Key Points

Dry gas production fell by 0.44 billion cubic feet per day (Bcf/d) this report week to average at 92.09 Bcf/d. This marks the second consecutive week that production has fallen. Cool temperatures across the country saw demand from the power generation sector fall from 37.73 Bcf/d to 35.11 Bcf/d in the report week vs. the prior report week. Dry gas imports from Canada dropped by 0.13 Bcf/d to average 4.67 Bcf/d, while dry gas exports to Mexico slightly declined from 5.31 Bcf/d to 5.30 Bcf/d for the report week.

Our storage analysis leads us to expect a 99 Bcf build for the report week of Sept. 20. Our expectation is above the current 88 Bcf consensus whisper and 25 Bcf higher than the five-year average of 74 Bcf.

Our overall view for the week is to see a negative movement in Henry Hub prices. We anticipate Henry Hub prices will likely trade this week within +/- 5 cents of the Sept. 23 $2.60/MMBtu closing price.

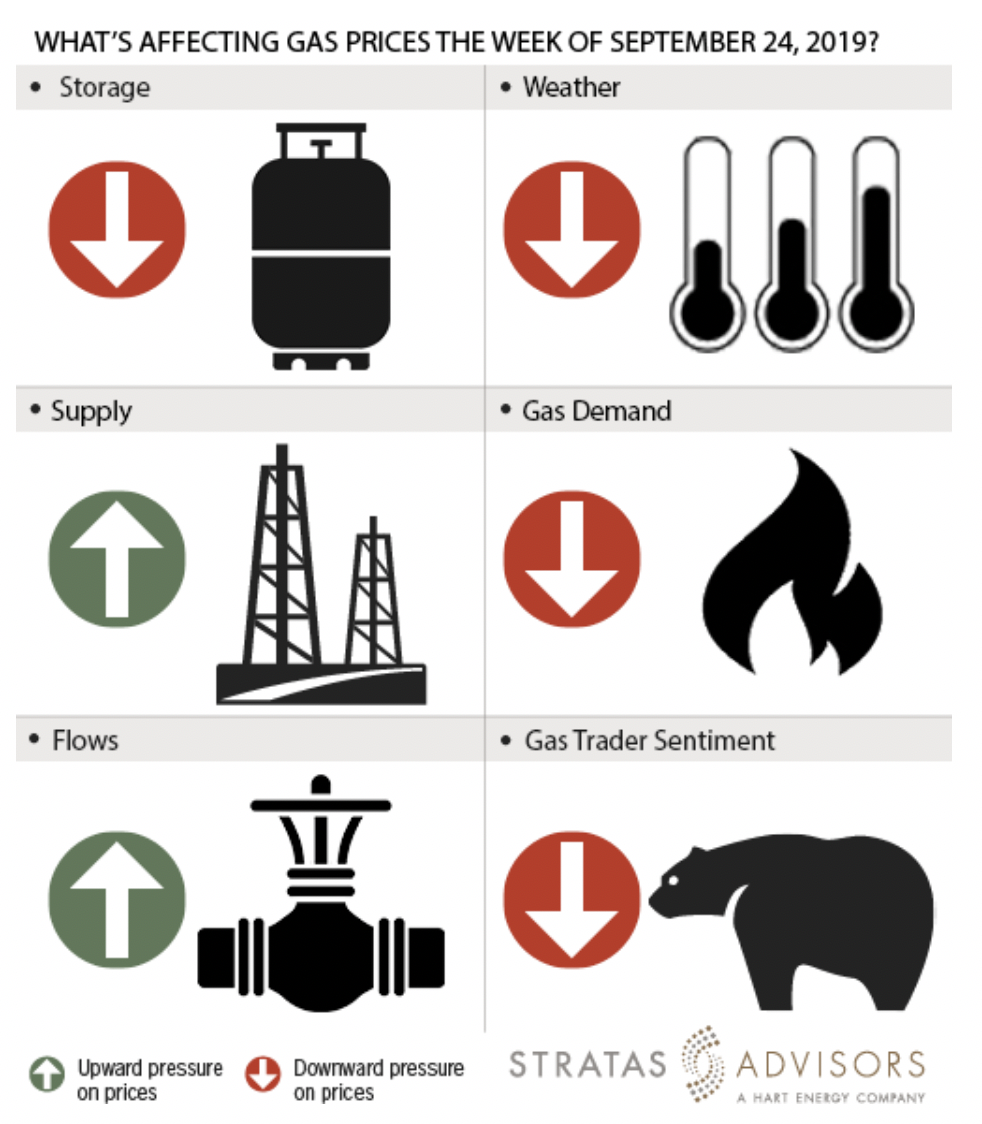

Storage: Negative

We estimate a storage build of 99 Bcf will be reported by EIA this week for the week ended Sep 20. Last week, EIA reported an 84 Bcf injection for the prior week. The build increased inventory levels to 3,103 Bcf, 393 Bcf higher than the year ago value but still 75 Bcf lower than the five-year average. With the expectation of a 99 Bcf injection, we expect this week build to be higher than five-year average. With a higher injection expected this week compared to the five-year average, we see storage changes as a negative driver for gas prices this week.

Weather: Negative

The latest weekly temperature forecast from NOAA shows showers and cooling temperatures across the country for different periods during the week. The strongest demand will likely come from the Southeast and South West regions were temperature highs in the upper 80s to lower 90s are projected. Overall, we expect the weather to have a negative effect in gas prices.

Supply: Positive

Supply levels declined this report week to average 92.09 Bcf to post a 0.44 Bcf/d or 3.08 Bcf decline from the previous report week. Accordingly, supply will offer little but positive pressure to this week’s price activity.

Demand: Negative

Industrial demand declined from 21.22 Bcf/d to 21.03 Bcf/d for the report week. Residential and commercial sector, demand marginally increased by 0.63 Bcf to around 8.35 Bcf/d. The overall low demand from structural demand side drivers for the report week will likely have a negative effect on prices.

Flows: Positive

Flows to LNG terminals show a week on week gain of 0.35 Bcf/d to average 6.39 Bcf/d for the report week. The slight increase in flows can be considered as positive this week.

Trader Sentiment: Negative

The CFTC’s Sept. 20 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on Sept. 17 were 118,573 net short while reportable commercial operator positions came in with a 84,435 net long position. Total open interest was reported for this week at 1,254,125 and was down 19,536 lots from last week's reported 1,273,661 level. Sequentially, commercial operators this reporting week were cutting longs by 6,109 while adding to shorts by 23,984. Financial speculators cut shorts and added longs for the week (-25,484 vs 2,777, respectively). Overall, we think timing will be slow so trader sentiment will likely be negative this week.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.