Free cash flow is coursing through a sector that once exemplified value-destruction and some of the worst excesses in corporate America. (Source: Shutterstock.com; Hart Energy)

Living within their means has never been a strong point for U.S. shale producers.

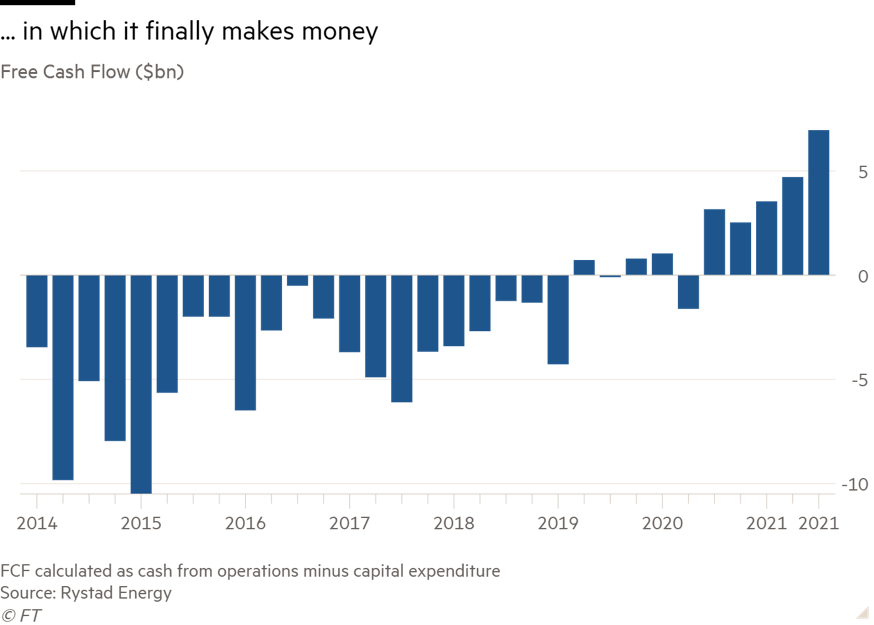

But last year’s crash, and colossal Wall Street pressure, have proven to be the nudge companies needed to get their houses in order. After years of burning through investor cash in pursuit of ever-greater growth, America’s shale patch is suddenly making money. Lots of money.

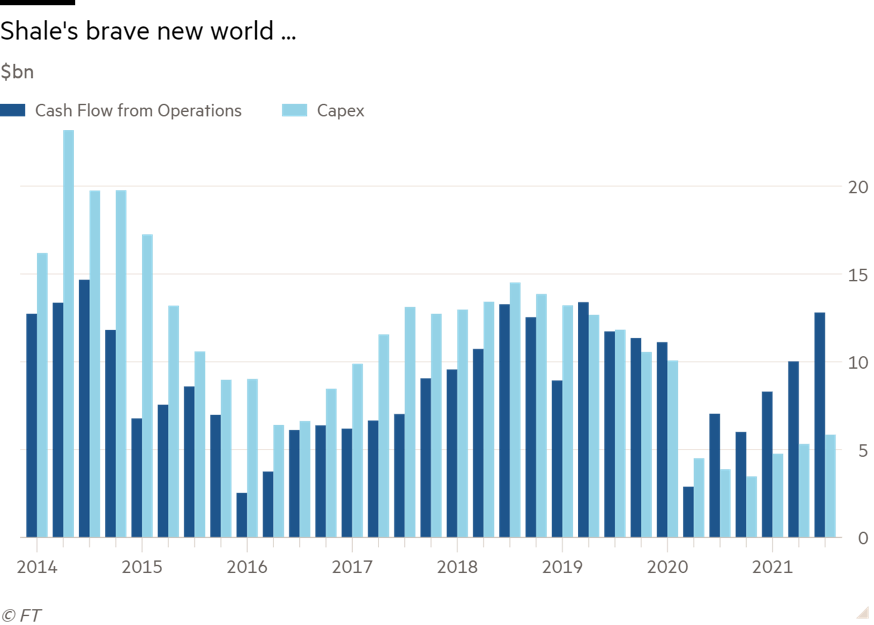

As 2021 rounds to a close, public shale companies shelled out a combined $6 billion in capex in the last quarter, according to consultancy Rystad Energy. That is less than a quarter of their levels at the height of the boom.

Cash from operations, meanwhile, sits at around $13 billion, approaching record levels.

All of which means that free cash flow, a key shale investor metric determined by the difference between cash from operations and capex, is coursing through a sector that once exemplified value-destruction and some of the worst excesses in corporate America.

The transformation—helped by a doubling in oil prices in the past 12 months—is stark, as the chart below shows.

It has been a long time coming. Investors have left oil and gas in droves in recent years, causing the sector to shrink from one of the biggest hitters on the S&P 500 to representing less than 3% of the index—half of Apple alone.

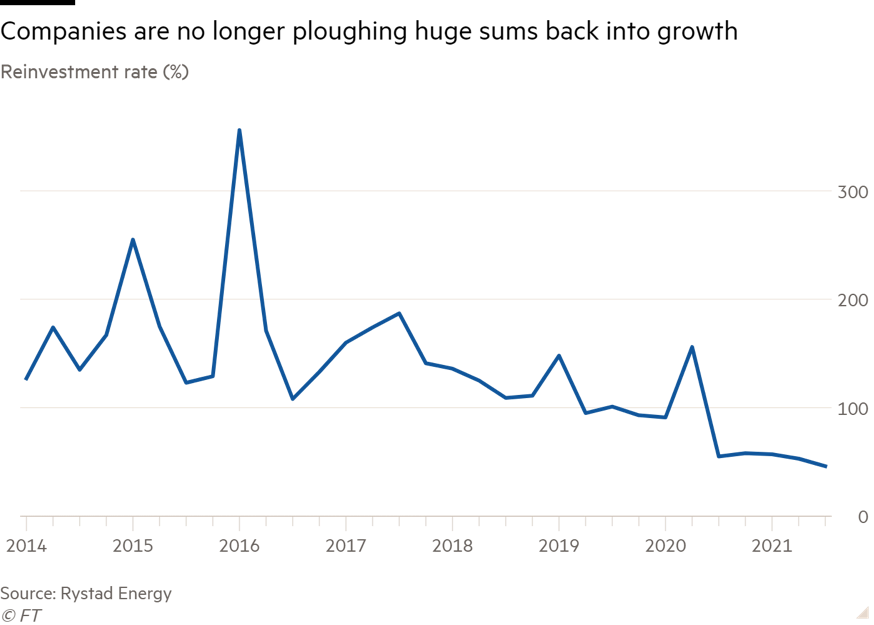

The old guard of growth investors have run for the hills, to be replaced with a new breed of value investors, keen on returns rather than untrammeled expansion of drilling.

“Our investors have evolved,” a senior shale executive told Financial Times during a recent visit to Midland, Texas. “They pushed for growth at all costs and now they get the new model and they like it . . . it’s important to them.”

That new model involves not injecting cash back into drilling new wells but rather funneling cash back to investors in the form of healthy dividends.

Scott Sheffield, CEO of Pioneer Natural Resources Co., the biggest shale player, described it in Houston last week as a new “contract” between the industry investors. In Pioneer’s case that means growing by no more than 5% annually and distributing a hefty chunk of free cash flow back to investors.

And this new model is here to stay, he told me: “There’s no way that the industry is going to change overnight and start growing again.”

Even as private operators put rigs back out in the field and look to ramp up drilling, public operators will be conspicuously cautious.

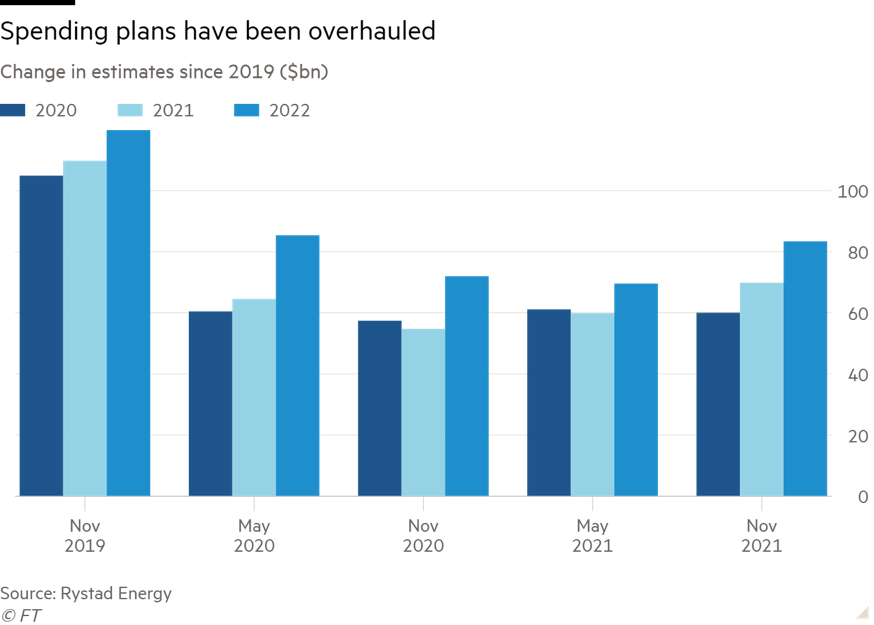

Before the pandemic, spending in 2022 was estimated to rise to $120 billion, according to Rystad. Now that figure looks closer to $80 billion.

It’s an easier approach, the Midland exec told Financial Times. It means companies don’t have to scramble to put out rigs, hire more workers and ramp up drilling every time the oil price picks up. Rather they can stick to a plan that stays constant whatever the price is doing.

“It’s a pretty volatile industry already,” he said. “So in the pyramid of craziness—oil price probably being the biggest—if we can control capital and control production, then investors can make a call on oil price, but we’re going to be OK in our plan.”

Will all this win back the old investors that fled the sector in recent years? The shale patch probably needs to get through another quarter or two of strong oil prices to prove its new fiscal discipline is here to stay. Judging from the XOP, an ETF often used as a proxy to judge market sentiment about the U.S. oil sector, which is up 63% this year, investors are warming to the new shale cash machines.

This article is an excerpt of Energy Source, a twice-weekly energy newsletter from the Financial Times.

Recommended Reading

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.