The Deepsea Yantai semisubmersible drilling rig drilled the Ringhorne North exploration well in the Central North Sea. (Source: Odfjell Drilling)

Vår Energi’s Ringhorne North discovery in the North Sea will underpin the operator’s long-term growth plans in the region, Vår said April 17.

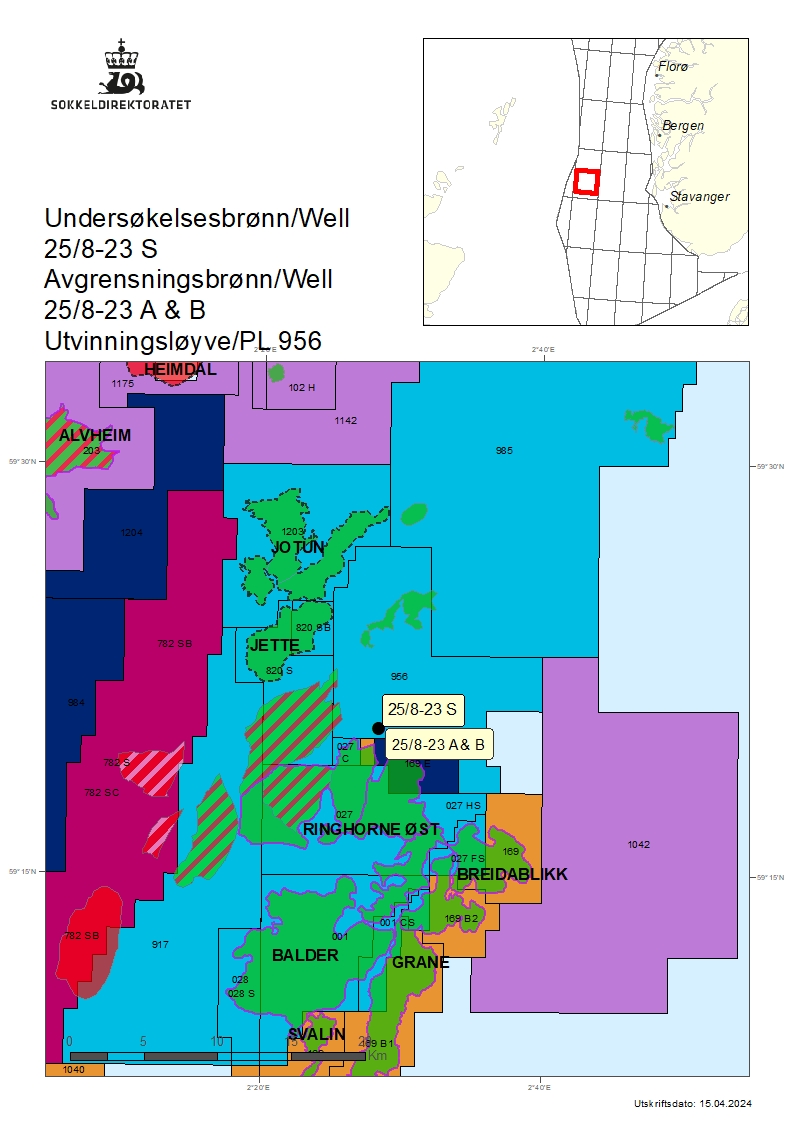

Vår said the latest Ringhorne North exploration well in PL 956 holds estimated recoverable resources between 13 MMbbl and 23 MMbbl and is being considered as a tieback to existing infrastructure in the Balder area.

Torger Rød, Vår COO, said in a press release that the company’s near-field exploration strategy on the Norwegian Continental Shelf is paying off.

“We believe there is more value to be unlocked in the Balder area, and we are intensifying exploration activities to maximize value creation from the existing infrastructure,” he said.

According to Vår, the discovery supports its plans for continuous development in the Balder area as a long-term production hub in the North Sea.

In addition to unlocking new resources and proving the northern extension of the Ringhorne Field, Vår said the Ringhorne North discovery also de-risks drillable prospects in the area and opens up potential development synergies with nearby Vår-operated discoveries such as King-Prince and Evra-Iving.

Rune Oldervoll, Vår’s executive vice president for exploration and production, said in a press release the Balder area’s reserves and resource base has steadily grown for decades and that the company is convinced it will continue to do so in the coming decades.

“We are positioned to produce high value, low emission barrels for a long time – and the latest Ringhorne North discovery is underpinning our long-term production targets,” Oldervoll said.

The Deepsea Yantai semisubmersible drilling rig drilled the Ringhorne North exploration well and two additional side-track/appraisal wells in the Central North Sea, 8 km north of the Vår-operated Ringhorne Field, in 127 m water depth.

According to the Norwegian Offshore Directorate, these are the first exploration wells to be drilled in PL 956, which was awarded in 2018.

The primary exploration target for well 25/8-23 S was to prove petroleum in reservoir rocks in the Ty Formation in the Paleocene and in the Skagerrak Formation in the Triassic. The secondary exploration target was to prove petroleum in reservoir rocks in the Nansen Formation in the Lower Jurassic.

Well 25/8-23 S encountered a 5-m oil column in the Ty Formation in sandstone with good to very good reservoir quality. The oil/water contact was not proven. The Nansen Formation was encountered with a total thickness of 15 m, of which 12 m were sandstone with good to very good reservoir quality with traces of oil, Vår said. The well encountered the Skagerrak Formation with a total thickness of 137 m, of which 20 m were of moderate to poor reservoir quality. The formation was aquiferous.

Well 25/8-23 S was drilled to 2,454 m MD below sea level and was terminated in basement rock.

Sidetracks 25/8-23 A and 25/8-23 B were intended to prove petroleum in reservoir rocks in the Ty Formation and Nansen Formation, respectively. Well 25/8-23 A was drilled to 2,264 m MD below sea level and did not encounter sandstone in the Ty Formation

Well 25/8-23 B encountered an 8-m oil column in the Nansen Formation. The reservoir showed a total thickness of 17 m, of which 13 m were of quality. Well 25/8-23 B was drilled to 2,206 m ME below sea level.

The wells were not formation-tested, but extensive data acquisition and sampling was undertaken. The wells were also plugged and abandoned.

Vår operates PL 956 with 50% interest on behalf of partners, Aker BP ASA with 20%, Harbour Energy Norge AS with 15% and Sval Energi AS with 15%.

Recommended Reading

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.

How Diversified Already Surpassed its 2030 Emissions Goals

2024-04-12 - Through Diversified Energy’s “aggressive” voluntary leak detection and repair program, the company has already hit its 2030 emission goal and is en route to 2040 targets, the company says.