical impact, but the government response is worth watching for an indication of how threatened leadership feels.

Geopolitical Unrest – Neutral

Global Economy – Neutral

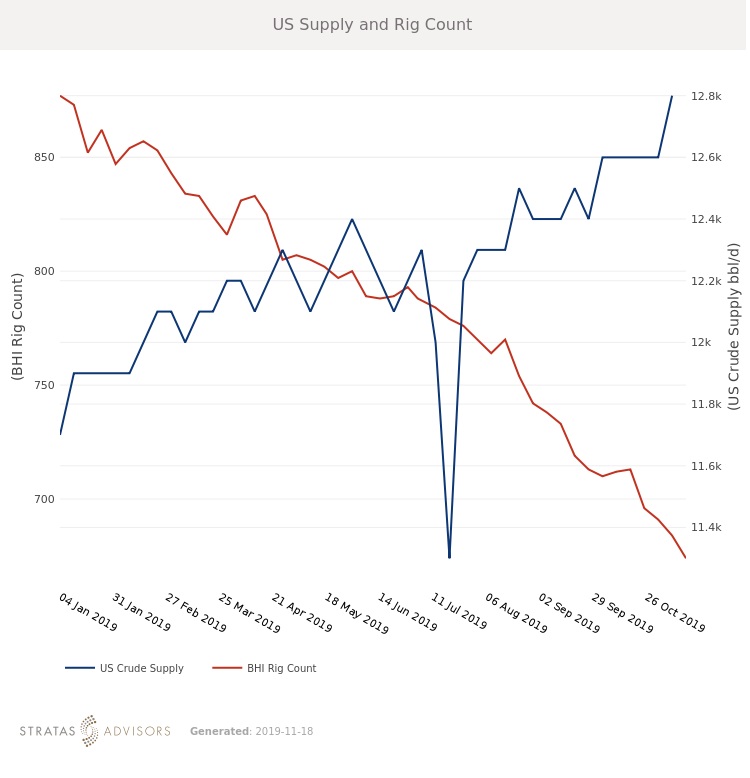

Oil Supply – Neutral

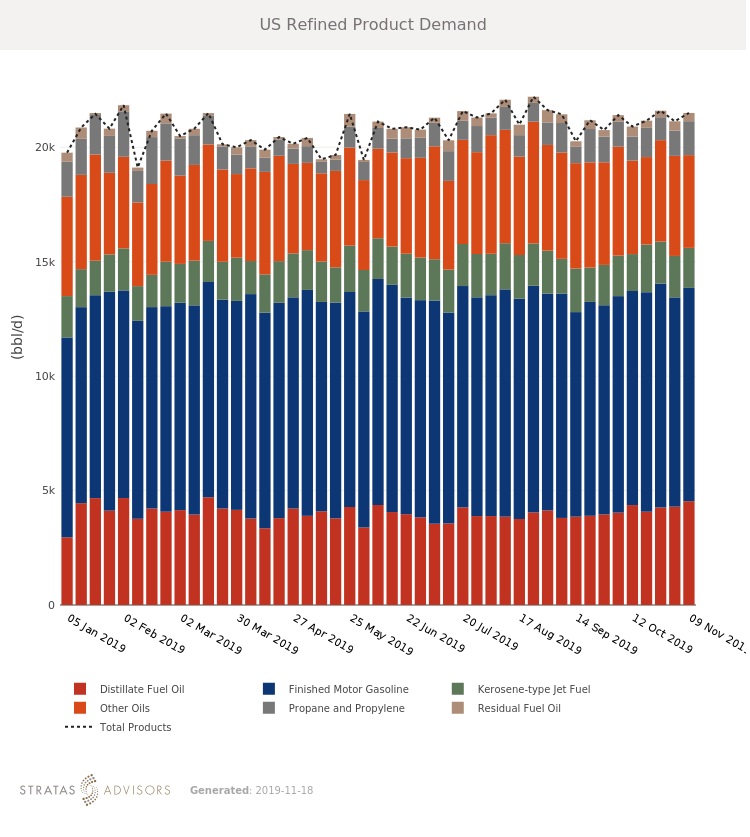

Oil Demand – Negative

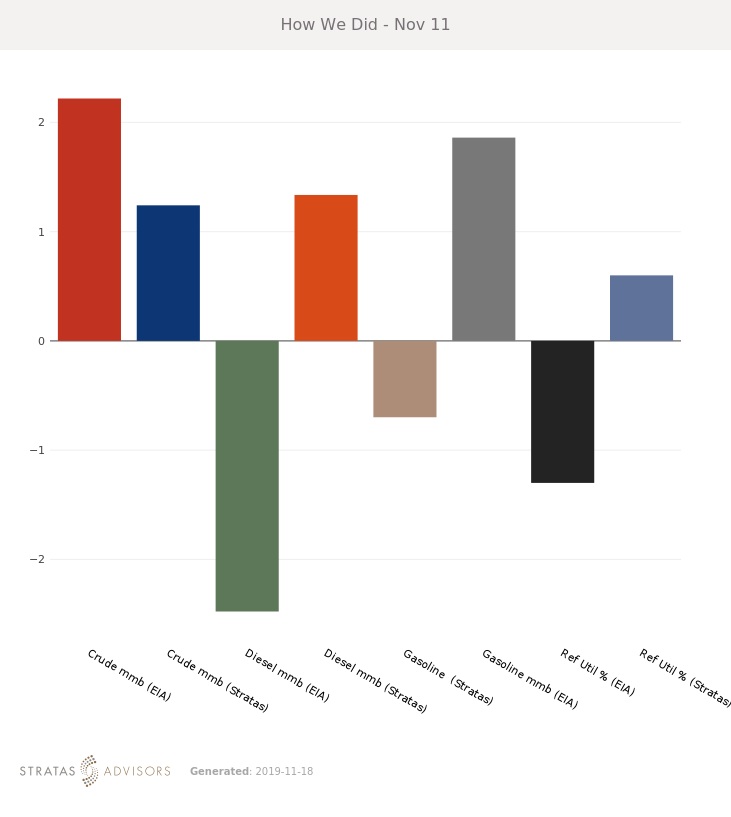

How We Did

Recommended Reading

Marketed: Bendel Ventures 73 Well Package in Texas

2024-03-05 - Bendel Ventures LP has retained EnergyNet for the sale of a 73 well package in Iron and Reagan counties, Texas.

Marketed: EnCore Permian Holdings 17 Asset Packages

2024-03-05 - EnCore Permian Holdings LP has retained EnergyNet for the sale of 17 asset packages available on EnergyNet's platform.

Marketed: Ascent Resources- Utica 96 Well Package in Ohio

2024-03-12 - Ascent Resources- Utica LLC and Ascent Utica Minerals LLC has retained EnergyNet for the sale of a non-operated 96 well package in Belmont, Guernsey, Harrison, Jefferson and Noble counties, Ohio.

Marketed: Anschutz Exploration Six Asset Package in Wyoming

2024-02-26 - Anschutz Exploration Corp. has retained EnergyNet for the sale of six AFE asset packages in Campbell County, Wyoming.

Marketed: Anadarko Minerals Woodford Shale Opportunity

2024-02-26 - Anadarko Minerals has retained EnergyNet for the sale of a Woodford Shale opportunity in Blaine County, Oklahoma.