The price of Brent crude ended the week at $80.75 after closing the previous week at $83.47. With the decrease last week, the price of Brent crude dropped below its 200-day moving average. The price of WTI ended the week at $76.49 after closing the previous week at $79.19. The price of DME Oman crude ended the week at $80.58 after closing the previous week at $82.42.

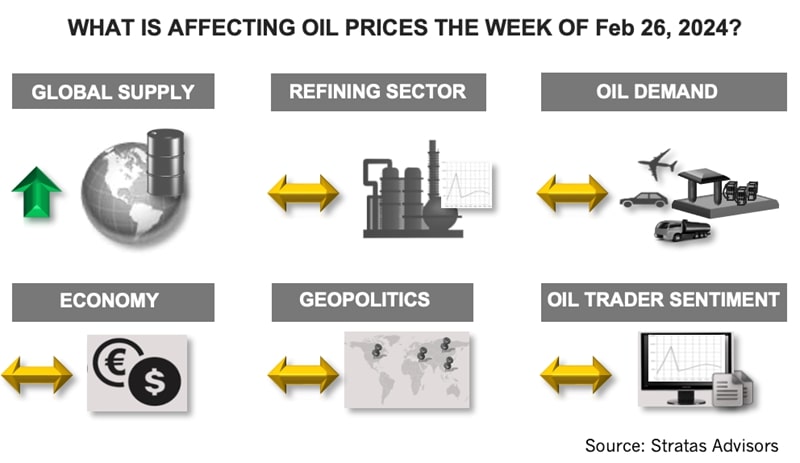

In our previous weekly report, we stated that supply/demand fundamentals will be coming to the forefront with the influence of geopolitics receding – and we are still holding to that view with consideration of recent developments:

- On Jan. 25, the Biden Administration stated that the U.S., Israel, Egypt and Qatar have reached an understanding on the terms of a potential cease-fire deal in Gaza that would involve the release of hostages and the exchange of Palestinian prisoners. There are also separate talks going on with Hamas. The deal, however, would only pertain to a temporary cease-fire and not a final deal.

- The Houthis are still attacking ships moving through the Red Sea, which is pushing shipping rates for Very Large Crude Carriers (VLCC) upwards because of the longer distances that the oil must travel to avoid the Red Sea and the Suez Canal. Conversely, shipping rates for Aframax and Suezmax tankers decreased in February.

- Last week, in response to the death of Alexei Navalny, the Biden Administration imposed additional sanctions on Russia, which affects more than 500 entities, including Sovcomflot, which is Russia’s largest tanker group, and 14 of its crude oil tankers.

While the geopolitical situation remains worrisome, the impact on the oil markets has been minimal with oil continuing to flow. While the pending agreement between Israel and Hamas only pertains to a temporary cease-fire, such a deal would relieve some of the pressure in the region. Additionally, Russia has managed to find workarounds with respect to the sanctions and been able to keep exporting its crude oil and oil products – and the latest round is not likely to have much impact – especially in the short term.

From a fundamental perspective, supply from OPEC+ is showing signs of complying with the latest round of agreed cuts with OPEC+. We also expect that OPEC+ will decide in March to extend its cuts for at least another quarter.

We are forecasting that global crude production will be essentially unchanged from 2023, which means that demand growth in 2024 will outpace supply growth.

- Crude production in the U.S. will increase by 360,000 bbl/d on average in comparison with 2023;

- Crude production in Brazil will increase by 320,000 bbl/d on average in comparison with 2023; and

- Crude production in the Middle East will decrease by 760,000 bbl/d on average in comparison with 2023.

Consequently, we are expecting that demand growth in 2024 will outpace supply growth, even though we expect demand growth to be muted in comparison to 2023 – in part, because of weakness associated with China’s economy. Unlike the U.S. and Europe, China is dealing with deflation. In January, prices for consumer goods in China declined by 2.5%. Prices increases pertaining to services have also been slowing with prices increasing by only 0.5% in comparison to the previous year. Price increases have been faltering because of weak domestic demand and weak demand from export markets. In 2023, China’s exports of goods increased by only 0.6%. It must be noted, however, that while China’s economic growth is being affected by weakness in the export markets, in relative terms, China’s position as the leading exporter is improving because overall global traded decreased by 5% in 2023. Additionally, in 2023, China became the largest exporter of vehicles with exports approaching 5 million vehicles. China’s economy has also been negatively affected by a decrease in foreign investment, which fell by 8% in 2023.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Tangled Up in Blue: Few Developers Take FID on Hydrogen Projects

2024-04-03 - SLB, Linde and Energy Impact Partners discuss hydrogen’s future and the role natural gas will play in producing it.

Occidental Reports ‘Great Progress’ on Net-zero Pathway, DAC

2024-02-21 - Most of Occidental Petroleum’s planned $600 million investment in emerging low-carbon ventures for 2024 will go to direct air capture facility STRATOS, CEO Vicki Hollub says.

SLB to Acquire Majority Stake in Aker Carbon Capture

2024-03-31 - SLB and Aker Carbon Capture plan to combine their technology portfolios, expertise and operations platforms to bring carbon capture technologies to market faster and more economically, SLB said in a news release.

NZT Power, NEP Pick Contractors for Teesside-based Decarbonization Projects

2024-03-15 - About $5.1 billion in work will go to the contractors once projects reach FID, which is expected in September.

No Silver Bullet: Chevron, Shell on Lower-carbon Risks, Collaboration

2024-04-26 - Helping to scale lower-carbon technologies, while meeting today’s energy needs and bringing profits, comes with risks. Policy and collaboration can help, Chevron and Shell executives say.