Key Points: Average dry gas production increased week-on-week and reached about 92 billion cubic feet per day (Bcf/d) for the report week ending Aug. 9. Demand from power generation rose to 42.5 Bcf/d, an increase of 1.27 Bcf/d from the previous week. LNG net exports from the U.S. were 1.80 Bcf/d higher during the report week. Imports from Canada increased from 5.45 Bcf/d to 5.63 Bcf/d while exports to Mexico rose by 0.1 Bcf/d to average at 5.4 Bcf/d.

Our analysis leads us to expect a 58 Bcf injection level for the report week. Our expectation is closely aligned to the current consensus of 56 Bcf and more than the 49 Bcf five-year average storage build.

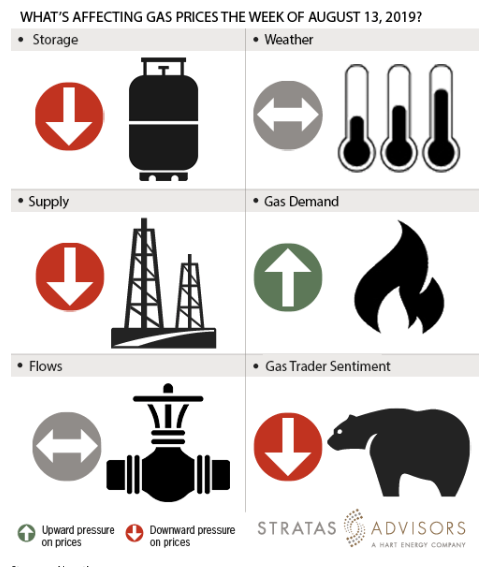

Storage: Negative

We estimate a storage build of 58 Bcf will be reported by the U.S. Energy Information Administration (EIA) for the week ended Aug 9. Last week, EIA reported a 59 Bcf injection for the prior week. The build increased inventory levels to 2,689 Bcf and increased deficits to 111 Bcf compared to the five-year average. This week we expect the build to be closely aligned to the five-year average. All in, we see storage changes as a negative driver for gas prices this week.

Weather: Neutral

Cooler temperatures in the 70s to 80s range in the Northeast and Midwest regions, along with high temperatures in the 90s to 100s in the Southwest region, have the NOAA estimating a moderate weather forecast for the next eight to 10 days. Based on this, we project neutral natural gas demand.

Supply: Negative

Field supply increased to more than 92 Bcf/d during the report week. Average total dry gas production has increased by about 0.65 Bcf compared to the prior week. We think that supply growth will continue to impact prices negatively this week.

Demand: Positive

Gas demand for power averaged nearly 42.5 Bcf/d and accounts for more than half of total natural gas demand in the U.S. Power generation demand has increased by 1.27 Bcf/d or 8.89 Bcf week-on-week. Demand from industrial plants has dropped slightly by 0.16 Bcf/d to average 42.48 Bcf/d. Despite the fall in industrial plant demand, we think that the overall demand growth will be a positive driving factor for gas prices.

Flows: Neutral

Flows can be considered neutral this week as there were no new upset conditions.

Trader Sentiment: Negative

With cooler temperatures expected for the Midwest and Northeast regions, we project Henry Hub prices to average lower than the $2.20 range for the current week. The CFTC’s Aug. 9 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (managed money and other) on Aug. 6 were 203,912 net short while reportable commercial operator positions came in with a 170,671 net long position. Total open interest was reported for this week at 1,400,379 and was up 37,901 lots from last week’s reported 1,362,478 level.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.