Key Points

Field production decreased marginally during the report week ended Aug. 30 by 0.12 billion cubic feet per day (Bcf/d) or 0.84 Bcf. Gas demand from the major categories fell by almost 4.76 Bcf/d for the report week, compared to the previous week. Imports from Canada dropped by 0.56 Bcf/d or 3.92 Bcf while exports to Mexico rose by 0.1 Bcf/d or 0.7 Bcf week-on-week.

Our analysis leads us to expect 84 Bcf storage build would be reported by the EIA for the report week, in comparison to the current 76 Bcf consensus whisper expectation and 11 Bcf higher than the five-year average storage build of 73 Bcf. Based on this week’s reported data, we think overall low supply should support Henry Hub prices; however, potential demand destruction on the East Coast as a result of Hurricane Dorian will likely hold in prices under $2.40 this week.

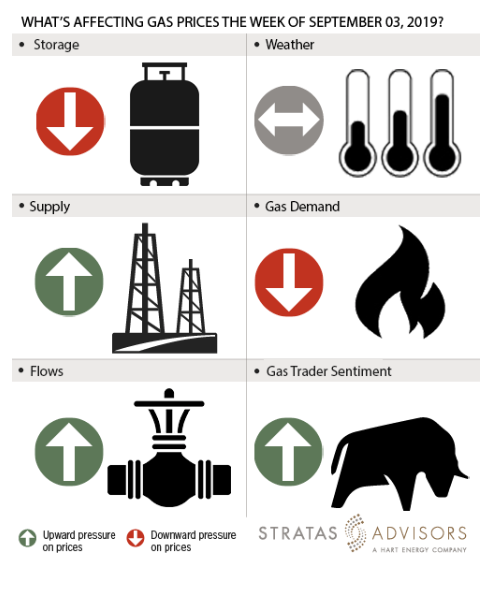

Storage: Negative

For the week, we anticipate a storage build of 84 Bcf will be reported by the EIA. The injection into working gas stocks has been higher this year compared to 2018 because of higher supply. For this reason, we see a higher injection being reported this week. We see the higher injection as a negative driver for gas prices this week.

Weather: Neutral

We believe that natural gas demand in Southeast and Northeast regions will be low due to the disturbance in the Atlantic Ocean caused by Hurricane Dorian. The latest six-to-10 day temperature forecast from NOAA shows a temperature forecast for the Midwest, Mid-Atlantic and Northeast averaging between the 60s to 80s, leading to light natural gas demand. Rains from Hurricane Dorian will likely contribute to cool temperatures in Florida and the Southeast region, leading to light natural gas demand there in gas-power generators, which could potentially be offset by less solar power output in the region. Natural gas demand is expected to be high in the West and in Texas as temperatures are expected to range between 90 to 100 for the forecast period. In the presence of mixed weather data, we see weather as having a neutral impact on gas prices.

Supply: Positive

Average field supply remained robust for the report week, maintaining below-92 Bcf/d levels. However, for the current week the reported values from Bloomberg indicate a 0.12 Bcf/d drop compared to the same period of last week. This drop could be attributed to offshore gulf producer uncertainty in the run up to the landfall of Hurricane Dorian. With additional tropical disturbance being forecasted in the Gulf Coast region, we anticipate temporary supply reductions to continue for at least another week. Accordingly, supply will offer little but positive pressure to this week’s price activity.

Demand: Negative

Demand from major categories such as residential and commercial power generation saw a drop of 4.57 Bcf/d and 0.37 Bcf/d, respectively. Industrial demand did see an increase 0.18 Bcf/d, or 1.26 Bcf. We see low demand exerting a negative pressure on this week’s gas prices.

Flows: Positive

Flows to LNG terminals show a week-on-week increase of 1.08 Bcf/d. The startups of long-haul natural gas pipelines in the Permian to the Gulf Coast, along with new LNG unit trains, have driven the increase in natural gas flows. We expect flows to be positive for this week’s gas price activity.

Trader Sentiment: Positive

The CFTC’s Aug. 30 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (managed money and other) on Aug. 27 were 187,019 net short while reportable commercial operator positions came in with a 155,866 net long position. Total open interest was reported for this week at 1,315,335 and was down 60,424 lots from last week’s reported 1,375,759 level. The data shows a split but an overall positive view as financial speculators strongly cut shorts more than longs, while commercial operators added shorts and cut longs.

Recommended Reading

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

FERC Approves ONEOK Pipeline Segment Connecting Permian to Mexico

2024-02-16 - ONEOK’s Saguaro Connector Pipeline will transport U.S. gas to Mexico Pacific’s Saguaro LNG project.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.