(Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

Just two weeks ago, Royal Dutch Shell Plc announced a plan to offer for sale seven refineries around and, surprisingly, last week announced the decision to close the Convent refinery in Louisiana.

Convent is better positioned than the other six refineries Shell is offering for sale. Given the way this decision unfolded, however, it is possible that none of these variables were as important as Shell’s need to address its financial position—and to indicate to the equity markets that Shell is being proactive in positioning itself for the future.

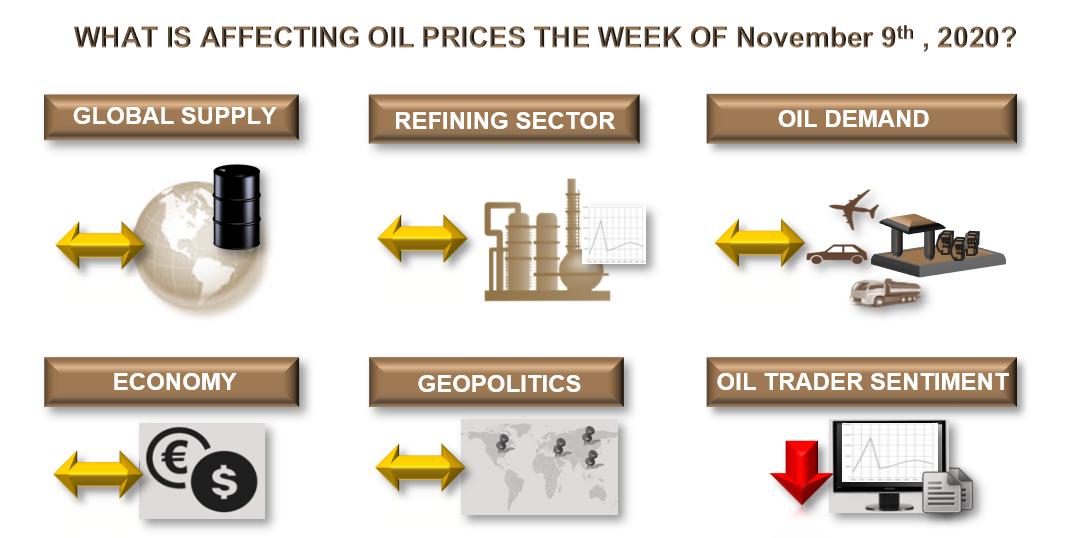

Global Supply—Neutral

Rumors about alleged conversations between Russia and Saudi Arabia prior to the upcoming OPEC+ meeting continued last week. This development is important because it would consolidate diverging views into a single approach—especially in light of Russia’s Energy Minister as a few weeks ago still signaling the intent to continue with the plan to pump more oil to markets as of January.

For the upcoming we expect this variable to be neutral with respect to oil prices.

Geopolitics—Neutral

There are reports of alleged Israeli incursions in Palestinian settlements that could create tension in the region, but considering the most recent agreements in between Israel and some Arab-countries (facilitated by the use of Israel pipeline that adds an option for reaching the Mediterranean market), such pressures will be less impactful than in the past.

We see this variable as neutral for this week.

Economy—Neutral

The U.S. unemployment rate continues to recover when compared to the large collapse seen in March. However, perceptions about the rest of the global economy vary.

We see the net impact of this variable as neutral for oil prices this week.

Oil Demand—Neutral

Oil consumption around the world is holding up despite the ongoing presence of COVID. U.S. demand continues to be strong for diesel, whereas gasoline remains within 90% of the five-year average range.

Asian demand has recovered in general except for jet fuel. Cold-weather conditions in northern Japan have recently underpinned kerosene consumption, which lends support to distillate spreads in general.

For the upcoming week, we expect this variable to be neutral.

Refining sector—Neutral

After the decline in crude prices during the last days of October, prices recovered ground last week, which negatively impacted refining margins across all the regions. From a wider perspective, refining margins have remained to hover in a relatively stable range over the last six weeks.

For the upcoming week expect this variable to have a neutral impact on oil prices.

Oil Trader Sentiment—Negative

Open interest for all relevant oil contracts increased last week, which reflects that participants are being attracted to take additional positions for both crude and products, in order to leverage the upcoming OPEC+ announcements, as well as seasonal patterns and potential developments with regards to a COVID vaccine.

For the upcoming week, we expect oil trader sentiment to be a negative variable for oil prices.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

CERAWeek: Saudi Aramco CEO Says No Peak in Oil Demand for Some Time to Come

2024-03-18 - Reducing greenhouse gas emissions from hydrocarbons through carbon capture and other technologies achieves better results than alternative energies, Saudi Aramco CEO Amin Nasser said.

NAPE: CCUS is a Risky Venture Hinging on Tech, Regulation, Reservoirs

2024-02-14 - Transdisciplinary collaboration and reservoir understanding are key to mitigating CCUS risks.

Amid Climate Scaremongering, Energy Execs Urge Engagement, Realism

2024-02-06 - From shale boom to net zero goals, industry experts grappled with the contradictions facing the energy industry during SPE’s Hydraulic Fracturing Technology Conference.

CERAWeek: NOCs Balance Financial Realities, Energy Transition

2024-03-21 - National oil companies’ strategies include diversifying energy sources and seeking reserves located deeper in the ground and in deeper waters, while still working to curb emissions.

‘Growth Story’ for Oil: Rice's Kenneth Medlock on Demand Trends

2024-03-05 - Economics drive oil demand, not politics, Rice University’s Kenneth Medlock said during the International Drilling Conference and Exhibition in Galveston.