Karen Marsh, former senior environmental engineer with the U.S. Environmental Protection Agency (EPA), is joining Validere as senior advisor of carbon strategies. (Source: Shutterstock)

Validere announced Karen Marsh, former senior environmental engineer with the U.S. Environmental Protection Agency (EPA), is joining the company as senior advisor of carbon strategies in a March 28 press release.

Marsh will be joining Validere’s market fundamentals team to develop strategies and optimize measurement programs to meet clients’ operational and environmental goals.

“Throughout my career, I’ve worked to identify how to best tackle some of the biggest challenges to improving air quality and reducing emissions from various industries,” Marsh said. “Just as the regulatory landscape continues to change, so do the technologies and best practices available for tackling complex issues such as climate change. I’m really excited to work with such an amazing group of experts at Validere to help the industry find the best paths forward.”

Marsh brings 15+ years of experience developing regulations regarding emissions, detection and reporting in the industry. While at the EPA, she served as a lead regulation developer within the sector policies and programs division of the Office of Air Quality Planning and Standards. She also authored key regulations such as new source performance standards for the industry.

“We are proud to have such an experienced emissions and regulatory expert join the Validere team,” says Nouman Ahmad, Validere co-founder and CEO. “As a key developer of regulations for the EPA, her background and expertise will strengthen how we help clients prepare for today’s evolving regulatory environment.”

Marsh is a licensed professional engineer with a focus in climate change. She earned a bachelor’s of science in Chemical Engineering from North Carolina State University and a master’s of science in Water and Waste Engineering from Loughborough University in England.

Validere is a measurement, reporting and verification SaaS company providing energy companies with financial and environmental pathways with their data.

Recommended Reading

Exclusive: Chevron New Energies' Bayou Bend Strengthens CCUS Growth

2024-02-21 - In this Hart Energy LIVE Exclusive interview, Chris Powers, Chevron New Energies' vice president of CCUS, gives an overview of the company's CCS/CCUS activity and talks about the potential and challenges of it onshore-offshore Bayou Bend project.

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.

Exclusive: As AI Evolves, Energy Evolving With It

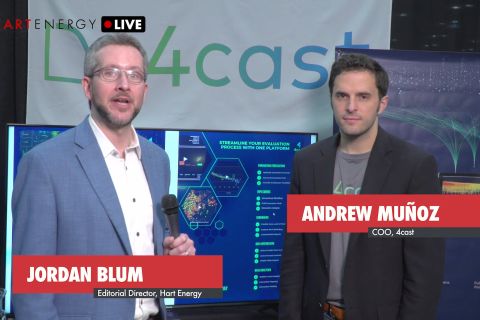

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.