In the week since our last edition of What's Affecting Oil Prices, Brent rose a modest $0.42/bbl last week to average $65.91/bbl, pretty much in line with our forecast of $66/bbl. WTI rose $0.23/bbl to average $56.42/bbl. For the week ahead we expect Brent to continue having trouble gaining traction, hovering near the $65/bbl mark with the potential to fall farther.

Disappointing economic data released at the end of last week will continue to pressure prices this week. Sagging equity markets will drag on energy prices. Added to that, markets will be closely watching the latest data from the IEA’s monthly Oil Market Report, to be released on March 15. If the report indicates growing concerns about oversupply, expect a sharp move lower.

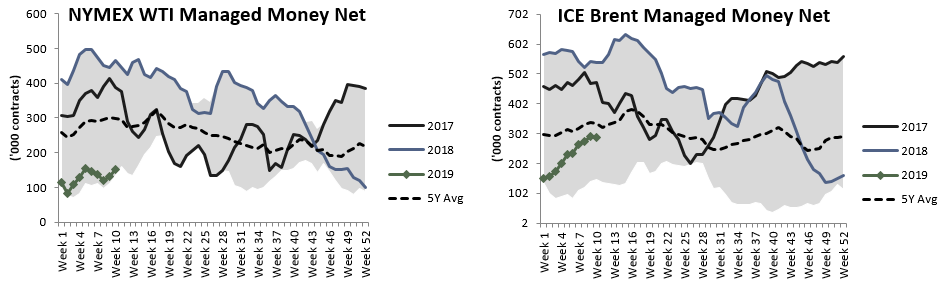

In the U.S., speculators raised their net long positions, likely driven by optimism that a trade deal would soon be struck between the U.S. and China. However, Brent managed money net long positioning fell. The rekindling of fears about the global economy combined with optimism about the state of global supply make it difficult to ascribe clear sentiment to current markets.

Geopolitical: Neutral

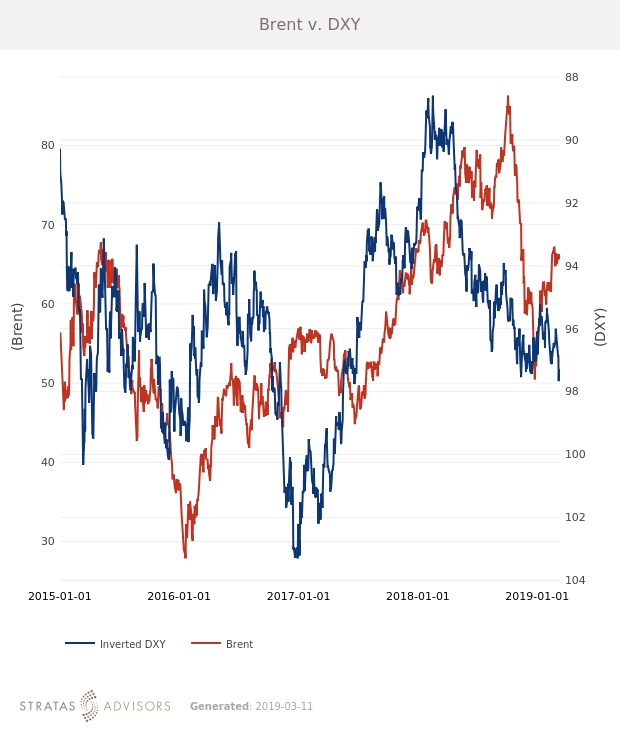

Dollar: Negative

Trader Sentiment: Neutral

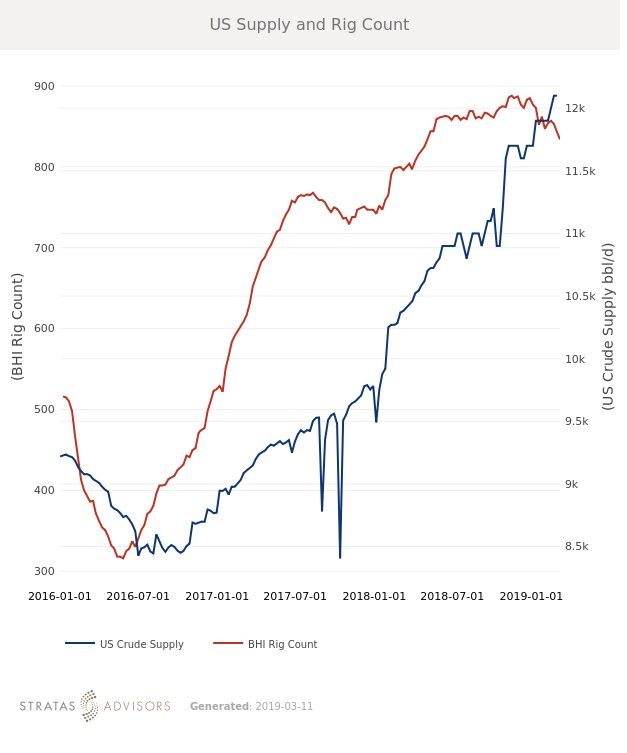

Supply: Negative

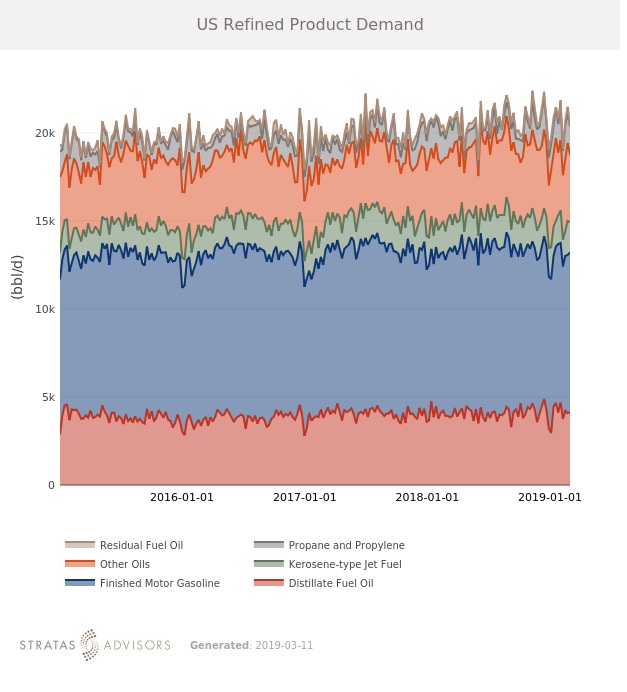

Demand: Neutral

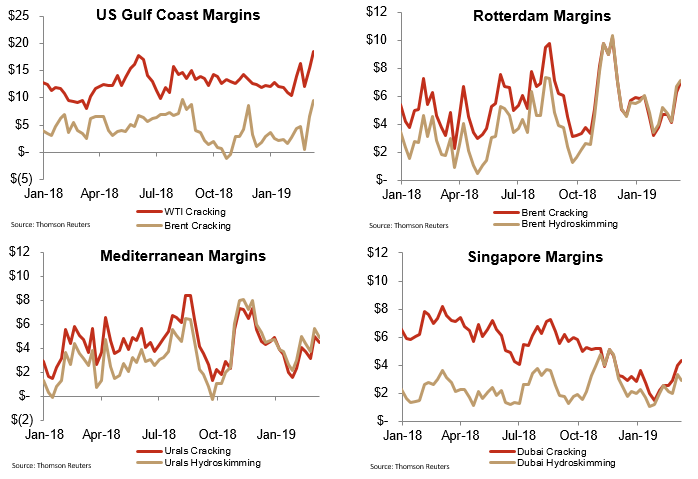

Refining Margins: Neutral

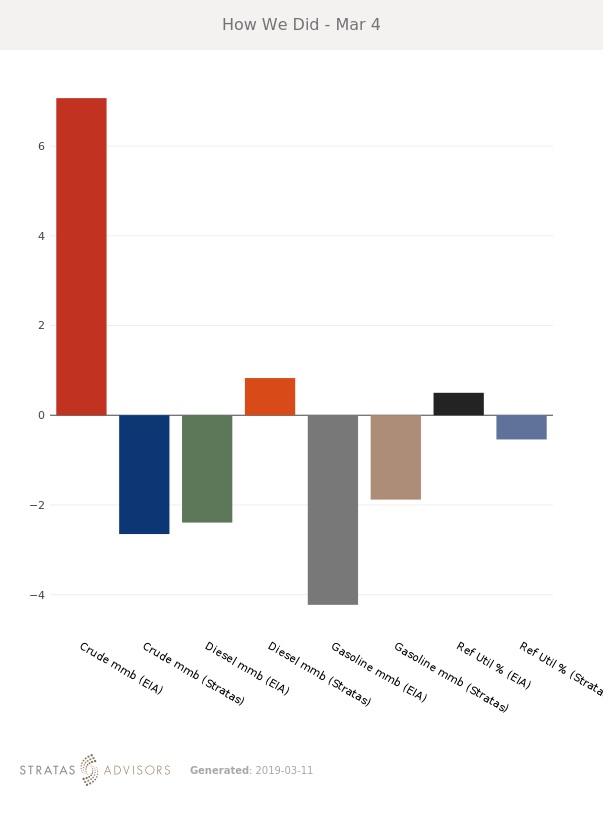

How We Did

Recommended Reading

The Jones Act: An Old Law on a Voyage to Nowhere

2024-04-12 - Keeping up with the Jones Act is a burden for the energy industry, but efforts to repeal the 104-year-old law may be dead in the water.

Venture Global Gets FERC Nod to Process Gas for LNG

2024-04-23 - Venture Global’s massive export terminal will change natural gas flows across the Gulf of Mexico but its Plaquemines LNG export terminal may still be years away from delivering LNG to long-term customers.

Hirs: LNG Plan is a Global Fail

2024-03-13 - Only by expanding U.S. LNG output can we provide the certainty that customers require to build new gas power plants, says Ed Hirs.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.

Watson: Implications of LNG Pause

2024-03-07 - Critical questions remain for LNG on the heels of the Biden administration's pause on LNG export permits to non-Free Trade Agreement countries.