A recent change in policy and increasing concerns about inflation is increasing the probability of the Federal Reserve moving quicker in raising interest rates—and the expectations are providing upward support for the U.S. dollar, says Stratas Advisors. (Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

Last week, crude oil prices declined for the third straight week. The price of Brent crude ended the week at $81.95 after closing the previous week at $82.55. The price of WTI ended the week at $80.69 after closing the previous week at $81.17.

Additionally, there were more developments coming from COP26, which ended on Nov. 12, including the following:

- An agreement, involving 197 countries, to reduce carbon emissions was reached. While India and China pushed back on the strength of the language, a compromise was reached to phase down the use of coal-fired power plants that do not including carbon capture and storage. Similar language of phasing down was agreed for subsidies of fossil fuels.

- An agreement for a global carbon market was reached and includes a centralized system open to the public and private sectors and a bilateral system. The framework also includes a mechanism for 5% of the credits to be placed into a fund to support developing countries in addressing decarbonization. Additionally, 2% of the generated credits will be cancelled to encourage the reduction in carbon emissions. One concern is that the agreement allows for some 300 million of old credits to be included in the new system, which could result in depressing the future price of carbon.

- An agreement, involving 24 countries and several automotive manufacturers to end the production of fossil-fuel-powered vehicles by 2040 or earlier was reached. Countries signing the agreement include Canada, New Zealand, the Netherlands, Ireland, and the U.K. However, the U.S., China and Germany did not sign the agreement. Automotive manufacturers that signed the agreement include Ford, Daimler, and Volvo. However, Volkswagen, Toyota and BMW did not sign the agreement.

Another development worth noting is the reaction of some climate activists to the increased focus on electric vehicles (EVs). These activists are pushing back against EVs, in part, because of the concerns associated with ramping up the production of metals, such as cobalt and lithium, but also because of concerns associated with any type of private vehicle—concerns such as congestion and safety for bicyclists and pedestrians. These activists are pushing for more support of public transportation, biking and walking—and not infrastructure for EVs.

Note: Stratas Advisors tracks energy-related policy initiatives from a global perspective. For more information please see Policy Assessment & Ratings.

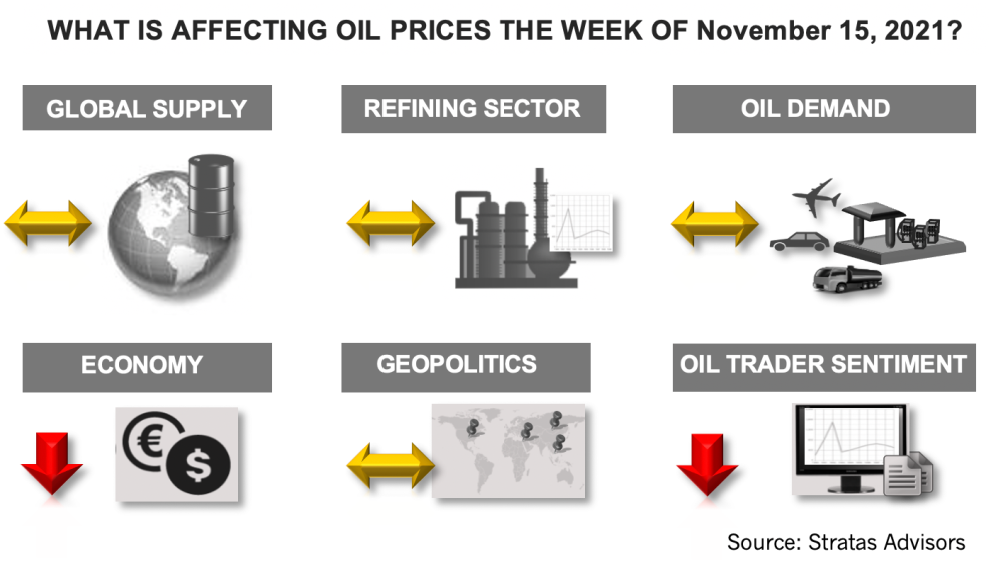

Meanwhile, as we have been forecasting for several months, the U.S. dollar continues to strengthen, as indicated by the U.S. Dollar Index closing last week at 95.12 from the previous week of 94.32. The U.S. dollar has rebounded significantly since reaching a low of 89.64 on May 25 and is now at the highest level of all year—and the highest level since July 2020. We have been forecasting that the U.S. Dollar Index will continue to increase through the rest of the year and will approach 96.00. The stronger U.S. dollar will put downward pressure on oil prices. Last week, the Federal Reserve announced plans for initiating the reduction of its $120 billion in monthly bond purchases. This change in policy and increasing concerns about inflation is increasing the probability of the Federal Reserve moving quicker in raising interest rates—and the expectations are providing upward support for the U.S. dollar.

Additionally, we are assessing that the impact of increasing COVID-19 cases in Europe and now North America, including the U.S. Cases in the U.S. are ticking upward in all regions except the South, where cases have plateaued. This aligns with concerns that we have been highlighting for last few weeks that with cases in Europe increasing cases would start to rebound in the U.S.

Because of the strength of the U.S. dollar, concerns about inflation, and the uptick in COVID cases, for the upcoming week, we are expecting that oil prices will have a downward bias.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Keeping it Tight: Diversified Energy Clamps Down on Methane Emissions

2024-04-24 - Diversified Energy wants to educate on emission reduction successes while debunking junk science.

Darbonne: The ESG Sword: BlackRock's Life, Death by ESG

2024-04-17 - BlackRock, the $10 trillion investment manager, is getting heat for too much ESG investing, while shareholders are complaining it’s doing too little.

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.