(Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude oil closed last week at $55.88, which continues the recent trend of the price of Brent crude oil slowly creeping upwards. In contrast, the price of WTI closed at $52.20, which was slightly down from the prior week’s close of $52.27.

With respect to fundamentals there was some positive news pertaining to inventories of crude oil in the U.S., which, as reported by EIA, fell by nearly 10 million barrels during the previous week. The impact was partially offset by an increase in inventories of gasoline by some 2.5 million bbl/d, while inventories of diesel fuel fell by 815,000 bbl/d.

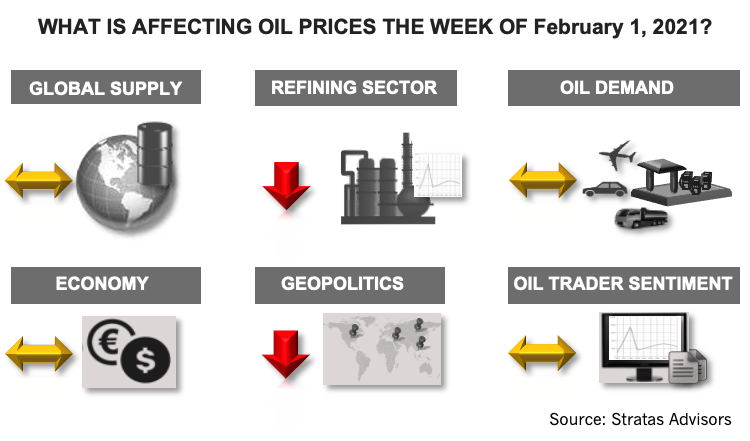

Other factors that affected oil prices include the following:

- Signs that the U.S. economy is still struggling to move back to full recovery, including another disappointing jobless claims report, which indicated that another 847,000 workers in the U.S. lost their jobs

- Struggles with the rollout of vaccines continues in the U.S., as well as in Europe—but there is some positive news in that the Johnson & Johnson vaccine will soon be available to the market. While the test data is not quite as impressive as the Moderna and Pfizer vaccines, the Johnson & Johnson vaccine is easier to ship and handle and requires only one shot.

- The pace of new COVID-19 cases in the U.S. has been declining since Jan. 8 and are now at the lowest level since mid-November of last year. Additionally, there is the possibility that India is moving past COVID-19 with cases in India falling to an average of around 13,000 new infections per day, which is a significant reduction when compared to 100,000 that was occurring during September of last year.

Another factor to watch out for is the impact of the disruption in the U.S. equity markets because of the difficulties faced by some hedge funds, which were caught in a “short squeeze” led by retail investors. While this development would not appear to be sufficient to cause a systemic issue for the financial markets, it is forcing the selling of some long positions to provide funds to cover short positions—and putting some downward pressure on the equity markets. Furthermore, a similar dynamic is now appearing in the silver market.

While more of long-term factor, another development to keep in in mind is the announcement by GM to produce only zero-emission vehicles by 2035. While there remains uncertainty of the ability of GM to achieve this objective, the announcement by GM highlights the growing momentum of the desire of major consumers to move away from oil.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

TC Energy Appoints Sean O’Donnell as Executive VP, CFO

2024-04-03 - Prior to joining TC Energy, O’Donnell worked with Quantum Capital Group for 13 years as an operating partner and served on the firm’s investment committee.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

Genesis Energy Declares Quarterly Dividend

2024-04-11 - Genesis Energy declared a quarterly distribution for the quarter ended March 31 for both common and preferred units.

Stockholder Groups to Sell 48.5MM of Permian Resources’ Stock

2024-03-06 - A number of private equity firms will sell about 48.5 million shares of Permian Resources Corp.’s Class A common stock valued at about $764 million.