The price of Brent crude ended the week at $78.82 after closing the previous week at $77.15. The price of WTI ended the week at $73.95 after closing the previous week at $71.77. The price of DME Oman crude ended the week at $78.53 after closing the previous week at $77.26.

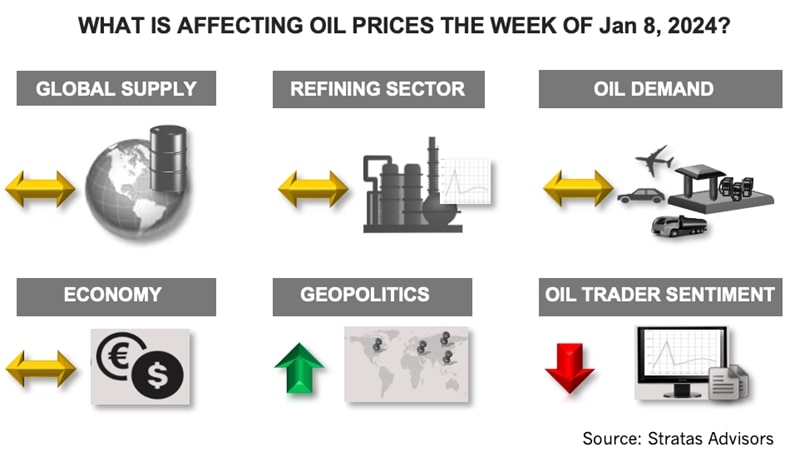

There remain geopolitical risks that have the potential to affect the oil market, as reflected by recent developments:

- The Afghanistan-based branch of ISIS appears to be responsible for the recent bombings in Iran that took place Jan. 3;

- Hezbollah responded to Israel’s killing of Hamas’ deputy chief in Beirut with 62 rockets targeted at a key Israeli observation post; and

- The U.S. moved an aircraft carrier (USS Dwight D. Eisenhower) to the Red Sea on Friday as part of the effort to prevent the Houthis attacking vessels traveling through the Red Sea.

The oil market is currently discounting the risks and we expect will continue to do so unless there is a tangible impact on oil flows – either through increased sanctions or because of disruption to tanker traffic in the Red Sea or the Arab/Persian Gulf. Until then, oil prices will bounce upwards with geopolitical news, but the price increase will quickly fade as the oil continues to flow.

Additionally, at this time, the oil market is more focused on potential weakness in oil demand because of deteriorating economic conditions:

- While the headline number associated with the recent U.S. jobs report exceeded market expectations, the report has some underlying signs of weakness: labor force participation remains low at 62.5% with 683,000 workers falling out of the labor force in December; a record high 8.69 million workers are holding multiple jobs; since June 2023, 1.5 million full-time jobs have been eliminated, while 796,000 part-time jobs have been created;

- The latest PMIs from the ISM also indicate weakness in the U.S. economy. The ISM services PMI for December decreased to 50.6 from 52.7 in November. The ISM manufacturing ISM for December increased to 47.4 from 46.7 in November: however, the index has remained below 50 (which reflects contraction) for 14 consecutive months;

- The manufacturing sector in the Eurozone also remains under pressure with manufacturing activity contracting for 18 consecutive months. There are also concerns about inflation accelerating again with the initial estimate for CPI in the Eurozone for December reaching 2.9%, in comparison to 2.4% in November. Increases in the costs of food and services offset the moderate decrease in energy costs; and

- Last week, the World Bank issued its forecast for China’s economic growth for 2024 (4.5%) and 2025 (4.3%), which compares to 5.2% in 2023. China’s economy continues to be hampered by its real estate sector where investment has decreased by 18% during the last two years and a limited recovery in consumer spending.

Consequently, the sentiment of oil traders continues to be negative. The net long position of WTI traders remains at a depressed level and near the level seen in July 2023 before the announcement of the voluntary cut of 1 MMbbl/d by Saudi Arabia. Since late September, traders of WTI have reduced their net long positions by more than 70%. Last week, traders of Brent reduced their net long positions with long positions remaining essentially unchanged, while short positions increased by 52%.

The current market sentiment could be changed by OPEC+ following through with the additional supply cuts announced at its Nov. 30 meeting. Another development that could be supportive of oil prices would be the U.S. reimposing tighter sanctions on Iranian oil exports, which have increased during the last two years and are currently around 1.5 MMbbl/d. The increased sanctions would place the U.S. in opposition to Iran, but also China, which imported 1.2 MMbbl/d of Iranian crude in December.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Occidental Reports ‘Great Progress’ on Net-zero Pathway, DAC

2024-02-21 - Most of Occidental Petroleum’s planned $600 million investment in emerging low-carbon ventures for 2024 will go to direct air capture facility STRATOS, CEO Vicki Hollub says.

1PointFive, AT&T Enter Carbon Removal Pact

2024-03-13 - 1PointFive said it is also participating in AT&T’s Connected Climate Initiative to collaborate on carbon removal solutions like direct air capture.

Going Green? Kraft Seeks $170MM from DOE for ‘Delicious Decarbonization’

2024-03-25 - Kraft Heinz, a $43 billion food company, is seeking to reduce its annual emissions by 99% through a Department of Energy grant.

High Interest Rates a Headwind for the Energy Transition

2024-04-18 - Persistent high interest rates will make transitioning to a net zero global economy much harder and more costly, according to Wood Mackenzie Head of Economics Peter Martin.

Tangled Up in Blue: Few Developers Take FID on Hydrogen Projects

2024-04-03 - SLB, Linde and Energy Impact Partners discuss hydrogen’s future and the role natural gas will play in producing it.