The U.S. has taken another step in its quest to boost offshore wind capacity to 30 gigawatts (GW) by 2030, scheduling its first-ever lease sale for offshore wind development in the Gulf of Mexico. (Source: Shutterstock.com)

The U.S. has taken another step in its quest to boost offshore wind capacity to 30 gigawatts (GW) by 2030, scheduling its first lease sale for offshore wind development in the Gulf of Mexico.

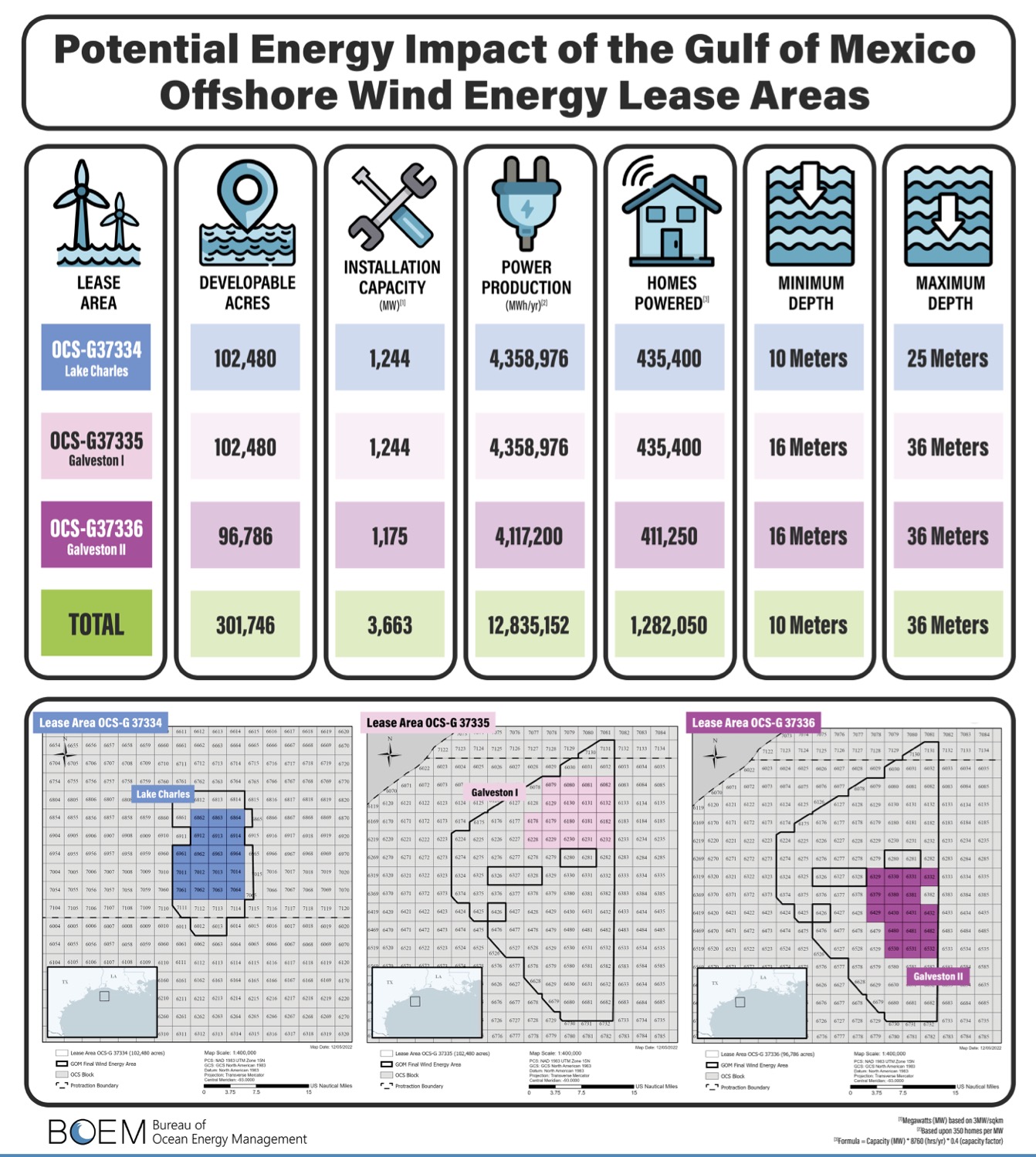

Wind developers will have a chance to bid Aug. 29 on areas that include 102,480 acres offshore Lake Charles, Louisiana; 102,480 acres offshore Galveston, Texas; and another 96,786 acres also offshore Galveston. Combined, the areas could generate about 3.7 gigawatts (GW) of electricity and power nearly 1.3 million homes, according to the U.S. Department of Energy.

“Since I took office, we’ve seen more than $16 billion in new offshore wind investment, including 18 offshore wind vessels, 12 manufacturing facilities and 13 ports,” U.S. President Joe Biden said July 20 at a Philadelphia shipyard, where the offshore wind vessel Acadia is being built. “Today, we announced the first ever offshore wind sale in the Gulf of Mexico. We’re going to the Gulf. Think I’m kidding? Ain't seen nothing yet.”

Expanding offshore wind has been key in the Biden administration’s clean energy goal to have a carbon-free electricity sector by 2035. With construction underway for two major wind projects off the Northeast Coast, the 800-megawatt (MW) Vineyard Wind and the 132-MW South Fork Wind, Biden said the target is not hypothetical.

So far, it has held three offshore lease auctions: the record-setting New York Bight lease sale garnering $4.4 billion in winning bids from six companies; the Carolina Long Bay Offshore Wind lease sale bringing in $315 million in total winning bids; and the first federal auction in the Pacific Ocean off California, where floating wind technology is expected to be used. The California sale drew competitive high bids from five companies totaling more than $757 million.

Action continued in recent months with the BOEM reaching out for public input on draft environmental analysis of the Gulf of Maine offshore wind research lease, completing the environmental analysis for the proposed Revolution Wind Farm project offshore Rhode Island and approving the construction plans for Ørsted 1.1-GW Ocean Wind 1 project offshore New Jersey.

The Biden administration said July 20 that investments in U.S. offshore wind have quadrupled since 2021, rising to $21.6 billion. The figure includes $7.7 billion since the Inflation Reduction Act was signed into law, paving the way for nearly $370 billion in clean energy incentives. The White House said data show more than 4,100 companies in all 50 states are looking to support the U.S. offshore wind industry.

“The Gulf of Mexico is poised to play a key role in our nation’s transition to a clean energy future,” said Elizabeth Klein, U.S. Bureau of Ocean Energy Management (BOEM) director.

Erik Milito, president of the National Ocean Industries Association, called the latest announcement a significant milestone in advancing the U.S. offshore wind sector.

“The Gulf of Mexico has long been esteemed as a premier offshore energy hub, spearheading the way with low-carbon barrels of oil. This achievement underscores the region’s history of unwavering innovation and leadership,” Milito said. “The introduction of new offshore wind lease sales, combined with the resumption of a long-term oil and gas leasing program, can establish a solid foundation for the continued prosperity of the Gulf of Mexico's exceptional and invaluable energy portfolio.”

The American Clean Power Association (ACP) also applauded the move.

“The region is eager to get involved in the offshore wind game, as evidenced by Louisiana Governor John Bel Edwards’ ambitious goal of deploying 5 GW of offshore wind by 2035,” said Josh Kaplowitz, ACP’s vice president for offshore wind. “The Gulf presents a unique opportunity for offshore wind development, which can harness the offshore oil and gas supply chain and expert workforce that has developed in Texas and Louisiana over the past century and build on the region’s important energy-producing legacy.”

By 2025, BOEM said it expects to review at least 16 construction and operations plans for commercial offshore wind facilities. Together, the developments could add more than 27 GW of clean energy, it said.

Recommended Reading

Kimmeridge Activates on SilverBow: A Battle for South Texas Gas

2024-03-01 - Investment firm Kimmeridge is looking for more natural gas production for its own E&P to participate in the Gulf Coast LNG market. SilverBow Resources has gas.

Heard from the Field: US Needs More Gas Storage

2024-03-21 - The current gas working capacity fits a 60 Bcf/d market — but today, the market exceeds 100 Bcf/d, gas executives said at CERAWeek by S&P Global.

Plus 16 Bcf/d: Power Hungry AI Chips to Amp US NatGas Draw

2024-04-09 - Top U.S. natural gas producers, including Chesapeake Energy and EQT Corp., anticipate up to 16 Bcf/d more U.S. demand for powering AI-chipped data centers in the coming half-dozen years.

BKV CEO: Texas Grid Needs More Combined Cycle NatGas Plants

2024-04-12 - BKV CEO Chris Kalnin dives into the "core issue" of Texas' renewable grid and how the company is increasing production as the the largest producer in the Barnett Shale, in this Hart Energy Exclusive interview.

Commentary: Fact-checking an LNG Denier

2024-03-10 - Tampa, Florida, U.S. Rep. Kathy Castor blamed domestic natural gas producers for her constituents’ higher electricity bills in 2023. Here’s the truth, according to Hart Energy's Nissa Darbonne.