The price of Brent crude ended the week at $77.33 after closing the previous week at $83.55. The price of WTI ended the week at $72.28 after closing the previous week at $78.01. The price of DME Oman crude ended the week at $77.32 after closing the previous week at $83.10.

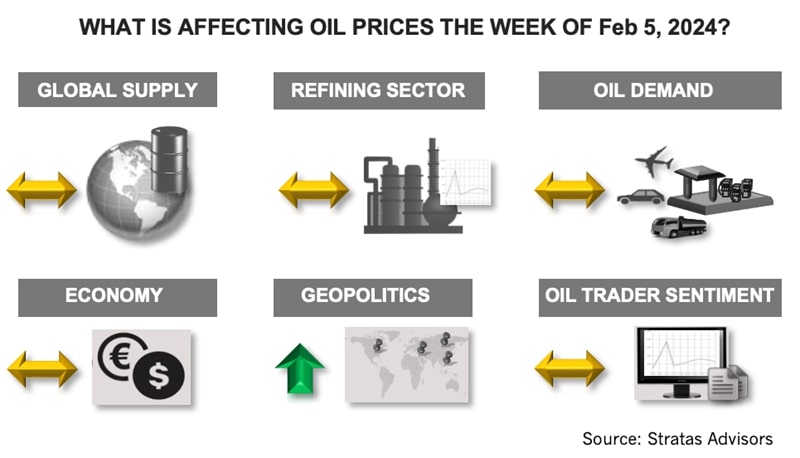

Oil prices decreased despite the positive news for the second straight week about the U.S. economy:

- The U.S. jobs report was released for January and indicated that the U.S. added 353,000 jobs while the unemployment rate held at 3.7%. Additionally, wages increased 0.6% and on an annual basis by 4.5%. (Less positive was that the average hours worked fell to 34.1 in comparison to 34.3 of the previous month.) Other positive news about the U.S. economy is that productivity increased by 3.3 in Q4 of 2023 after increasing by 4.9% in Q3.

- The favorable jobs report follows the report of the previous week from the U.S. Commerce Department, which indicated that the U.S. economy grew at 3.3% (annualized basis) during Q4 of 2023 after growing by 4.9% in Q3. With the strong growth in the second half of the year, the U.S. economy grew at 2.5%, which compares to 1.9% in 2022. The recent data release was also favorable with respect to inflation. The personal consumption expenditure (PCE) price index increased by 0.2% and 2.6% on an annual basis. The PCE price index excluding food and energy increased by 2.9% on an annual basis, which is the smallest increases since March 2021. At the same time, consumer spending increased by 0.7% and incomes increased by 0.3%.

- Additionally, the final reading for January from the University of Michigan Consumer Sentiment Index that was released on Friday indicates that consumer sentiment reached 79.0 in January from 69.7 in December. The index is at the highest level since July 2021.

The flip side of the positive economic news is that the U.S. Federal Reserve has less urgency to cut interest rates. The Federal Reserve kept interest rates unchanged last week, and the Chairman of the Federal Reserve stated that a rate cut is unlikely for March. Other members of the Federal Reserve have indicated that there will be no rate cuts during the first half of 2024. In response, the U.S. Dollar Index ended the week at 103.92, up from 103.43 of the previous week and broke through the 200-day moving average. Additionally, China’s economy continues to struggle with high youth unemployment, price deflation, weak exports, coupled with a debt-laden real estate sector.

Furthermore, as we expected, the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted. And while, OPEC reduced production in January, it is still producing above target and there is still some uncertainty about how much Russia has reduced supply. As we expected, the Joint Ministerial Monitoring Committee (JMMC) of OPEC+ that met last week kept the current voluntary production cuts of 2.2 MMbbl/d in place. It is expected that OPEC+ will decide on the extension of the supply cuts in March.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Ithaca Deal ‘Ticks All the Boxes,’ Eni’s CFO Says

2024-04-26 - Eni’s deal to acquire Ithaca Energy marks a “strategic move to significantly strengthen its presence” on the U.K. Continental Shelf and “ticks all of the boxes” for the Italian energy company.

Apollo to Buy, Take Private U.S. Silica in $1.85B Deal

2024-04-26 - Apollo will purchase U.S. Silica Holdings at a time when service companies are responding to rampant E&P consolidation by conducting their own M&A.

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.