Oil workers extract crude oil from a platform in Venezuela. (Source: Shutterstock.com)

Venezuela’s oil production, which has recently been on an upward trend, could come to an abrupt halt as the deadline for a six-month license issued by the U.S. to entice foreign investments expires on April 18, according to a recent study by Rystad Energy.

“As things stand, the U.S. looks more likely to keep sanctions lifted than re-impose them,” Rystad Senior Vice President Jorge León wrote April 4 in a research report.

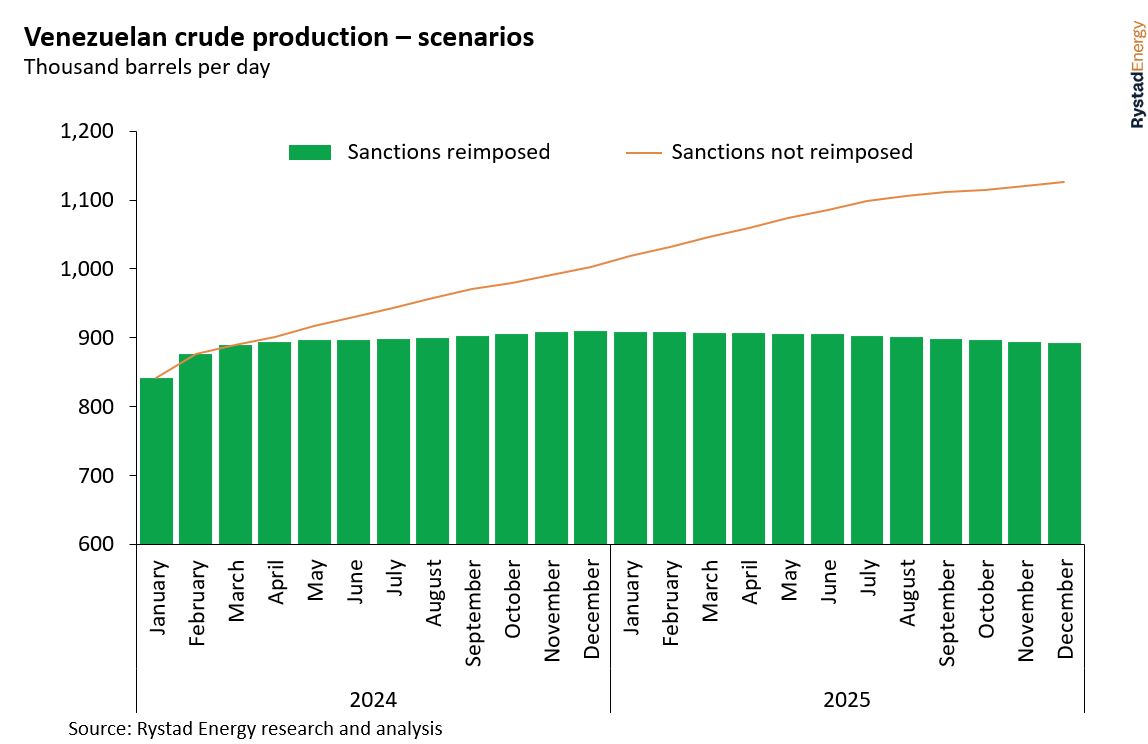

“If the U.S. does not reimpose [oil] sanctions, Venezuela could surpass the 1 million bbl/d threshold as early as December this year, rising to 1.12 million bbl/d by the end of 2025,” León said. “If sanctions are reimposed, production is expected to remain flat at about 890,000 bbl/d.”

León reiterated that the outlook for the South American nation’s oil industry appears uncertain as the deadline to renew the license approaches.

In January, U.S. Department of State spokesperson Matthew Miller alerted that Washington could decide not to renew General License No. 44, issued by U.S. Office of Assets Control (OFAC) on Oct. 18 to assist the OPEC country rebuild its oil and gas production capacity, citing “anti-democratic actions” in the lead up to presidential elections this year.

The Department of State has already revoked sanctions relief for Venezuela’s gold sector.

RELATED: US Threatens to Not Renew Venezuelan Energy Sector License

“However, the U.S. could choose to issue a cosmetic reversal of the sanctions that looks good politically but still allows crude to flow out of the country,” León said. “For instance, Venezuela could continue to sell crude to international customers, but instead of in U.S. dollars, they would sell in Venezuela’s national currency, the bolivar, through debt relief payments.”

Venezuela has struggled to get its production to surpass the 800,000 bbl/d mark on an ongoing basis amid U.S. sanctions and years of oil sector mismanagement. OPEC founding member Venezuela produced around 3.23 MMbbl/d in 1997.

León said new sanctions could further tighten an already constrained global oil market in which oil prices are around $90 per barrel and add additional upside price pressure and raise pump prices for U.S. consumers.

“As we approach summer and the expected spike in gasoline demand, you have to think that keeping pump prices subdued will be a major priority for President Joe Biden’s administration.”

Recommended Reading

Diamondback Prices Senior Notes to Help Cover Endeavor Deal Cost

2024-04-10 - Diamondback Energy’s notes will help cover cash consideration for the pending acquisition of Endeavor Energy as well as repaying debt owed by Endeavor.

GeoPark to Acquire Interests in Vaca Muerta

2024-04-11 - GeoPark Ltd. entered into a binding offer to acquire a non-operated working interest in Argentina’s Neuquen Basin’s Vaca Muerta Formation as it extends its reach across Latin America.

Continental Resources Makes $1B in M&A Moves—But Where?

2024-02-26 - Continental Resources added acreage in Oklahoma’s Anadarko Basin, but precisely where else it bought and sold is a little more complicated.

Kodiak Gas Services Closes $850MM Deal for CSI Compressco

2024-04-02 - Kodiak Gas Services’ acquisition of CSI Compressco was financed as an all-equity transaction valued at approximately $854 million, including assumption of $619 million in debt.

Enterprise Buys Assets from Occidental’s Western Midstream

2024-02-22 - Enterprise bought Western’s 20% interest in Whitethorn and Western’s 25% interest in two NGL fractionators located in Mont Belvieu, Texas.