(Source: Shutterstock.com)

Oil prices took a hit Feb. 14, as the U.S. stockpiles expanded in the first week of February and demand fell in the same period.

U.S. crude oil stocks rose by 12.8 MMbbl from Feb. 2 to Feb. 9, the U.S. Energy Information Administration reported, while demand for finished petroleum products dropped by 973,000 bbl/d. Andrew Fletcher, senior vice president of commodity derivatives at KeyBank National Association, had expected an inventory build of 3.3 MMbbl of crude oil.

Traders reacted to the news, as WTI prices fell by more than $1.275, opening the day at $77.81 and finishing at $76.88 per barrel. Futures contracts fell by at least $0.92/bbl for each of the next four months.

Oil prices had gained 1% earlier in the day’s trading, following news reports that Israel had called in airstrikes on targets in Lebanon after a rocket attack, escalating tensions in the area and potentially raising the possibility of an enlarged military response by Israel in the Gaza Strip.

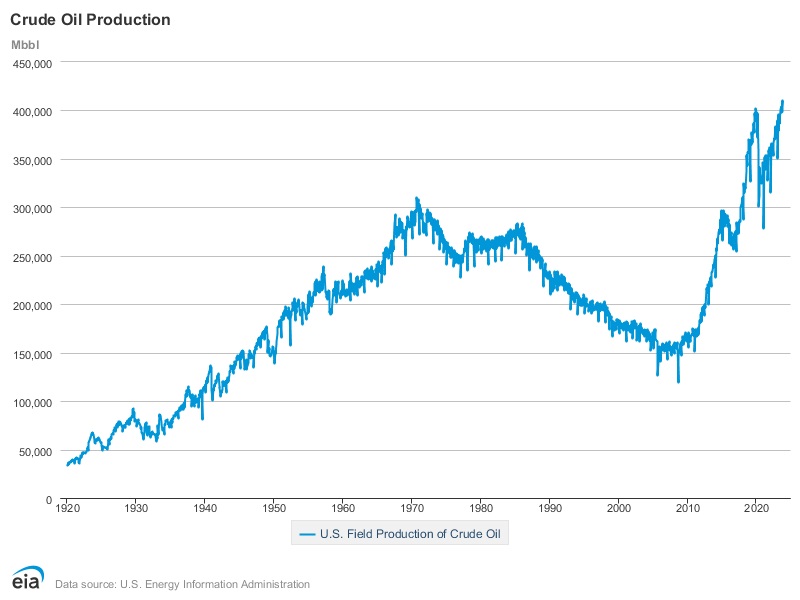

Tensions in the area could affect the world’s supply of crude oil, as Houthis continue to attack tankers and cargo ships in the Red Sea. However, U.S. crude production continues to set records. On Feb. 12, the EIA estimated that U.S. production in December hit 13.3 MMbbl/d average, a new record.

The EIA expected production would fall to a 12.6 MMbbl/d average in January, thanks to cold weather shutting down some facilities.

Recommended Reading

Honeywell Bags Air Products’ LNG Process, Equipment Business for $1.8B

2024-07-10 - Honeywell is growing its energy transition services offerings with the acquisition of Air Products’ LNG process technology and equipment business for $1.81 billion.

TGS Awarded Ocean Bottom Node Data Acquisition Contract in North America

2024-07-17 - The six-month contract was granted by a returning client for TGS to back up the client’s seismic data capabilities for informed decision making.

E&P Highlights: June 10, 2024

2024-06-10 - Here’s a roundup of the latest E&P headlines, including a decline in global drilling activity and new contract awards.

TGS Undertakes Multiclient Reprocessing Agreements Offshore Liberia

2024-06-10 - TGS and the National Oil Company of Liberia plan to reprocess over 24,700 km in the Liberia and Harper basins.

Trendsetter to Deliver Subsea Manifolds Offshore Brazil to Trident Energy

2024-06-13 - The subsea contract follows Trendsetter establishing local facilities in Brazil.