(Source: Shutterstock.com)

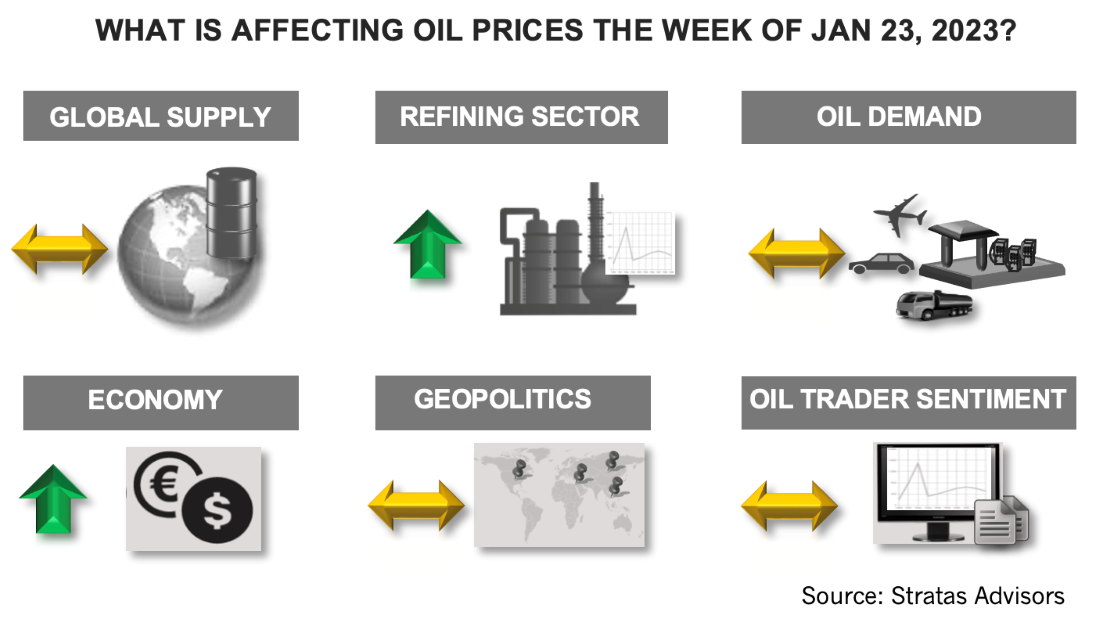

The price of Brent crude ended the week at $87.63 after closing the previous week at $85.28. The price of WTI ended the week at $81.64 after closing the previous week at $79.86.

Additionally, traders of Brent crude increased their net long positions by some 35% by reducing their short positions while adding to their long positions. Likewise, traders of WTI increased their long positions while only reducing their short positions resulting in an increase in the net long positions by around 17%. The net long positions, however, remain at the lowest level since April 2020 at the beginning of COVID-19.

Oil prices have now moved up significantly since the price of Brent crude fell to $77.84 on Jan. 4. We have been forecasting for several months that the price of Brent crude will average $89.25 in first-quarter 2023, but prices will be moderated by the supply/demand situation moving towards a slight surplus in 2023.

The latest Energy Information Agency report indicated that U.S. oil production was 12.2 MMbbl/d, which compares to 11.7 MMbbl/d at the same time of the previous year. The report also indicates that U.S. crude inventories increased by 8.41 MMbbl/d and currently stand at 448 MMbbl. In comparison to the same period of the previous year, crude inventories are 34.2 MMbbl greater, and are 10.96 MMbbl greater than the level of 2019, and are 35.36 MMbbl more than in 2018.

Outside the U.S., production has been rebounding in Africa, including Nigeria where oil production reached 1.24 MMbbl/d in December with production reaching 1.52 MMbbl/d at the end of December with the return of Forcados and partial restoration of the Trans Niger Pipeline. The production is the highest level since March of 2022 and an increase of 32% from September of 2022. Iraq is another member of OPEC+ that experienced production growth in 2022 with oil production average 4.62 MMbbl/d in December and 4.61 MMbbl/d for 2022, which compares to 4.2 MMbbl/d in 2021.

From a demand perspective, we are forecasting that global oil demand will increase by more than 2 MMbbl/d in 2023 compared to 2022. Demand for gasoline and diesel is forecasted to increase. Jet fuel is also forecasted to increase by nearly 22%, which represents more than 40% of the total increase in demand.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.