The price of Brent crude ended the week at $84.89 after closing the previous week at $89.17. (Source: Shutterstock)

The price of Brent crude ended the week at $84.89 after closing the previous week at $89.17. The price of WTI ended the week at $80.51 after closing the previous week at $85.46. The price of DME Oman ended the week at $85.87 after closing the previous week at $90.88.

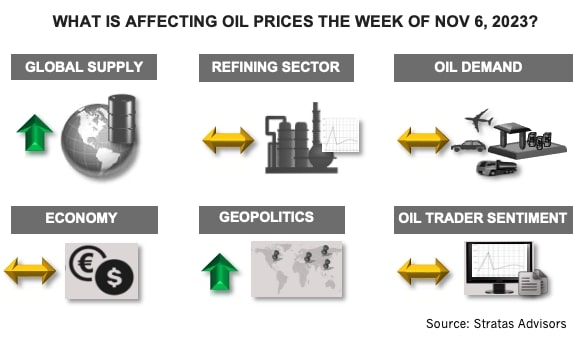

Oil traders continue to dismiss the geopolitical situation and the potential impact on the oil markets. As we have been highlighting, if the threat to the flow of oil is viewed to be a low probability, the risk premium will erode, and the previous price dynamics will govern price movements. We also think that it is unlikely that the flow of oil will be interrupted. The Israeli - Hamas conflict, however, continues to be volatile with the potential to expand. Iran continues to represent the greatest potential for triggering an interruption to oil flow – either through Iran’s actions to interfere with oil traffic associated with the Strait of Hormuz, or through the U.S. tightening sanctions on Iran’s oil-related exports. (Much less probable is the possibility of Iran, in conjunction with other producers, imposing an oil embargo on oil moving to western countries.) Iran also continues to put out statements that are threatening, including on Sunday, when Iran’s Minister of Defense stated that if the U.S. does not immediately implement a ceasefire in Gaza that the U.S. will be hit hard. The U.S. pentagon has also reported that U.S. troops in the Middle East have been attacked 14 times in Syria and Iraq with 24 people injured during the last week. Further such attacks will put pressure on the U.S. to act in response.

Other downward pressure on oil prices, includes the latest economic data, which have not been supportive of oil prices. The October readings purchasing manager index (PMI) from the Institute for Supply Management (ISM) indicate a weakening U.S. service sector. The reading was 51.8, which is the lowest in five months, and a decrease from 53.6 in September. The PMI for the U.S. manufacturing sector decreased to 46.7 from 49.0 in September. The October reading was the 12th consecutive month of readings less than 50 (less than 50 represents contraction). Additionally, the outlook for the future does not look promising with the index for new orders decreasing to 45.5 from 49.2 in September. The jobs report for October is also consistent with slowing growth. During October, the number of jobs increased by only 150,000 in comparison to 297,000 in September. The unemployment rate increased to 3.9% and the broader unemployment rate (includes discouraged workers and underemployed workers) increased to 7.2% from 7.0% in September.

The U.S. dollar, however, could be supportive of higher oil prices. With the probability of additional rate increases waning, the U.S. dollar weakened with the U.S. dollar Index decreasing to 105.02 from the previous week of 106.56. The reading remains higher than early July of this year when the index was at 99.91, but well below the level in October 2022, when the U.S. dollar Index reached 113.11. All things equal, a weakening U.S. dollar puts downward pressure on oil prices.

Additionally, as we pointed out last week, the fundamentals remain favorable for higher oil prices. During Q4, we are forecasting that crude supply will increase in comparison with 3Q with non-OPEC supply forecasted to increase by 1.10 MMbbl/d, while OPEC supply remains essentially unchanged. However, we are also forecasting that oil demand will outpace supply by 0.87 MMbbl/d even with the forecasted oil demand in Q4 being about around 400,000 bbl/d less in comparison to demand in 3Q 2023.

For the upcoming week, we are expecting that the price of Brent crude will bounce upwards from the $85 level, which is the current floor for Brent prices and could approach $87.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

White House Open to Ending LNG Export Pause in Push for Ukraine Aid, Sources Say

2024-04-02 - Reversing the pause could be tolerable to the White House in order to advance Ukraine aid, in part because the pause has no bearing on near-term LNG exports, the White House sources said.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

US Expected to Supply 30% of LNG Demand by 2030

2024-02-23 - Shell expects the U.S. to meet around 30% of total global LNG demand by 2030, although reliance on four key basins could create midstream constraints, the energy giant revealed in its “Shell LNG Outlook 2024.”

Silver Linings in Biden’s LNG Policy

2024-03-12 - In the near term, the pause on new non-FTA approvals could lift some pressure of an already strained supply chain, lower both equipment and labor expenses and ease some cost inflation.

Russia Orders Companies to Cut Oil Output to Meet OPEC+ Target

2024-03-25 - Russia plans to gradually ease the export cuts and focus on only reducing output.