Next-generation geothermal energy uses existing oil and gas technologies (enhanced geothermal) or closed loop systems (advanced geothermal) to generate electricity from anywhere. (Source: Shutterstock)

What’s green, present just about everywhere —but has a small footprint and must be scaled with existing technology– a built-in workforce and an attractive value proposition? The Earth’s crust.

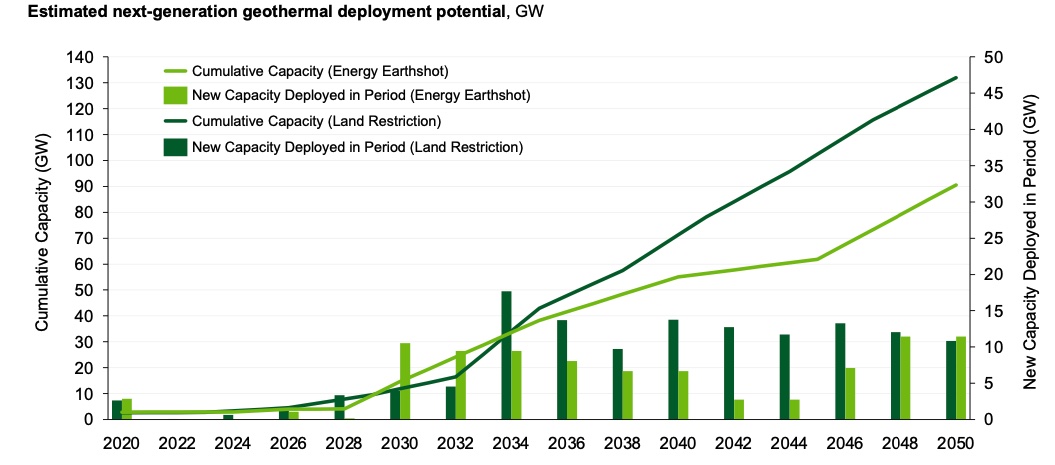

More specifically, it’s geothermal energy—and the U.S. Department of Energy (DOE) says the nation is positioned to produce up to 5 gigawatts (GW) of the clean energy power source across a handful of states. But it will take between $20 billion and $25 billion in investment to get reached that power threshold by 2030. To produce an additional 90 GW to 130 GW across more states by 2050 could require up to another $250 billion.

DOE experts say it’s possible. They discussed the potential for next-generation geothermal power and the department’s pathways to commercial liftoff report on a recent webinar.

“We think this is absolutely feasible because next gen geothermal has some unique and really significant starting advantages,” said Vanessa Chan, chief commercialization officer and director of the DOE’s Office of Technology Transitions.

For starters, there’s a secure and established supply chain not impacted by geopolitics and pandemics, she said. Plus, oil and gas sector employees are equipped with skillsets to build and operate geothermal systems, and the technology already exists to make it happen.

“We’re pretty much ready to roll and scale as quickly as investment dollars are ready, and that is not the case for all the different clean energy technologies,” Chan said. “And when we say next-gen geothermal is clean, we mean it’s really, really squeaky clean. Once the well is drilled, no additional energy is required. That means there are no fuel costs or emissions. And most next-generation projects will have no secondary emissions of any kind.”

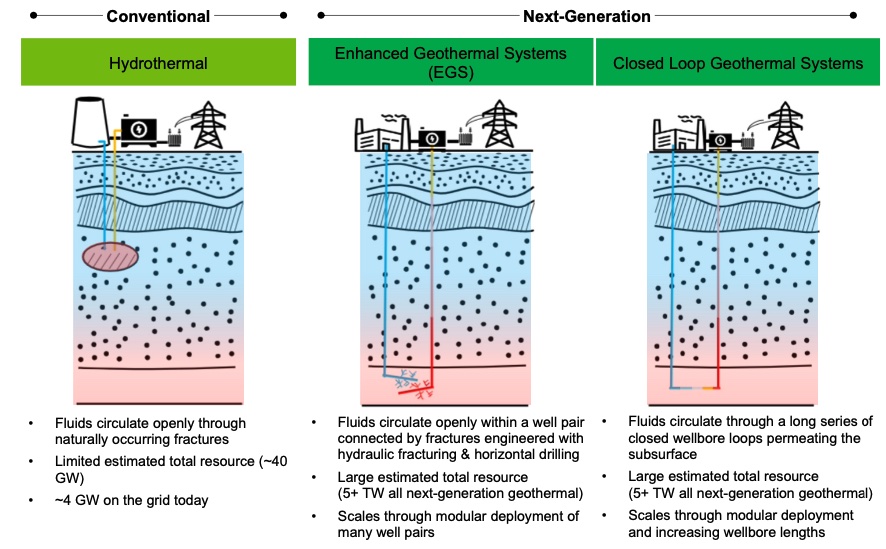

Geothermal energy harnesses heat belowground using wells to drill into reservoirs. The heat extracted can be used to heat or cool homes and buildings via direct use heat, or to generate electricity with higher temperature geothermal resources.

Besides being a renewable energy source, geothermal power plants provide baseload power —meaning they consistently produce electricity—regardless of weather conditions. Plus, their footprints are relatively small compared to other forms of renewable energy such as solar and wind.

Targeting next-gen

Unlike conventional geothermal, which doesn’t need much engineering to produce power by harnessing heat from naturally-occurring fractures in hot rock, next-generation geothermal energy uses existing oil and gas technologies (enhanced geothermal) or closed loop systems (advanced geothermal) to generate electricity from anywhere.

“A lot of people are familiar with conventional geothermal, where we tap the reservoirs of steam and hot water that occur naturally beneath the Earth’s surface. These energy resources are great, but geographically limited and hard to find,” said Jigar Shah, director of the DOE’s Loan Programs Office (LPO). “That’s why while we have the largest geothermal industry in the world, the U.S. currently only gets about 4 gigawatts of energy from conventional geothermal today. Instead of hunting for naturally occurring reservoirs in just a few locations, next-gen geothermal technologies make their own reservoirs using the hot rock that’s everywhere beneath the Earth’s surface.”

Enhanced geothermal systems require no new technology, considering hydraulic fracturing and horizontal drilling already exist. Modular deployment of multi-well pairs enables this model to scale, Shah said.

With closed-loop systems, fluids circulate through a series of closed wellbore loops, scalable through module deployment and increased wellbore length, he added.

Both have resource potential of more than 5 terawatts of energy.

The good news is that the industry is seeing progress in both.

Making progress

The DOE-sponsored Utah FORGE project, an international field laboratory managed by the Energy & Geoscience Institute at the University of Utah, is among those moving the sector forward.

Melissa Klembara, director of portfolio strategy for the Office of Clean Energy Demonstrations, pointed out how Utah FORGE’s work has enabled improvements in costs, well stimulation and drilling times—all among the areas that have challenged geothermal’s growth in the past.

“These commercial demonstration projects out there now are now matching FORGE’s drilling speeds, which is really great news to see,” she said.

Earlier this year, Fervo Energy said it reduced its drilling time by 70% with its Cape Station drilling campaign compared to its Project Red campaign in 2022. The reduced drilling time can be attributed to the use of modern oil and gas drilling equipment, including polycrystalline diamond compact drill bits.

The company also said costs for the first four wells in a six-well drilling program dropped by about 50% to $4.8 million per well from $9.4 million per well. The campaign, which included one vertical well, reached depths as great as 14,000 ft amid high temperatures.

RELATED

Oil, Gas Drilling Tech Transfer Boosts Fervo’s Geothermal Prowess

Advanced geothermal company Eavor Technologies is also making notable progress. The Canada-based company’s technology operates on a closed-loop system, so it doesn’t require fracking or water consumption. The DOE singled out Eavor’s successes, including a pilot loop in Alberta and a deep drilling demonstration in New Mexico, in the liftoff report.

“Success at this stage has enabled Eavor Technologies to develop the first ever large-scale demonstration of closed loop geothermal, in Geretsried, Germany, which is scheduled to produce about 8 MW of power from four loops drilled to about 3 miles’ depth in 2027,” according to the report. “Eavor anticipates drilling over 220 miles of borehole in total for the Geretsried, Germany, demonstration project.”

Bridging the gap

Liftoff analysis shows that next generation technologies could expand geothermal power by more than a factor of 20, Shah said. That would provide 90 GW or more that are clean and firm to the grid by 2050 across the U.S.

Shah said the $20 billion to $25 billion in investment needed to reach between 2 GW and 5 GW of geothermal energy in the U.S. is actually low compared to other technologies trying to become bankable, thanks to a mature oil and gas drilling industry.

“Once banks know what to expect from next-generation geothermal projects, they can start providing financing earlier and earlier in project development, which can really change the economics and help this industry start to get real scale,” he said. “We know firsthand at LPO how catalytic early financing can be in projects, and we’re actively looking for next-generation projects with innovative and exciting technologies to apply for LPO loans to bridge this gap.”

Becca Jones-Albertus, the DOE’s acting deputy assistant secretary for renewable energy, said the transition to clean energy and a net-zero economy will be “private-sector led, but government-enabled.”

“There's a big role for government to play, for instance, providing top notch market based research like the liftoff series, but it's definitely a supporting role,” she said. “The private sector has to lead the way.”

Recommended Reading

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Bobby Tudor on Capital Access and Oil, Gas Participation in the Energy Transition

2024-04-05 - Bobby Tudor, the founder and CEO of Artemis Energy Partners, says while public companies are generating cash, private equity firms in the upstream business are facing more difficulties raising new funds, in this Hart Energy Exclusive interview.

Genesis Energy Declares Quarterly Dividend

2024-04-11 - Genesis Energy declared a quarterly distribution for the quarter ended March 31 for both common and preferred units.