In the week since our last edition of What’s Affecting Oil Prices, Brent fell $0.54/bbl last week to average $73.11/bbl while WTI fell $0.89/bbl to average $67.91/bbl.

The Brent-WTI spread now stands at slightly over $5/bbl after getting as tight as $2.61/bbl in the second-half of July. We expect the spread to widen further as WTI loses support from the Syncrude outage. We expect Brent to average $73/bbl in the week ahead with no strong supporting factors apparent.

Iraqi production volumes and exports are reportedly coming in at record levels this summer which should help assuage fears of a supply shortage. In Asia, Chinese bookings of U.S. crude fell sharply after Beijing announced that U.S. crude would be subject to a 25% tariff. However, as analysts expected would happen, other locations took the opportunity to absorb additional volumes, with Indian purchases of U.S. crude nearly tripling from July to August of this year. The most recent tariff list released by Beijing removed U.S. crude, so Chinese volumes could again increase in coming months. If Indian and Chinese purchases both remain strong heading into fall, this will be a positive for U.S. prices, which typically weaken as domestic refining runs seasonally decline.

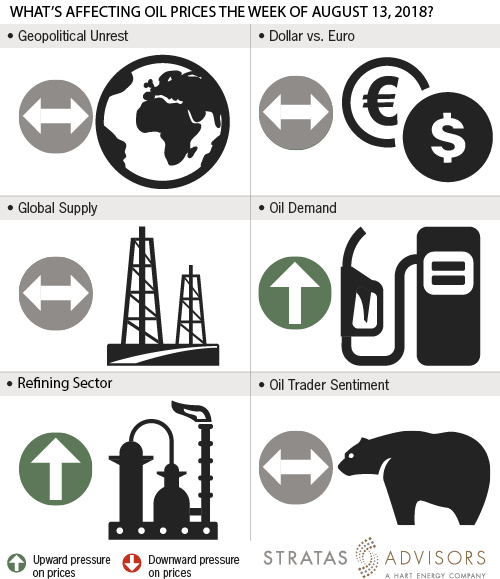

Geopolitical: Neutral

Geopolitics will be a neutral factor in the week ahead.

Dollar: Neutral

The dollar will be a neutral factor in the week ahead as fundamental and sentiment-related drivers continue to have more impact on crude oil prices.

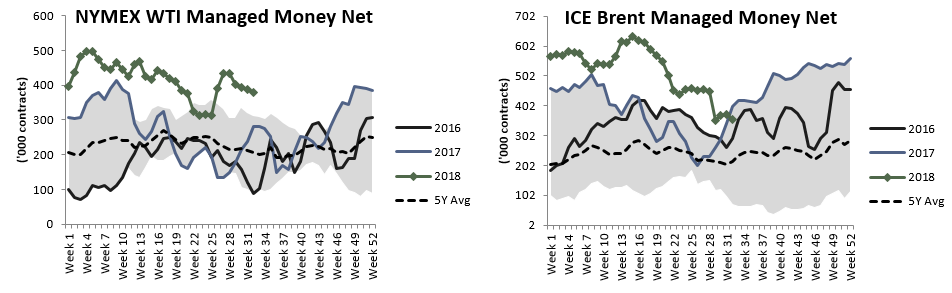

Trader Sentiment: Neutral

Supply: Neutral

Supply will be a neutral factor in the week ahead. While some concerns remain about medium term supply given upcoming sanctions against Iran, Iraqi production and exports have been setting records this summer, which is likely to alleviate some fears.

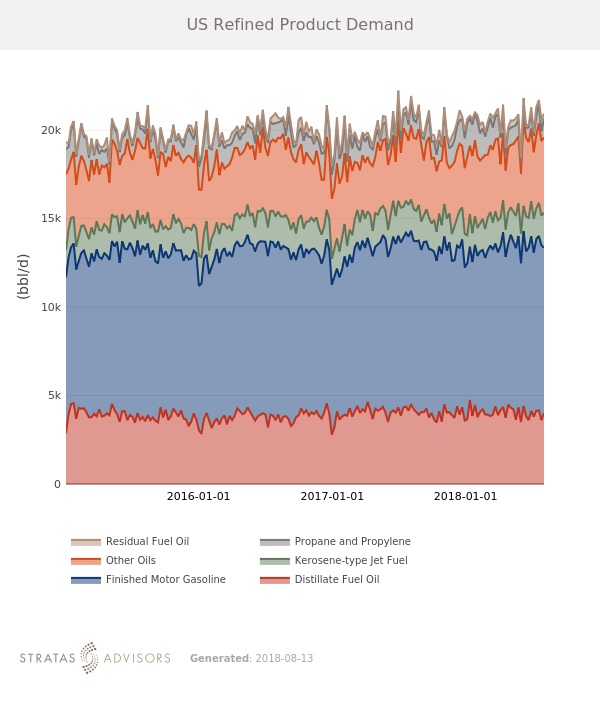

Demand: Positive

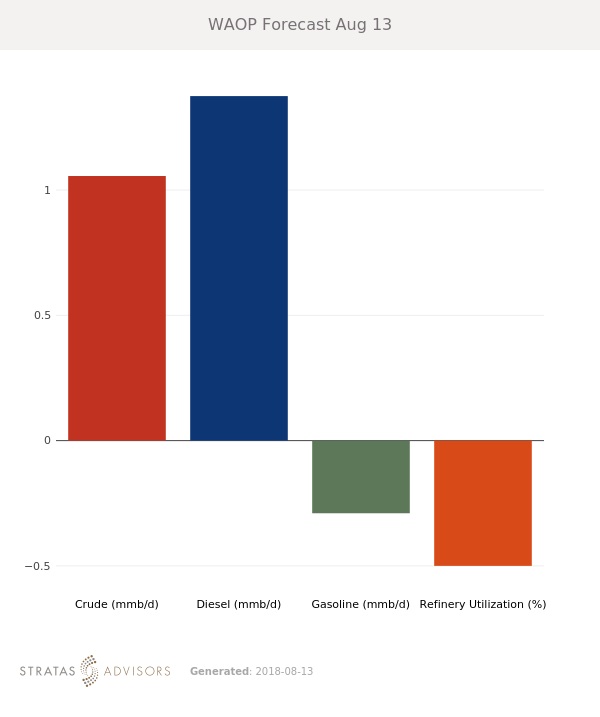

Demand will be a positive factor in the week ahead. If Indian and Chinese purchases of US crude remain strong heading into fall, this will be a positive for US prices, which typically weaken as domestic refining runs seasonally decline.

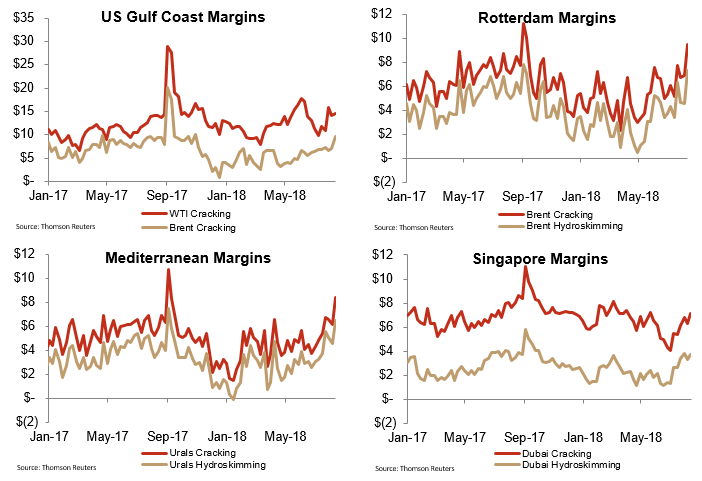

Refining: Positive

How We Did

Recommended Reading

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.