Coupled with the moderating demand, Stratas Advisors expects that the oil supply situation will stabilize but also thinks there is some potential upside to oil supply, including additional non-OPEC supply. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $122.01 after closing the previous week at $119.72. The price of WTI ended the week at $120.67 after closing the previous week $118.87. In recent weeks, we have suggested that oil prices would not move significantly higher than $120 over the next few months, in part, because our expectation that the supply situation would stabilize, and that global demand growth would remain moderate.

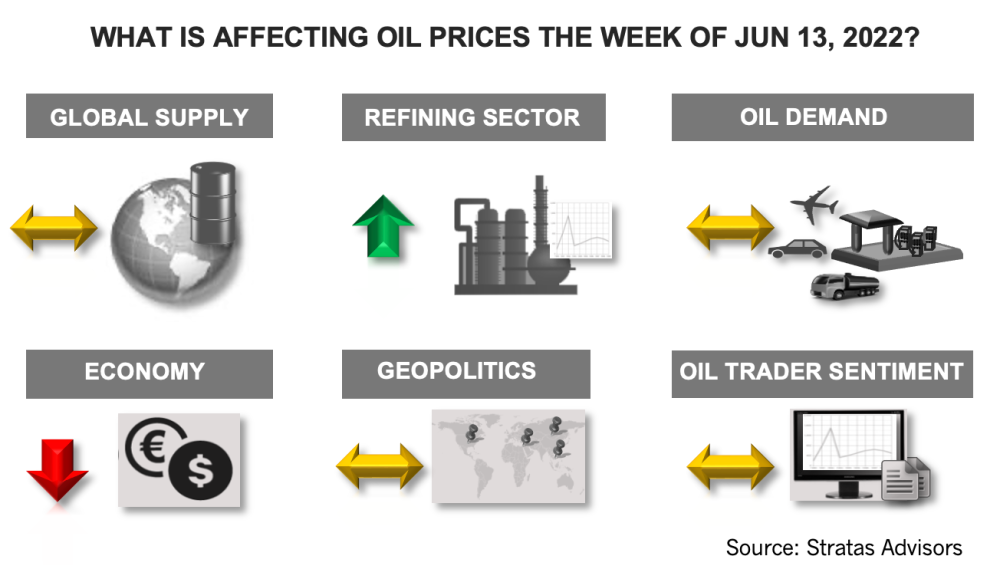

While oil prices moved up last week, there are several factors that are putting downward pressure on oil demand.

- The U.S. Dollar Index reached 104.19 (from 102.14 of the previous week) and is at a level not seen since December of 2002. The stronger dollar is making the cost of oil relatively higher for importing countries, and given the elevated strength of the U.S. dollar, oil prices in local currencies are effectively higher now than during 2008 when the price of oil prices approached $150. Additionally, because of the tight refining situation, product prices are even higher than typically would be indicated by oil prices. Furthermore, the consumer is facing elevated costs for food and housing, which will further dampen demand.

- The latest data from Energy Information Administration (EIA), indicates that demand is already being affected in the U.S. where gasoline prices have moved above $5 per gallon and diesel prices are approaching $6 per gallon. The latest weekly report from EIA indicates that gasoline demand in the U.S. increased to 9.20 million bbl/d from the previous week of 8.98 million bbl/d. However, based on the four-week average, current gasoline demand is running 535,000 bbl/d less than for the same period of 2019, which represents a difference of 5.6%. Diesel demand in the U.S. decreased to 3.65 million bbl/d from the previous week of 3.97 million bbl/d. However, based on the four-week average, diesel demand is running 131,000 bbl/d less than in 2019, which represents a difference of 3.3%.

- As we highlighted last week, while the number of COVID-19 cases has remained low, it does not appear that China will be moving away from its zero-COVID policies any time soon. Currently, mass testing is taking place in Shanghai after four cases were confirmed on June 11. Additionally, five districts barred residents from leaving home during the testing period. Additionally, Beijing is being affected with a government spokesman announcing on Saturday that Beijing is experiencing an explosive COVID-19 outbreak.

Coupled with the moderating demand, we are expecting that the oil supply situation will stabilize. Given that the EU has recently agreed to ban the imports of Russia oil, we think that will be the last major announcement that will negatively affect future oil supply. While the EU is also working to implement a ban on insurers covering oil tankers (oil and refined products) that will be phased in over six months, we do not think the ban will have a major impact on Russian oil exports. We are holding to that view, in part, because we think there is sufficient tanker capacity to handle the increased distances that Russia crude oil (and products) will need to travel to reach markets other than Europe. For instance, in January of this year, global very large crude carrier (VLCC) tonnes miles were still some 16% below pre-COVID levels. Additionally, the utilization rate for VLCCS was below 50%. And after an extremely difficult 2020 and a slow recovery, at least some of the vessel owners will be open to additional business.

We also think there is some potential upside to oil supply, including additional non-OPEC supply. Additionally, there is potential for several African producers to produce more oil, although it will require the easing of internal conflict for these producers to do so on a consistent basis. Conversely, we do not expect that there will be an increase in Iranian exports stemming from a renewed nuclear deal. While there has been some noise about the U.S. reducing sanctions to allow Iran to export more oil, we think this is highly unlikely—and even more so now, given the recent actions by Iran to remove cameras that allows for monitoring by the International Atomic Energy Agency (IAEA).

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.