The price of Brent crude ended the week at $81.43 after closing the previous week at $84.89. (Source: Shutterstock)

The price of Brent crude ended the week at $81.43 after closing the previous week at $84.89. The price of WTI ended the week at $77.17 after closing the previous week at $80.51. The price of DME Oman ended the week at $81.21 after closing the previous week at $85.87.

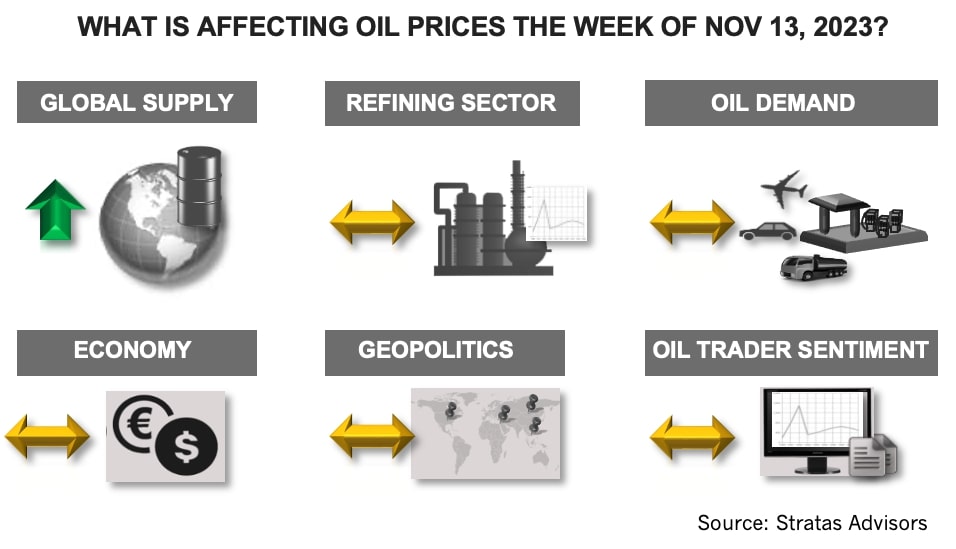

The price of Brent and the price of WTI both broke below their 200-day moving average. Prices rebounded after Nov. 8 but remained below the moving averages, with oil traders dismissing the geopolitical situation and the potential impact on the oil markets as the threat to the flow of oil.

The messages emerging from the summit held this weekend in Saudi Arabia, involving 57 Muslim-majority countries and with the attendance of the Iranian leader, are, all things considered, somewhat measured with respect to the ongoing Israeli-Hamas conflict. The group of countries issued a statement condemning Israeli aggression against Gaza and demanding the U.N. to impose a cease fire. Additionally, the statement included a call for an arms embargo against Israel and for the International Criminal Court to complete its investigation into alleged war crimes committed by Israel. Furthermore, the Assistant Secretary General of the Arab Leagues stated that it is unacceptable to separate Gaza from the West Bank and for a multinational force (including Arab forces and western forces) to administer Gaza. At the same summit, however, Saudi Arabia, in conjunction with UAE, blocked a proposal to break all ties with Israel.

While the conflict between Ukraine and Russia continues, with Ukraine’s counter offensive not resulting in any substantial gains, the conflict has entered a new phase with hints there is more willingness to reach a settlement. The risk remains, however, that Russia will push forward with the attempt to capture more territory, including in the southwest of Ukraine and Odesa. Nevertheless, while sanctions are still in place, Russian exports are still flowing.

Iranian oil exports have increased to around 1.5 MMbbl/d with Iranian production approaching 3.2 MMbbl/d. The U.S. House of Representatives passed a bill on Nov. 3 pertaining to sanctions on Iranian oil that focuses on foreign ports and refineries. The bill still needs to be passed by the Senate and then signed by President Biden. Even if the bill becomes law, it is unlikely to be any more effective than other sanctions, given the proven ability of those being targeted to evade the sanctions. Furthermore, China is the largest importer of Iranian crude, averaging around 1 MMbbl/d so far this year and exceeding 1.40 MMbbl/d in October. The passing of the bill into law, however, would likely still provide a short-term spike in oil prices, given how the market reacts to news flow.

On the other hand, we expect OPEC+ will continue to be proactive in managing supply to support oil prices. As such, we would not be surprised to see OPEC+ act at its upcoming November meeting, including Saudi Arabia extending its voluntary production cut through the first quarter of next year.

We also still think that the fundamentals remain favorable for higher oil prices. During the fourth quarter, we are forecasting that oil demand will outpace supply by around 900,000 bbl/d. Included in our forecast is that China demand in the fourth quarter will be essentially flat in comparison with the third quarter and that U.S demand in the fourth quarter will decrease by 310,000 bbl/d in comparison with the third quarter, mainly because of seasonal patterns.

Consequently, our base case, which considers the fundamentals along with the macro-level factors (including geopolitics), still calls for the price of Brent crude to move back to around $90. Potential wildcards include geopolitical disruptions and unexpected bad economic news associated with the U.S. and China.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Initiative Equity Partners Acquires Equity in Renewable Firm ArtIn Energy

2024-04-26 - Initiative Equity Partners is taking steps to accelerate deployment of renewable energy globally, including in North America.

Energy Transition in Motion (Week of April 26, 2024)

2024-04-26 - Here is a look at some of this week’s renewable energy news, including the close of a $1.4 billion decarbonization-focused investment fund.

No Silver Bullet: Chevron, Shell on Lower-carbon Risks, Collaboration

2024-04-26 - Helping to scale lower-carbon technologies, while meeting today’s energy needs and bringing profits, comes with risks. Policy and collaboration can help, Chevron and Shell executives say.

Solar Sector Awaits Feds’ Next Move on Tariffs

2024-04-25 - A group of solar manufacturers want the U.S. to impose tariffs to ensure panels and modules imported from four Southeast Asian countries are priced at fair market value.

Solar Panel Tariff, AD/CVD Speculation No Concern for NextEra

2024-04-24 - NextEra Energy CEO John Ketchum addressed speculation regarding solar panel tariffs and antidumping and countervailing duties on its latest earnings call.